Biobanking Industry Data Book - Biobanks, Cell Banking Outsourcing, Cord Blood Banking Services, DNA & RNA Banking Services Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

Grand View Research’s Biobanking Industry databook is a collection of market sizing & forecasts insights, market dynamics & trends, opportunity assessment, regulatory & technology framework, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses studies. Within the purview of the databook, such information is systematically analyzed and provided in the form of summary presentations and detailed outlook reports on individual areas of research.The following data points will be included in the final product offering in four reports and one sector report overview.

Access the Global Biobanking Industry Data Book, 2023 to 2030, compiled with details like trade data, pricing intelligence, and competitive benchmarking.

Biobanks Market Report Highlights

The global Biobanks Market size was estimated at USD 66.66 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030.

- The biobanking equipment segment accounted for the maximum revenue share in 2022 owing to the high cost of instruments coupled with an increase in the number of biorepositories

- The biobanking and repository services segment accounted for the largest revenue share in 2022 due to the higher penetration of these services and the increased need for the preservation of biosamples for developing precision medicine and disease-specific research

- Human tissues are the most stored sample for clinical research, resulting in the dominance of this sample type in the market

- The virtual biobanks segment is anticipated to witness the fastest CAGR during the forecast period owing to the growing demand for 3D biospecimens coupled with the need for rare disease data for biomedical research

- The therapeutics application segment accounted for the largest revenue share in 2022 owing to the growing popularity of cell therapies for cancer treatment

- Several pharma/biotech companies have established their private banks to support clinical trials and the development of cell therapies, resulting in revenue growth in this segment

Order your copy of Free Sample of “Biobanking Industry Data Book - Biobanks, Cell Banking Outsourcing, Cord Blood Banking Services, DNA & RNA Banking Services Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

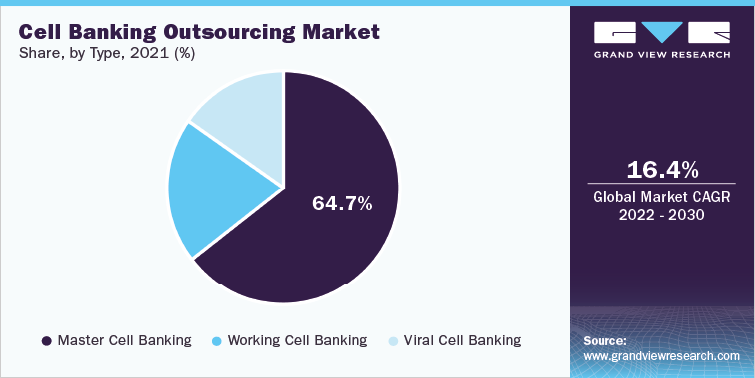

Cell Banking Outsourcing Market Report Highlights

The global Cell Banking Outsourcing Market size was estimated at USD 9.86 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 16.39% from 2022 to 2030.

- Master cell banking accounted for the largest market share in 2022, owing to rise in these facilities across the globe. Moreover, master cell banks are useful for the preparation of working cell banks and thus find applicability in various research and development perspectives for gene therapy thereby resulting to segment growth

- Master cell banking is done for longer duration and it also requires high-end equipment and advanced cryopreservation methodologies. As a result, cost incurred for these services is quite high, thus increasing the revenue share of this segment.

- Some of the major factors driving the market growth include increasing adoption of stem cell therapy, development of advanced cryopreservation and cell banking methodologies, and high demand for mAbs and other life-saving biopharmaceuticals.

- Furthermore, increasing government support and new initiatives for the development of stable cell lines along with development of new technologies for better cell line storage and characterization are some key factors pushing the market growth during the assessment period.

Go through the table of content of Biobanking Industry Data Book to get a better understanding of the Coverage & Scope of the study

Competitive Landscape

Competitive rivalry in the biobanking industry is high due to the presence of a large number of both well-established players and small- to mid-sized companies as well as biobanks in the market space. To maintain a significant share in the market, key participants are undertaking various initiatives and implementing business strategies, such as product launches, product portfolio expansion, reinforcement and stabilizing the distribution network, and manufacturing capacity expansion and geographic reach expansion through acquisitions, collaborations, and partnership.

Key players operating in the Biobanking industry are:

- Hamilton Company

- Becton, Dickinson and Company

- Avantor

- Promocell GMBH

- Biocision

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment