Hair Removal Devices Industry Overview

The global hair removal devices market size was valued at USD 1,083.83 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 8.6% during the forecast period. There was a fall in the global market in 2020 due to the COVID-19 pandemic. The rise in beauty consciousness and growth in awareness about enhancing esthetic appeal are among the factors boosting the market. The COVID-19 pandemic had adversely impacted the beauty industry. The lockdown and restrictions have changed the purchase and usage behavior across the beauty and personal care space, which has resulted in a decrease in sales across many beauty segments.

However, the market is still recovering as some restrictions have been lifted and the spread of the virus is also declining. The growing awareness among people pertaining to their physical grooming and esthetics has led to high product demand. In the current scenario, people are highly concerned about their physical appearance. With the rise in disposable income levels, spending on personal care products is also increasing. This has boosted product sales. In addition, with the introduction of advanced products, the preference for noninvasive techniques for personal grooming is increasing. Potential risks associated with invasive procedures for improving esthetic appeal have led to the high demand for non-invasive or non-surgical techniques.

Gather more insights about the market drivers, restraints, and growth of the Global Hair Removal Devices market

There has been an increase in the availability of technologically advanced products. For instance, there have been consistent improvements in laser techniques, which have increased their efficiency and cost-effectiveness. Thus, benefits associated with the use of technologically advanced products are motivating people to use these tools. However, the high costs of laser products are expected to be an obstacle for people in developing regions. For instance, hair removal treatment on legs costs around USD 800 for a single session. This factor impacts their purchasing power, thereby leading to sluggish growth in developing regions.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Laser Hair Removal Market - The global laser hair removal market size was valued at USD 798.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 18.4% from 2022 to 2030.

Skincare Devices Market - The global skincare devices market size was valued at USD 12.5 billion in 2021 and is anticipated to witness a compound annual growth rate (CAGR) of 11.9% from 2022 to 2030.

Hair Removal Devices Market Segmentation

Grand View Research has segmented the global hair removal devices market on the basis of product, application, end-use, distribution channel, region:

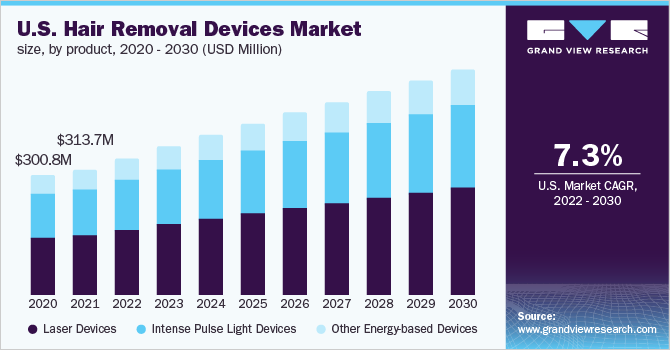

Hair Removal Devices Product Outlook (Revenue, USD Million, 2017 - 2030)

- Laser Devices

- Intense Pulse Light Devices

- Other Energy-based Devices

Hair Removal Devices Application Outlook (Revenue, USD Million, 2017 - 2030)

- Facial Hair Removal

- Legs

- Hands

- Others

Hair Removal Devices End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Beauty Clinics

- Dermatology Clinics

- Home Use

Hair Removal Devices Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Supermarkets and hypermarkets

- Drug-stores

- Online

Hair Removal Devices Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights

Some of the major players in the global hair removal devices market are:

- Solta Medical, Inc.

- Cynosure, Inc.

- Lumenis

- Venus Concept Canada Corp.

- Alma Lasers

- Lutronic

- Cutera

- Syneron Medical Ltd.

- Sciton, Inc.

- Viora

- Panasonic Corporation

- Home Skinovations Ltd

- Procter & Gamble Company

- iluminage Beauty Inc.

- Koninklijke Philips N.V

- Dermacell Private Limited

- LASERBIO OPTOTECH LLP

Order a free sample PDF of the Hair Removal Devices Market Intelligence Study, published by Grand View Research.