Livestock Artificial Insemination Industry Data Book - Bovine, Equine, Swine, Ovine & Caprine Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

The global Livestock Artificial Insemination Industry was valued at USD 6.45 billion in 2022 and is anticipated to increase at a significant CAGR of 6.30% from 2023 to 2030.

Grand View Research’s livestock artificial insemination industry data book is a collection of market sizing information & forecasts, regulatory data, competitive benchmarking analyses, macro-environmental analyses, and technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

Access the Global Livestock Artificial Insemination Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies

Bovine Artificial Insemination Market Growth & Trends

The global bovine artificial insemination market size is expected to reach USD 4.54 billion by 2030, registering a CAGR of 6.17% over the forecast period, according to a new report by Grand View Research, Inc. The market is driven by increasing demand for high-quality beef and dairy products, a focus on improving the genetic traits of bovines, as well as advancements in breeding technology. Artificial insemination facilitates animal owners to select the best sires for their cows, resulting in offspring with desirable traits such as increased milk production or meat yield.

As per OECD 2020-29 estimates, about 80% of the world’s milk production comprises cow milk. By 2029, India and Pakistan are projected to contribute to over 30% of the worldwide milk production. This is expected to propel the demand for bovine AI solutions to ensure efficient breeding programs. The COVID-19 pandemic limited access to artificial insemination solutions such as equipment, semen, and services. This led to dampened growth and reduced sales across the market. However, the market has recovered gradually since then, owing to unchanged underlying drivers.

For instance, advances in breeding technology have made artificial insemination a more efficient and affordable option for farmers. Semen can be collected from top-performing bulls and stored for use later, allowing farmers to access superior genetics without having to purchase expensive bulls or maintain them on their farms. Governments in many countries are also supporting the use of artificial insemination as a means of improving livestock productivity and reducing the environmental impact of animal agriculture.

Order your copy of the Free Sample of “Livestock Artificial Insemination Industry Data Book - Bovine, Equine, Swine, Ovine & Caprine Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

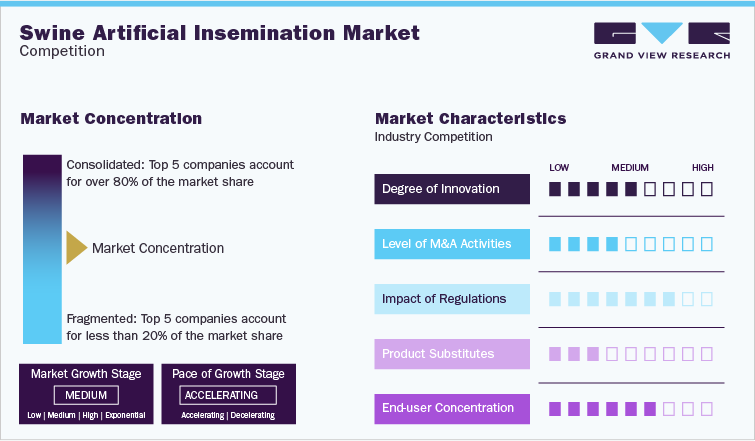

Swine Artificial Insemination Market Growth & Trends

The global swine artificial insemination market size is expected to reach USD 3.16 billion by 2030, expanding at a CAGR of 6.67% from 2023 to 2030, according to a new report by Grand View Research, Inc. The market is driven by factors such as increasing demand for pork products, advances in artificial insemination technology, awareness about the benefits of artificial insemination in pigs, and a focus on swine genetics, among others. PIC - a subsidiary of Genus, for instance, reported continued investments in its PRRSv-resistant pig program in 2022. The company estimates final FDA submissions to be made by December 2023. This will enable the company to launch gene-edited PRRSv-resistant pigs and explore tech-based solutions to other diseases.

The increasing focus on sustainable food production, animal genetics, and concerns over zoonoses are other factors driving the market growth. Swine producers exhibit increasing awareness of the benefits of artificial insemination, which often translates to increased productivity and better herd health. Swine producers are hence increasingly adopting artificial insemination products and services to breed swine that are more disease-resistant, have better meat quality, and are more efficient at converting feed into meat. Overall, the swine artificial insemination industry is expected to continue its growth in the coming years, driven by rising awareness about the benefits of artificial insemination in pigs and ongoing technological advancements in the field.

Go through the table of content of Livestock Artificial Insemination Industry Data Book to get a better understanding of the Coverage & Scope of the study

Competitive Landscape

Key players operating in the Livestock Artificial Insemination industry are:

- Genus Plc

- SEMEX

- URUS Group

- STgenetics

- Munster Bovine

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment