Advanced Payment Cards Industry Data Book - Virtual Cards, Dual Interface Payment Card and Biometric Payment Cards Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

The global Advanced Payment Cards Industry was estimated at USD 20.50 billion in 2022 and is anticipated to increase at a significant CAGR of 20.4% from 2023 to 2030.

Grand View Research’s advanced payment cards sector database is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

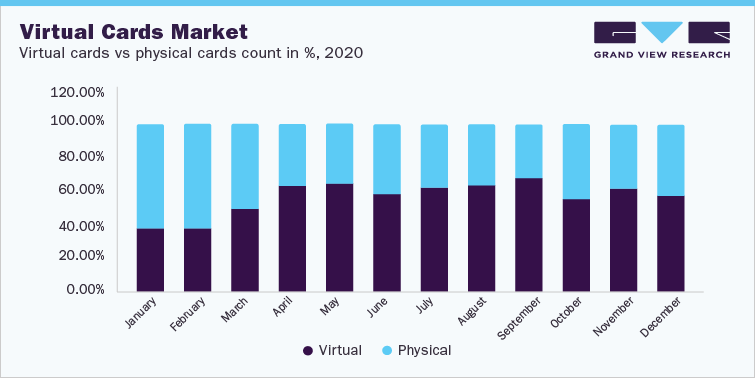

Virtual Cards Market Insights

The global virtual cards market was valued at USD 13.31 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 20.9% from 2023 to 2030. The growing number of digital transactions across the globe is projected to drive the demand for various types of virtual cards, thereby contributing to market growth. For instance, in May 2021, according to a report published by MasterCard Payment Index, 93% of the surveyed consumers preferred emerging payment trends such as biometrics, digital currencies, and QR code in addition to contactless payment. Hence, payment providers are constantly deploying multiple pay and shop solutions for consumers.

The demand for virtual cards is anticipated to be driven by the growing need for an extra layer of protection, such as tokenization in the digital payment gateway system. In addition, tokenization technology within virtual cards offers multiple benefits, such as a better user experience, reduced costs on protection, and others for both businesses and customers. Further, by integrating tokenization within these cards, merchants can transfer data between networks while protecting their customer’s vital information. Such factors are anticipated to create a positive outlook for the market during the forecast period.

The growing adoption of smartphones globally is emerging as one of the major factors propelling the adoption of virtual cards. Innovative technological advancements such as 5G are being integrated progressively within smartphones that offer users better customer satisfaction, thereby accentuating the market growth. In addition, growing internet penetration across the globe is leading to a surge in digital payments, thereby creating demand for virtual cards. In June 2022, according to the latest report published by World Bank, the global internet users have been estimated to be around 60% of the world population.

Order your copy of the Free Sample of “Advanced Payment Cards Industry Data Book - Virtual Cards, Dual Interface Payment Card and Biometric Payment Cards Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Dual Interface Payment Card Market Insights

The global dual interface payment card market size was valued at USD 7.10 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2023 to 2030. The continuous advancements made in payment card chips by technology companies enable dual interface payment card manufacturing businesses to improve their product offerings. Furthermore, the integration of several technologies such as Near Field Communication (NFC) and Radio Frequency Identification (RFID) within dual interface cards has enabled consumers to process contactless payments in seamless ways. Thereby, such trends in the industry are expected to drive growth over the forecast period.

The increasing demand for contactless payments by customers as well as small businesses is expected to drive market growth. Moreover, the increasing partnerships to launch contactless credit cards specifically designed for small businesses is expected to create growth opportunity for the growth of the dual interface payment cards market. For instance, in June 2022, Verizon announced its partnership with MasterCard and FNBO. This partnership was aimed at introducing small-scale business credit cards. The small business enterprises with these newly launched cards would be gaining the Verizon Business Dollars against gadgets or apparel for their company. Thereby enabling the scope of expansion for dual interface payment cards in the SMEs segment over the forecast period.

The rising demand in the banking sector for dual interface payment cards integrated with biometric sensors for payment verification is anticipated to drive the industry growth over the forecast period. Furthermore, the market players are involved in partnerships to manufacture and launch such biometric payment cards to offer high security and safety to their customers while processing payments. For instance, in February 2022, Swedish banking firm Rocker joined forces with the IDEMIA and IDEX. This collaboration was aimed at introducing Rocker Touch, a payment card leveraging biometric technology.

Go through the table of content of Advanced Payment Cards Industry Data Book to get a better understanding of the Coverage & Scope of the study

Advanced Payment Cards Industry Data Book Competitive Landscape

To endure the fierce competition, prominent market participants have formulated innovative concepts and ideas, improved their existing product lineup, and bolstered their profitability.

Key players operating in the Advanced Payment Cards Industry are:

- American Express Company

- JPMorgan Chase & Co.

- Mastercard

- Marqeta, Inc

- Skrill USA, Inc.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment