U.S. Laboratory Informatics Industry Overview

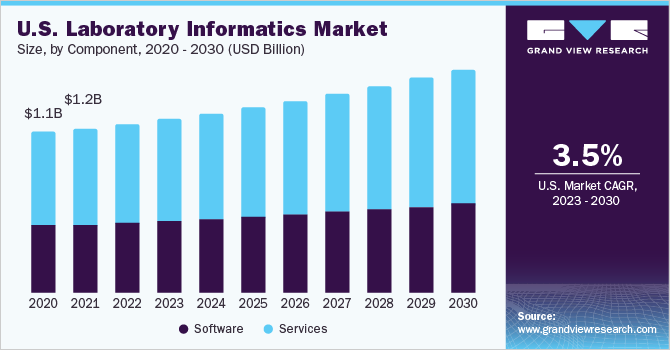

The U.S. laboratory informatics market size was valued at USD 1.20 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2022 to 2030. The growing demand for laboratory automation is expected to boost the adoption of laboratory information systems in the future. Surging demand for scientific data integration solutions among end-use industries including life sciences, Contract Research Organizations (CROs), food & beverage, and chemicals is projected to boost the market growth. The increasing need for clinical workflow management in laboratories to improve operational efficiency is likely to propel the market in the coming years.

Furthermore, the rising adoption of Laboratory Information Management Systems (LIMS) among independent and hospital-based labs to reduce the incidence of diagnostic errors and manage high data volumes is one of the key factors stirring up the adoption of laboratory informatics in the U.S. The COVID-19 pandemic affected the market as it has enforced the government and agencies to develop and introduce the COVID-19 vaccine to control the severity in cases. In addition, high volumes of WHO-recommended COVID-19 tests encouraged the implementation of healthcare laboratory informatics solutions. Likewise, numerous healthcare laboratory informatics market players are quickly incorporating Artificial Intelligence (AI) and data analytics to conduct further research on the different virus strains.

Gather more insights about the market drivers, restraints, and growth of the U.S. Laboratory Informatics market

Significant adoption of LIMS has been seen since the COVID-19 pandemic onset, allowing healthcare professionals to focus on drug and vaccine development by smoothening data collection procedures. Key players in the laboratory information systems are collaborating with public and private sector groups to employ advanced technologies for executing COVID-19-testing capabilities. In addition, laboratory information systems offer benefits, such as improved regulatory compliance, systems process optimization, intellectual property rights protection, paperless information management, and reduced throughput time.

They also offer improved information quality, reduce the labor cost, and provide faster & effective data analytics. Owing to the associated benefits, these systems are being increasingly used by CROs, biobanks, and academic research institutes. Furthermore, the growing adoption of wireless technologies in laboratories to allow remote access to information is estimated to fuel growth prospects. In addition, advancements in laboratory equipment help in replacing manual data evaluation methods, including the construction of calibration curves, and measuring peak areas or height in a shorter time than traditional methods. For instance, the Autosampler robotic system helps in sample preparation, which eliminates errors and saves cost & time on process execution.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Laboratory Information Management System Market - The global laboratory information management system market size was valued at USD 2.07 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030.

Electronic Lab Notebook Market - The global Electronic Lab Notebook (ELN) market size was estimated at USD 532.0 million in 2018 and is anticipated to expand at a CAGR of 4.8% over the forecast period.

U.S. Laboratory Informatics Market Segmentation

Grand View Research has segmented the U.S. laboratory informatics market on the basis of product, delivery mode, component, and end use:

U.S. Laboratory Informatics Product Outlook (Revenue, USD Million, 2017 - 2030)

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

U.S. Laboratory Informatics Delivery Mode Outlook (Revenue, USD Million, 2017 - 2030)

- On-Premise

- Web-hosted

- Cloud-based

U.S. Laboratory Informatics Component Outlook (Revenue, USD Million, 2017 - 2030)

- Software

- Services

U.S. Laboratory Informatics End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Life Sciences

- CROs

- Chemical Industry

- Petrochemical Refineries and Oil & Gas

- Food & Beverages and Agriculture

- Environmental Testing Labs

- Others Industries

Market Share Insights

September 2021: PerkinElmer completed the acquisition of BioLegend.

August 2021: Abbott Informatics released STARLIMS Laboratory Execution System v1.1. This is built on the latest STARLIMS Quality Manufacturing QM 12.2. Moreover, initiatives, such as a merger, acquisitions, product launches further support overall market growth.

Key Companies profiled:

Some of the prominent companies operating in the global U.S. laboratory informatics market are:

- Thermo Fisher Scientific, Inc.

- Waters

- LabWare

- Core Informatics

- LabVantage Solutions, Inc.

- LabLynx, Inc.

- PerkinElmer Inc.

- Abbott

- Agilent Technologies, Inc.

- IDBS

Order a free sample PDF of the U.S. Laboratory Informatics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment