Non-PVC IV Bags Industry Overview

The global non-PVC IV bags market size was valued at USD 1.69 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030. Rising demand for preventive measures for errors such as improper dose delivery and augmented demand for advanced IV containers are among the major drivers of the industry. In March 2021, Fagron Sterile Services US (FSS), a 503B outsourcing leader announced the addition of a new platform - intravenous (IV) bags - to its product portfolio. Issues with traditional IV containers include drug-packaging material interactions and difficulties in transporting, handling, and disposing of containers. The majority of these issues can be prevented by using non-PVC IV bags. As a result, demand for the same is predicted to skyrocket during the forecasted period.

Furthermore, there is a growing demand in the treatment of oncology processes, mainly for chemotherapy and targeted drug delivery as most of these therapeutic agents are prone to interaction with the plasticizers and have a tendency to convert into harmful agents. This discordancy can be minimalized by the use of containers without plasticizers. These bags are made of polypropylene and ethylene-vinyl acetate. Several firms are turning to plasticizer-free, biologically inert materials to substitute the use of polyvinyl chloride (PVC). In the past 5 years, B. Braun has spent around USD 500.00 million on developing innovative ways to provide PVC and DEHP-free product lines. The development and availability of modern materials in different designs are forecast to expand the need for non- PVC IV bags through the replacement of glass and PVC containers.

Gather more insights about the market drivers, restraints, and growth of the Global Non-PVC IV Bags market

The other factors supporting market growth include the surging presence of the local manufacturers in the global market, stringent regulations against the usage and disposal of PVC, and healthcare infrastructure development in emerging countries. Besides, technological advances in service quality and an increased number of hospitals worldwide are some of the other additional factors that drive the global non-PVC IV bags market.

Cancer treatment deprives the human body from nutrition. Moreover, it affects the human body by causing physical obstructions, GI dysfunction, and ulcers. All of these limit the body from naturally extracting nutrition from the food. As a consequence, the patients are required to be externally injected. The demand for IV bags has risen significantly as cancer has increased over the past few years. For instance, according to the World Health Organization (WHO), cancer has emerged as the second leading cause of death across the world. It is further stated that an estimated 9.6 million deaths, i.e., 1 in 6 deaths were reported due to cancer in 2018. The American Cancer Society, on the other hand, estimated that more than 1.7 million new cancer cases were diagnosed in America in 2019. From data by Cancer Research U.K., each year 36,7000 new cases of cancer are reported in the U.K. Increasing prevalence of cancer is the most promising factor for the growth of the IV solutions market.

There have been growing concerns in the medical field of PVC IV bags posing a risk to human health and the environment due to phthalates leaching from equipment. Furthermore, it has resulted in the production of toxic HCL by disposal of PVC products using the incineration process. This contributes further to acid rainfall. Building IV bags, made of PVC-free material with thermal stability, moisture-barrier properties, and environmentally-friendly disposal are therefore made for companies like Baxter, Hospira, and B. Braun Melsungen AG. Hence, with the adoption of PVC-free IV bags, the healthcare industry can make a significant stride in protecting the health and safety of the patient population globally.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Empty IV Bags Market - The global empty IV bags market size was valued at USD 4.54 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.60% from 2023 to 2030.

Stoma Care Market - The global stoma care market size was valued at USD 487.7 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2028.

Non-PVC IV Bags Market Segmentation

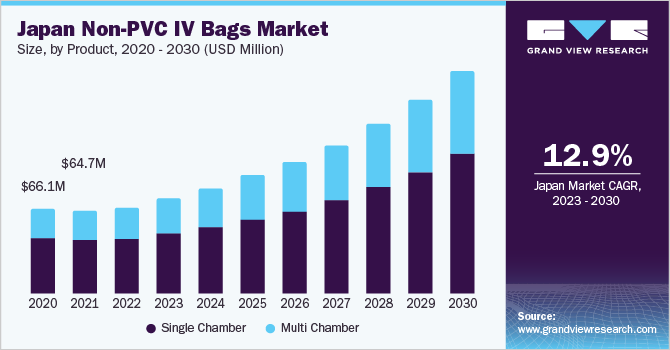

Grand View Research has segmented the global non-PVC IV bags market report based on product, material, content, and region:

Non-PVC IV Bags Product Outlook (Revenue, USD Million, 2018 - 2030)

- Single Chamber

- Multi Chamber

Non-PVC IV Bags Material Outlook (Revenue, USD Million, 2018 - 2030)

- Ethylene Vinyle Acetate

- Polypropylene

- Copolyester Ether

- Others

Non-PVC IV Bags Content Outlook (Revenue, USD Million, 2018 - 2030)

- Frozen Mixture

- Liquid Mixture

Non-PVC IV Bags Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia-Pacific

- Latin America

- MEA

Market Share Insights

July 2019: Baxter received U.S. FDA approval for Myxredlin, the 1st and only ready-to-use insulin for IV infusion.

May 2019: Sihuan Pharmaceutical Holdings Group Ltd, launched the “non-PVC solid-liquid double chamber bag for ceftazidime/sodium chloride injection” cooperatively developed by the Group and its associated company Beijing Ruiye Drugs Manufacture Co. Ltd.

Key Companies profiled:

Some prominent players in the global non-PVC IV bags market include:

- Baxter

- Braun Melsungen AG

- Pfizer, Inc. (Hospira)

- Fresenius Kabi AG

- JW Life Science

- RENOLIT

- PolyCine GmbH

- Sealed Air

- ANGIPLAST PVT. LTD

- Shanghai Solve Care Co Ltd.

- Kraton Corporation

- Jiangxi Sanxin Medtec Co., Ltd.

Order a free sample PDF of the Non-PVC IV Bags Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment