Insulin Delivery Devices Industry Overview

The global insulin delivery devices market size was valued at USD 12.5 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030. Insulin delivery devices including syringes, pens, pumps, and jet injectors are used to deliver insulin to diabetic patients. One of the foremost factors contributing to the growth of the market is the surging number of diabetics due to aging, obesity, and unhealthy lifestyles. Obesity is believed to be a major factor leading to the development of diabetes in individuals. According to the WHO, in 2014, over 1.9 billion people were identified to be overweight, of which, around 600 million people were obese.

Risk factors, such as obesity and being overweight are highly linked to the incidence of diabetes, which is rising by epidemic proportions, thus rendering a high prevalence of diabetes. Consequently, the large population afflicted with diabetes is driving the market for insulin delivery devices. In addition, the high demand for advanced insulin delivery devices is supporting the adoption of recently launched innovative pen devices and portable pumps, which is estimated to boost the market growth. However, stringent government rules and regulations governing the product approval process and the high cost of insulin analogs in diabetes care management could hinder the market growth.

Gather more insights about the market drivers, restraints, and growth of the Global Insulin Delivery Devices market

The outbreak of COVID-19 led to dramatic turmoil in the market for insulin delivery devices. Nearly 40% of the global Covid 19 facilities reported the admissions of people with diabetes. However, ~45% of those patients, didn’t receive routine medical care due to the fear of the virus spreading. One in every 5 patients, experienced the reduced availability of blood glucose monitoring devices and ~20% experienced the delaying of refilling of insulin pumps, mainly due to financial constraints. Disruption in the supply chain due to closure of manufacturing sites, shipping delays or shutdowns, and trade limitations or export bans on life-saving drugs such as Insulin.

China imposed a ban on life-saving drugs to export in the U.S., in March 2020. This led to the reduction in raw material supply for the manufacturing of insulin in the U.S. On the other hand, the market players like Eli Lilly, Sanofi, and Novo Nordisk, disapproved the shortage claims and fulfilled the market needs, by increasing manufacturing levels. But, the lack of reimbursement from the government, insurance losses, economic setbacks experienced by buyers, and the high cost of insulin, have led to the decline in the market for insulin delivery devices. It is said to grow at a steady rate by mid-2022.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Blood Glucose Monitoring Devices Market - The global blood glucose monitoring devices market size was valued at 11.71 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2022 to 2030.

Insulin Patch Pumps Market - The global insulin patch pumps market size was valued at USD 836.14 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.73% from 2022 to 2030.

Insulin Delivery Devices Market Segmentation

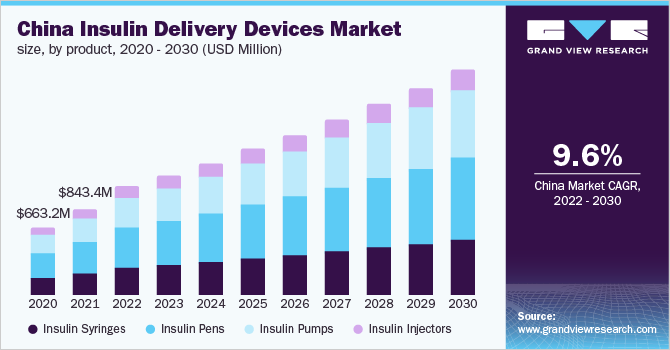

Grand View Research has segmented the global insulin delivery devices market based on product, end use, and region:

Insulin Delivery Devices Product Outlook (Revenue, USD Million, 2018 - 2030)

- Insulin syringes

- Insulin pens

- Insulin pumps

- Insulin injectors

Insulin Delivery Devices End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Homecare

- Others

Insulin Delivery Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

December 2021: Eli Lilly developed a biosimilar version of insulin glargine, Rezvoglar KwikPen, that received FDA approval.

November 2021: Sanofi partnered with Roche, to increase the adoption of disposable insulin pens. Further, these players are collaborating with local players to improve their market reach.

Key Companies profiled:

Some of the prominent players in the insulin delivery devices market include:

- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Biocon Ltd.

- Ypsomed AG

- Wockhardt Ltd.

- Medtronic

- Abbott Laboratories

- Hoffmann-La Roche, Ltd.

Order a free sample PDF of the Insulin Delivery Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment