Cryptocurrency Industry Data Book Covers Cryptocurrency Mining Hardware and Exchange Platform, Crypto Wallet, Cryptocurrency Payment Apps, and Crypto ATM Market

The global Cryptocurrency industry was estimated at USD 40.09 billion in 2021 and is anticipated to increase at a significant CAGR of 26.8% from 2022 to 2030.

Grand View Research’s cryptocurrency industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

Cryptocurrency Exchange Platform Market Insights

The global cryptocurrency exchange platform market size was valued at USD 30.18 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 27.8% from 2022 to 2030. The growing popularity of digital assets, such as cryptocurrencies and Non-Fungible Tokens (NFTs), is anticipated to increase the demand for cryptocurrency exchange platforms. People in developed countries, such as the U.S. and Canada, are rapidly adopting digital currency owing to its flexibility and ease of transaction. In addition, the rising acceptance of mobile-based trading platforms is expected to create opportunities for the industry. Furthermore, cryptocurrencies use blockchain technology for decentralization and efficient transactions.

Blockchain technology offers fast, secure, decentralized, transparent, and reliable transactions; hence, the companies are investing in blockchain and collaborating to deliver quality services to the consumers. For instance, in July 2022, KuCoin, one of the prominent cryptocurrency exchange platforms, announced its partnership with Coinrule Ltd., a trading bot for cryptocurrency platforms, to provide automated trading to its customers. In addition, traders using Kucoin’s platform are able to trade margin options, cryptocurrency futures, and perpetual swaps through Coinrule API. The growing popularity of cryptocurrencies as a medium of exchange for products and services led the central banks to support and accept digital currencies across the globe.

Furthermore, various prominent players are introducing innovative products, such as NFTs and Exchange Traded Funds (ETFs), which are expected to support the growth of the industry. For instance, in August 2022, an NFT ETF trading zone was introduced by KuCoin, a worldwide cryptocurrency exchange for more than 20 million users. The product seeks to lower the investment threshold for blue-chip NFTs and increase the liquidity of NFT assets. Prolonged crises with increasing inflation and the rising cost of living adversely affected nations, such as Iran, Venezuela, and El Salvador. Consequently, residents of these countries are shifting toward cryptocurrencies as a medium of exchange for basic utilities and a form of value storage.

It is anticipated to act as a substitute for fiat currencies, such as the Rial, the Bolivar, and other government-issued fiats in such regions. As a result, the growing demand for cryptocurrencies from these countries is expected to create a positive outlook for the industry. Although cryptocurrency is a new-age financial technology, the absence of laws and a uniform standard for exchange platforms & digital money is projected to limit its expansion. Regulators across the globe are concerned over the exploitation of such platforms for illegal activities, which is a major obstruction to the market’s growth. On the other hand, the advantages offered by blockchain and cryptocurrencies outweigh the increasing illegal activities. In addition, the government authorities have the potential to prevent such activities and regulate the exchanges in a manner that they can monitor suspicious activities.

Order your copy of the Free Sample of “Cryptocurrency Industry Data Book - Cryptocurrency Mining Hardware & Exchange Platform, Crypto Wallet, Cryptocurrency Payment Apps and Crypto ATM Market Size, Share, Trends Analysis, And Segment Forecasts, 2022 - 2030” Data Book, published by Grand View Research

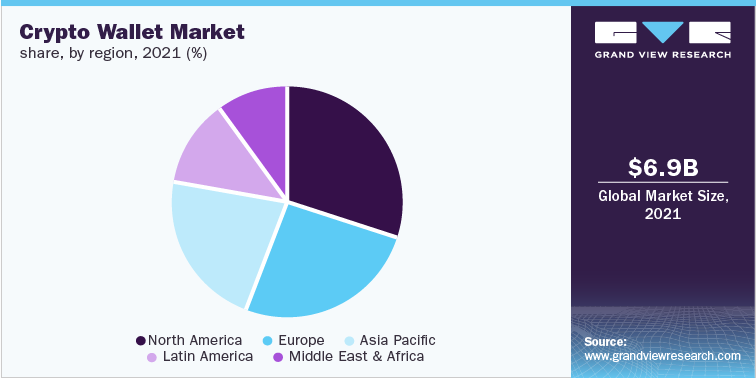

Crypto Wallet Market Insights

The global crypto wallet market size was valued at USD 6.97 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 24.4% from 2023 to 2030. Crypto wallets keep cryptocurrency safe and secure by storing their private keys in the wallet. Crypto wallets also allow sending, receiving, and spending of cryptocurrencies such as Ethereum and Bitcoin. Crypto wallets come in many forms, including hardware wallets or mobile wallets. Crypto holdings are stored on the blockchain and can only be accessed using private keys stored in crypto wallets. These private keys are proof of ownership, and hence protecting them is essential. The robust security provided by the crypto wallets is expected to impel the demand for crypto wallets, thereby driving the future market growth.

As of August 2022, the number of crypto wallet users reached 84.02 million worldwide, from 76.32 million users in August 2021. The increasing growth in crypto wallet usage can be attributed to the growing use of cryptocurrency. The number of crypto buyers has increased now more than ever. With more crypto buyers emerging, companies increasingly offer digital payment options across all channels. Additionally, increasing competition in the banking section, growing distrust in banks & financial systems, and increasing money laundering activities are the reasons for the increased use of cryptocurrency. The growing adoption of cryptocurrency is driving the adoption of the private crypto wallet.

The number of financially aware and technologically inclined adults has increased in the past few years, contributing to the greater adoption of cryptocurrency and its infrastructure, such as crypto wallets. With an increasing demand for cryptocurrencies, the number of merchants offering crypto payment options has also increased significantly.

Go through the table of content of Cryptocurrency Industry Data Book to get a better understanding of the Coverage & Scope of the study

Cryptocurrency Industry Data Book Competitive Landscape

The market players have adopted new product development as their key developmental strategy to cater to the increasing demands of end users. Additionally, they have obtained approvals to launch their products across various countries. For instance, in May 2022, Robin Hood, a financial service company, announced the launch of a new independent Web 3.0 cryptocurrency wallet that will cover clients' transaction costs on the blockchain network without keeping control of their assets. This launch will make it easy for the users to hold their keys and experience all the open financial system's opportunities.

Key players operating in the Cryptocurrency industry are:

- BlockFi International Ltd

- Coinmama

- eToro

- Coinbase

- Binance

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment