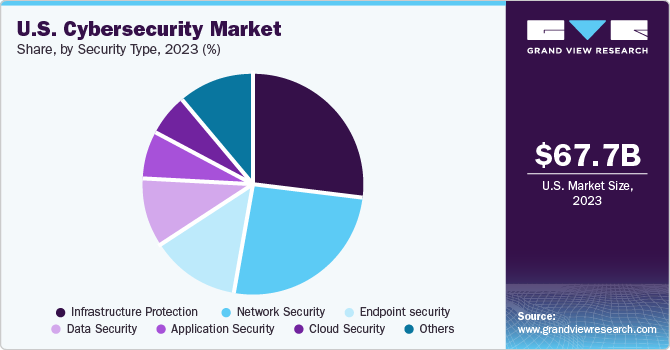

The U.S. cybersecurity market, valued at USD 67.69 billion in 2023, is projected to reach USD 135.34 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 10.7% from 2024 to 2030. The U.S. held a 30.4% share of the global customer experience management market. This growth in the U.S. cybersecurity market is primarily fueled by the escalating number of cyber threats and sophisticated malware attacks across various sectors. As new networks are deployed and existing ones expand within the United States, they become increasingly susceptible to cyber threats, driving the demand for robust cybersecurity solutions.

Furthermore, the U.S. government has actively worked to fortify its cybersecurity posture. In 2016, the Cybersecurity National Action Plan (CNAP) was introduced to strengthen national cybersecurity efforts. A key aspect of CNAP was an executive order establishing a commission dedicated to enhancing national cybersecurity. The Cybersecurity Act of 2015 promotes the responsible and efficient exchange of cyber threat information between the private sector and the U.S. government. Complementing this, the Cybersecurity Enhancement Act of 2014 facilitates voluntary public-private partnerships to improve cybersecurity and foster research and development in the field.

Key Market Dynamics & Insights:

- Services Segment Dominance: In 2023, the services segment led the market, generating the highest revenue of USD 39.04 billion. This is due to the increasing adoption of cybersecurity services by organizations to ensure data security and mitigate future cyberattacks.

- Infrastructure Protection Leading Security Type: The Infrastructure Protection segment dominated the market by security type, accounting for a 26.6% revenue share in 2023. This segment encompasses critical countermeasures such as vulnerability management, penetration testing, red teaming, intrusion prevention and detection, security monitoring, and configuration management to protect IT infrastructure.

- IAM Segment's Solution Leadership: The Identity and Access Management (IAM) segment was the leading solution type, with a revenue of USD 6.35 billion in 2023. IAM solutions are crucial for preventing identity theft through risk-based programs that emphasize logical access control and entitlement management.

- Professional Services' High Share: Professional services held the highest revenue share of 75.3% within the services segment in 2023. The increased adoption of these services can be attributed to the rising demand for offerings like enterprise risk assessment, penetration testing, physical security testing, and cyber security defense.

- On-Premise Deployment Preference: The on-premise deployment segment led the market, accounting for the highest revenue of USD 37.84 billion in 2023. Many large organizations prefer having complete ownership of their cybersecurity solutions and upgrades, particularly as they manage critical business information databases.

- Large Enterprises as Major Consumers: Large enterprises accounted for the largest revenue share of 66.5% in 2023. These businesses face significant risks, including data breaches and hacking, due to their reliance on advanced technologies.

- Defense/Government Application Sector: The Defense/Government segment generated the largest market revenue of USD 19.31 billion in 2023. Cybersecurity solutions provide essential network integrity for defense and government agencies, safeguarding their intellectual property, sensitive data, communications, and other intangible assets.

Order a free sample PDF of the U.S. Cybersecurity Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 67.69 Billion

- 2030 Projected Market Size: USD 135.34 Billion

- CAGR (2024-2030): 10.7%

Key Companies & Market Share Insights

Key players shaping the U.S. cybersecurity market include Microsoft Corporation, Cisco Systems, Inc., and IBM Corporation, among others.

- Cisco Systems, Inc. is a leading provider of technology solutions and services, with offerings categorized across networking, security, collaboration, applications, and cloud. Their security product and solution portfolio encompasses network security, identity and access management, advanced threat protection, industrial security, and user device security.

- IBM Corporation delivers a wide array of consulting and hosting services. The company specializes in areas such as cloud-based services, cognitive analytics, cybersecurity, general consulting, research, the Internet of Things (IoT), technology support, and various industry-specific solutions.

Key Players

- A10 Networks

- BAE Systems

- Broadcom

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- CrowdStrike

- CyberArk

- Fortinet, Inc.

- IBM Corporation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. cybersecurity market is experiencing substantial expansion, driven by increasing cyber threats and the continuous evolution of digital infrastructure. Government initiatives play a crucial role in strengthening the nation's cybersecurity posture, fostering collaboration between public and private sectors, and supporting vital research and development. The market is characterized by strong demand for services, infrastructure protection, and identity and access management solutions, with large enterprises and the defense sector being key application areas. Major technology companies are at the forefront of this competitive landscape, consistently innovating to provide advanced security offerings.

No comments:

Post a Comment