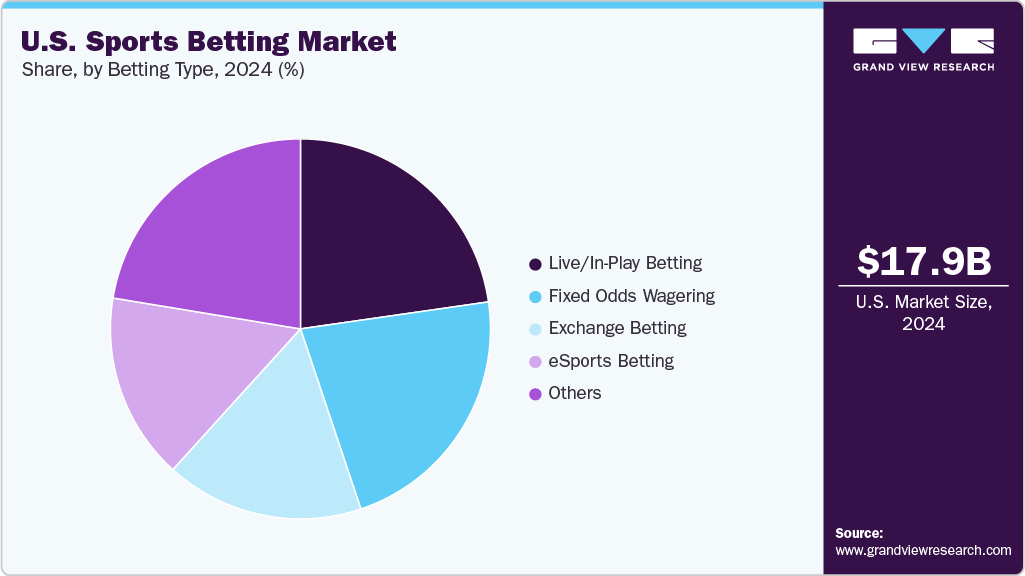

The U.S. sports betting market, valued at an estimated USD 17.94 billion in 2024, is projected to surge to USD 33.18 billion by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.9% from 2025 to 2030. This expansion is predominantly fueled by the ongoing legalization of online and mobile wagering across an increasing number of states. The sheer convenience offered by mobile platforms, coupled with rising sports viewership and a shift in consumer behavior towards real-time, interactive betting experiences, has significantly accelerated adoption rates. Moreover, strategic partnerships between sportsbooks and major sports leagues, teams, and media companies have played a pivotal role in normalizing sports betting and fostering its mainstream acceptance. Concurrently, state governments are benefiting substantially from the considerable tax revenues generated by these regulated wagering activities.

A prominent trend revolutionizing the industry is the seamless integration of betting functionalities directly into live sports broadcasts and streaming platforms. Operators are strategically investing in developing enhanced second-screen experiences, real-time odds integration, and gamified interfaces to both attract and retain users during live events. Collaborations between media giants and sportsbooks, exemplified by initiatives like ESPN Bet and FanDuel's partnerships with major networks, are fundamentally reshaping how sports content is consumed. These strategies are designed to elevate user engagement by harmoniously blending sports entertainment with betting opportunities, thereby creating novel monetization models while simultaneously enriching the overall fan experience.

Another burgeoning trend is the intensified focus on data-driven personalization and the proliferation of in-play betting options. As bettors increasingly demand greater control and customization, sportsbooks are expanding their offerings to include features such as micro-betting, real-time cash-out options, and tailored odds. The deployment of Artificial Intelligence (AI) and Machine Learning (ML) tools is becoming crucial for enhancing recommendation engines and gaining deeper insights into user preferences. This shift towards dynamic betting formats aligns perfectly with broader digital consumption trends, particularly among younger demographics who prefer fast-paced, interactive, and mobile-first experiences over traditional pre-game wagers.

Key Market Insights:

- Online Platform Dominance: The online segment led the market in 2024 and is forecast to achieve the fastest CAGR of 12.8% from 2025 to 2030. This growth is propelled by the rapid expansion of internet access, widespread smartphone adoption, and the increasing legalization of online sports betting across various states.

- Football's Enduring Appeal: Football continues to dominate the U.S. sports betting industry, holding the largest share in 2024. This leadership is primarily driven by the immense popularity of the National Football League (NFL), which consistently generates the highest betting volumes, particularly during the regular season, playoffs, and the Super Bowl.

- Live/In-Play Betting Revenue: The live/in-play betting segment dominated the industry in terms of revenue, contributing a significant portion to operators' total earnings. This segment allows users to place bets as a game unfolds, with continuously updated odds reflecting live events, appealing to those seeking dynamic and interactive engagement.

Order a free sample PDF of the U.S. Sports Betting Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 17.94 Billion

- 2030 Projected Market Size: USD 33.18 Billion

- CAGR (2025-2030): 10.9%

Key Companies & Market Share Insights

Key players in the highly competitive U.S. sports betting market are implementing various strategic initiatives to solidify their presence and expand the reach of their offerings. These companies are actively engaged in expansion activities, often entering newly legalized states, and forming crucial partnerships to drive market growth. For instance, many major operators are forging collaborations with sports leagues, teams, and media companies to enhance brand visibility and mainstream acceptance. Additionally, there's a strong focus on technological advancements, including the development of user-friendly mobile apps, integration of betting features into live broadcasts, and leveraging data analytics and AI for personalized experiences and in-play betting options.

Key Players

- 888 Holdings Plc

- Bet365

- Betsson AB

- Churchill Downs Incorporated

- DraftKings

- Entain plc

- FanDuel Group

- Flutter Entertainment Plc

- IGT

- Kindred Group Plc

- Sportech Plc

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. sports betting market is undergoing a transformative phase, driven by the expanding legalization of online wagering and the rising integration of betting features into live sports content. The growing preference for mobile-first, real-time betting experiences has propelled innovation and user engagement across platforms. Strategic collaborations between sportsbooks and major sports entities continue to normalize and promote widespread adoption. Moreover, advancements in AI and data analytics are enabling hyper-personalized betting journeys, appealing especially to tech-savvy, younger audiences. As the industry evolves, dynamic formats like in-play and micro-betting are set to shape the future landscape.