Metal Cans Industry Data Book - Aluminum Cans, Beverage Cans, Food Cans, 2- Piece Cans Market Size, Share, Trends Analysis, and Segment Forecasts, 2023 - 2030

The global Metal Cans Industry was valued at USD 61.7 billion in 2021 and is anticipated to increase at a significant CAGR from 2022 to 2030.

Grand View Research’s Metal Cans industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Beverage Cans Market Insights

The global beverage cans market size was estimated at USD 37.4 billion in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 5.3% from 2022 to 2030.The market is expected to witness growth owing to the increasing consumption of beverages such as carbonated soft drinks, beer, and cider. Additionally, the increasing ban on plastic products owing to sustainability concerns is likely to drive demand for alternative packaging solutions, benefitting the growth of the market. The superior physical properties of metal over its alternatives include the high malleability of aluminum and steel, easy labeling and printing on the metal surface, and design innovations that appeal to the young population. These benefits associated with the beverage cans for the manufacturers and end users are supporting the growth of the market. Thus the manufacturers are designing solutions that are meeting the requirements of consumers.

The global market is expected to witness substantial growth owing to the increasing recycling of used beverage cans. The growing demand for optimum utilization of natural resources has driven the demand for the recycling of metals for reuse. Metal recycling has garnered great support from government agencies such as the European Commission and the U.S. government who mandated the exchange of used cans. Furthermore, the metal recycling market is also expected to be benefitted from the municipal recycling programs initiated in countries such as the U.S., Italy, Brazil, Indonesia, and the U.K.

Order your copy of the Free Sample of “Metal Cans Industry Data Book - Aluminum Cans, Beverage Cans, Food Cans, 2- Piece Cans Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

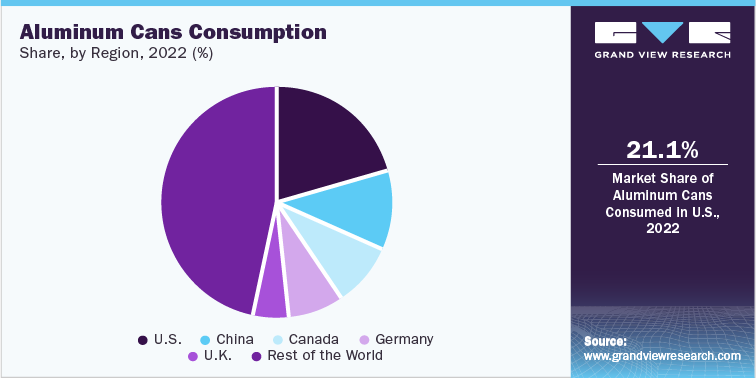

Aluminum Cans Market Insights

The global Aluminum Cans market size was valued at USD 45.6 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. The increasing awareness about the sustainability benefits associated with aluminum packaging coupled with easy recycling at infinite times without losing quality and less energy consumption is the major factor driving the market growth. According to the Metal Packaging Europe and European Aluminum, the recycling rate of aluminum beverage cans in the European Union including the United Kingdom, Switzerland, Norway, and Iceland was 73% in 2020.

Furthermore, as per the proposed new draft for a Packaging & Packaging Waste Regulation of the EU, aluminum cans meet the highest recyclability performance grade of 95%. Additionally, it allows varied customization including closure type, size, quality, and logo printing as per the requirement of end users also one of the major factors supporting the growth. These are some of the major factors supporting the growth and demand for aluminum cans in the global market. Therefore, the aluminum cans are expected to grow at a faster pace over the forecast period in contrast with steel cans.

Go through the table of content of Metal Cans Industry Data Book to get a better understanding of the Coverage & Scope of the study

Metal Cans Industry Data Book Competitive Landscape

The metal cans market is highly fragmented with the presence of various small-sized and medium-sized players. Metal Cans manufacturers are also making strategic efforts to expand their production capacities and geographical footprints along with the increase in the profit share in the global market. Metals cans market players are also focusing on sustainable packaging solutions and their reuse or recycling owing to the increasing rules and regulations by the respective government for suppressing the use of plastic packaging.

Key players operating in the Metal Cans Industry are:

- Amcor Ltd

- Ardagh Packaging Group Plc.

- Bail Corporation

- BWAY Corporation

- CPMC Holdings Ltd.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment