Petrochemicals Industry Data Book - Ethylene, Propylene, Butadiene, Benzene, Xylene, Toluene and Methanol Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

Grand View Research’s petrochemicals industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Access the Global Petrochemicals Industry Data Book, 2023 to 2030, compiled with details like trade data, pricing intelligence, and competitive benchmarking.

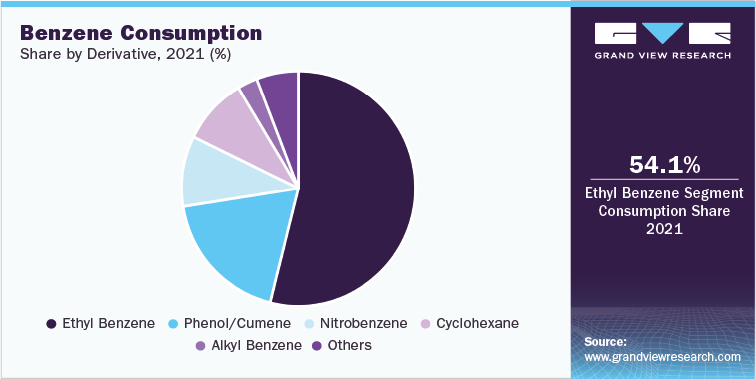

Benzene Market Report Highlights

The global Benzene Market size was estimated at 55.8 million tons in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030.

- The global market is estimated to advance with a growth rate at a CAGR of 6.1% from 2022 to 2030. This is attributed to the wide range of uses of the product in industries such as automobile, personal care, pharmaceuticals, packaging, and others

- Asia Pacific dominated the global market in 2022 with a revenue share of over 45.20%. This is owed to increasing demand for home appliances, automobiles, packaging in food & beverages and pharmaceutical, and personal care in the region

- The increasing demand for benzene in the Asia Pacific has also resulted in several companies increasing their production capacities. For instance, Hengyi Petrochemical of china has set up a naphtha cracker plant in 2021 which will increase its production capacity of benzene by 80,000 TPA. Additionally, Reliance industries one of the major producers of benzene in India has increased its production capacity to 1400KTA

- Ethylbenzene dominated the derivative segment with a revenue share of 53.69% in 2022. This growth is attributed to the fact that a major portion of ethylbenzene goes into the production of styrene which has its demand in several major industries such as rubber, packaging, and automobiles

- Automobile application in the ethylbenzene derivative by end-use segment held a revenue share of 43.53%. This is due to the fact that styrene produced from ethylbenzene finds its major usage in automobile parts and tires due to its unique properties of low rolling friction, abrasion resistance, and high traction during braking

- Catalytic reforming in the production process dominated the global market with a revenue share of 49.32% in 2022. This is attributed to the fact that this method gives high yield and is useful for the production of benzene in large quantity

Order your copy of Free Sample of “Petrochemicals Industry Data Book - Ethylene, Propylene, Butadiene, Benzene, Xylene, Toluene and Methanol Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Xylene Market Report Highlights

The global Xylene Market size was estimated at 60.4 million tons in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.4% from 2022 to 2030.

- In terms of additives, the solvent segment emerged as the fastest-growing application segment with a CAGR of 7.8% from 2023 to 2030. Xylene is widely used as a solvent in industries ranging from paints and adhesives to chemical manufacturing

- Based on type, the mixed-xylene segment dominated the market in 2022 with the largest revenue share. Mixed xylene, as the name suggests, is a combination of the three isomers - ortho-xylene, meta-xylene, and para-xylene. It is primarily employed as a solvent in various applications such as paints, coatings, adhesives, and thinners

- Based on region, Asia Pacific emerged as the fastest-growing region with a CAGR of 8.8% from 2023 to 2030, due to the demand for solvents and monomers in countries like China, Japan, India, and South Korea, which contribute to the overall market

- In April 2021, Tecnimont Private Limited was granted an Engineering, Procurement, Construction, and Commissioning (EPCC) contract by Indian Oil Corporation Limited (IOCL) to establish a comprehensive paraxylene (PX) and purified terephthalic acid (PTA) plant in Paradip, Odisha. The contract is valued at USD 450 million and involves integrating the plant with the existing Jagatsinghpur refinery facility in Odisha

- China holds a prominent position as a major producer of PET resins, with industry leaders such as PetroChina Group and Jiangsu Sangfangxiang standing out as significant global manufacturers, boasting a combined capacity exceeding 2 million tons. Consequently, the increasing demand for PET from various end-user industries is a key driving force behind the surge in the demand for paraxylene

- The paints and coatings sectors are both experiencing a growth in the utilization of xylene owing to substantial investments and expansions in the industry. Notably, the American Coatings Association reports that the production of paints and coatings in the United States surpassed 1.36 billion gallons in 2022. Projections indicate that the industry's output in 2023 is anticipated to surpass 1.38 billion gallons

Go through the table of content of Petrochemicals Industry Data Book to get a better understanding of the Coverage and scope of the study

Competitive Landscape

Over the past years, the industry participants have been witnessed to continuously engage in acquisitions & mergers, and joint ventures with governments and other key players already in the oil and gas field. By these operational integrations, companies seek to expand their reach to potential customers at optimum distribution cost.

Key players operating in the Petrochemicals industry are:

- BASF SE

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petrochemical Corporation (Sinopec)

- Exxonmobil Corporation

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter