Plasticizers Category - Procurement Intelligence

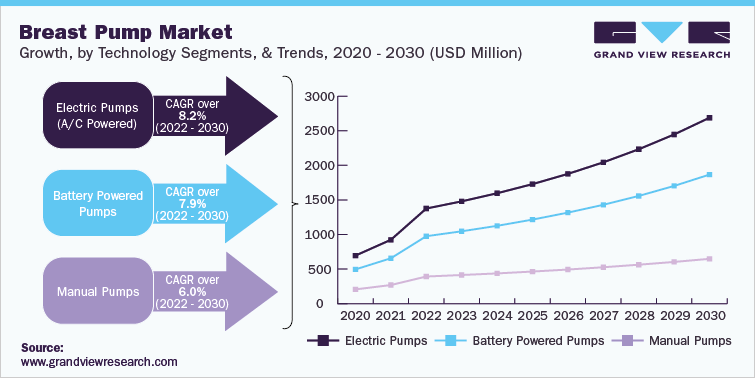

The Plasticizers Category is anticipated to grow at a CAGR of 5.5% from 2023 to 2030. A plasticizer is a compound or material that is added to a polymer solution in order to enhance its flexibility and plasticity. In the plastics industry, plasticizers are among the most frequently utilized additives. The most common polymer to employ plasticizers is Polyvinyl Chloride (PVC), which is the third largest by volume after Polypropylene (PP) and Polyethylene (PE). Numerous chemical families fall under the category of plasticizers based on the classification of chemical composition. However, the most prevalent ones are - Trimellitate ester plasticizers (like TINTM, TIDTM, and TEHTM), Phthalate ester plasticizers (like DIDP, DINP, and DEHP), Energetic plasticizers (like BDNPA, BTTN, and DNT), Benzoate plasticizers (like benzoate esters), Adipate plasticizers (like DIDA and DEHA), Bio-based plasticizers (vegetable oil plasticizers), and Citrates plasticizers (like TOC, ATBC, and ATOC).

The growing demand for plasticizers from manufacturing and films & sheet industry, the robust growth in PVC demand, the increasing focus on sustainability, and the booming automotive industry are some of the major factors driving the category growth. The growing use of the product in electrical applications such as jacketing & insulation and medical applications such as blood bags and IV tubing owing to the emergence of new diseases are further aiding category expansion. An area of recent interest for researchers is the use of reactive plasticizers.

Order your copy of the Plasticizers Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The polymers and in turn the plasticizers industry is highly fragmented. The nature of the polymer industry is such that it comprises a diverse range of specifications and end-user markets, leading to market fragmentation. It is even more complex in the recycled plastics industry. At the regional level, the plastics and polymers industry are primarily characterized by the presence of numerous small and micro-level players who dominate the market. All such factors increase the bargaining power of buyers. Many large companies/suppliers are now prioritizing the production of this substance using renewable technologies due to the increasing focus on sustainability. For instance, BASF’s plasticizer portfolio includes the use of renewable feedstocks, which can reduce carbon footprint by 60%. Other examples include:

- In September 2023, LANXESS took a significant step towards sustainability by introducing a new, eco-friendly plasticizer to replace its “Mesamoll” plasticizers. The eco-friendly product will be made using 30% raw materials sourced from sustainable sources. This move aims to reduce the carbon footprint of the product by 20%.

- Similarly, in May 2021, Evonik introduced new sustainable plasticizers with 20 – 59% of recycled content. Its proprietary, “Eastman 168 Renew 20 non-phthalate” plasticizers use 20% certified recycled content for roofing and flooring applications. Its “Eastman Triacetin Renew 59” plasticizers have 59% recycled content for food packaging adhesives and other food wrap applications. Eastman is working towards producing plasticizers using its carbon renewal technology.

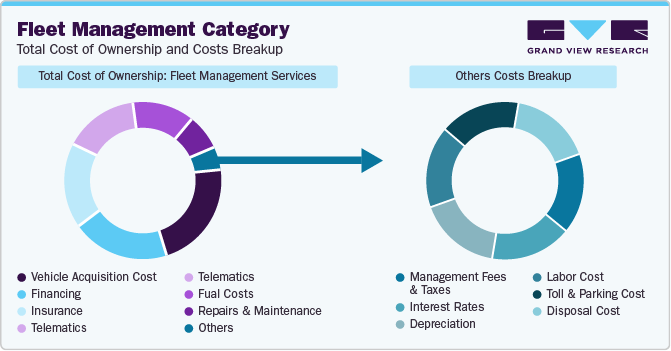

The key raw materials associated with the production of plasticizers are olefins, alcohols, and acids. Hence, the major cost components include raw materials, energy and equipment, labor, facilities and storage, and transportation. Other costs include utilities and administrative expenses, repairs and maintenance, testing, marketing, recycling, tax, insurance and depreciation, R&D, etc. A few common examples of olefins include butene or butylene, propene or propylene, etc. Fluctuations in the prices of raw materials can have a significant impact on the total cost of plasticizers. For instance, since July 2022, Eastman has increased its plasticizer prices due to ongoing pressure from raw materials, energy, and transportation costs. Price increases were in the range of USD 0.075 to USD 0.100 /LB in North America and Latin America.

List of Key Suppliers in the Plasticizers Category

- Arkema S.A.

- BASF SE

- Daelim Industrial Co. Ltd.

- Dow Chemical Company

- LG Chem Ltd.

- Evonik Industries AG

- ExxonMobil Chemical

- Eastman Chemical Company

- INEOS Group

- LANXESS AG

- UPC Group

Plasticizers Procurement Intelligence Report Scope

- Plasticizers Category Growth Rate: CAGR of 5.5% from 2023 to 2030

- Pricing Growth Outlook: 10% - 20% (Annually)

- Pricing Models: Volume-based, contract-based, and spot pricing model

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Production capacity, grade, application area (polymeric, specialized), properties (weight, pressure, volume, boiling point), operational and functional capabilities, technology used, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions