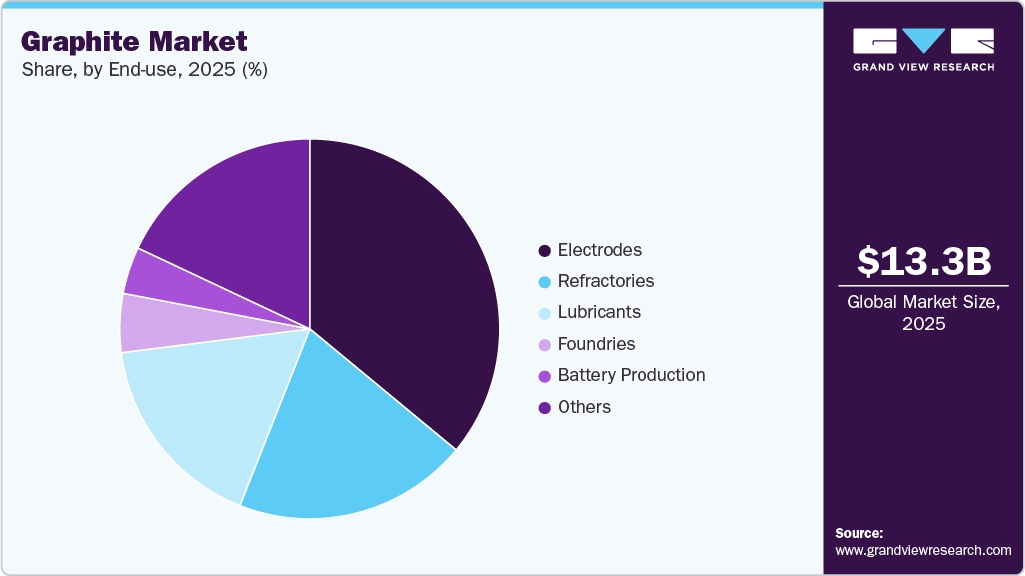

The global graphite market was estimated at USD 13.29 billion in 2025 and is projected to reach USD 23.87 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. Market growth is supported by increasing investments in industrial expansion, rising demand from detergents and petrochemical applications, and the material’s growing strategic importance across energy, mobility, and advanced manufacturing sectors.

Graphite demand is rising steadily due to its exceptional material properties, including high electrical and thermal conductivity, excellent lubricity, and chemical inertness. These characteristics make graphite indispensable in a wide range of applications, such as electrodes, lubricants, refractories, and advanced industrial components. Expanding petrochemical capacity and growing consumption of detergents and industrial chemicals are further contributing to market growth over the forecast period.

Graphite plays a critical role in the global transition toward clean energy and sustainable mobility. It is a key material in lithium-ion batteries, where it serves as the primary anode component. As electric vehicle adoption accelerates and renewable energy systems scale globally, demand for high-purity natural and synthetic graphite is increasing significantly. This trend positions graphite as a strategic raw material for long-term energy security and industrial innovation.

Sustainability initiatives and recycling efforts are increasingly shaping the future of the graphite market. Graphite recovery from spent lithium-ion batteries is gaining traction as part of broader circular economy strategies aimed at reducing raw material dependency and environmental impact. In parallel, manufacturers are investing in research and development to introduce greener production technologies and establish stable, low-emission supply chains. These efforts align closely with global decarbonization goals and carbon neutrality targets.

Key Market Trends & Insights

- Asia Pacific dominated the global graphite market with the largest revenue share of 44.4% in 2025.

- By form, synthetic graphite led the market, accounting for a revenue share of 67.5% in 2025.

- By end use, the electrode segment held the largest market share at 36.2% in 2025.

Download a free sample PDF of the Graphite Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2025 Market Size: USD 13.29 Billion

- 2033 Projected Market Size: USD 23.87 Billion

- CAGR (2026–2033): 7.8%

- Largest Regional Market (2025): Asia Pacific

Competitive Landscape

The graphite market is characterized by product innovation, capacity expansion, and strategic investments in next-generation battery materials.

- In April 2025, GrafTech International announced the upcoming rollout of an 800 mm graphite electrode following successful qualification trials. Designed for electric arc furnace steelmaking, the new electrode enables higher power input and reduced electrode consumption per ton of steel.

- In May 2025, Graphite India Ltd. invested INR 50 crore to acquire a 31% stake in Godi India Pvt. Ltd., a startup focused on advanced battery technologies including sodium-ion and solid-state materials, strengthening its presence in next-generation energy storage solutions.

- In April 2025, Imerys introduced SU NERGY, a catalyst-free, sustainable graphite product for battery and industrial applications, offering improved purity and enhanced environmental performance.

Key Companies in the Global Graphite Market

- Asbury Carbons

- ENERGOPROM Group

- BTR New Material Group

- HEG Ltd.

- Syrah Resource Limited

- AMG

- Eagle Graphite

- Imerys

- GrafTech International

- Graphite India Ltd.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global graphite market is poised for sustained growth, supported by rising electrification, increasing demand from battery and electrode applications, and a strong push toward sustainable and circular material practices. As industries worldwide prioritize clean energy, low-emission manufacturing, and advanced material solutions, graphite is expected to remain a critical resource underpinning long-term industrial and energy transitions.