U.S. Telehealth Industry Overview

The U.S. telehealth market size was valued at USD 23.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 44.4% from 2022 to 2028. The shortage of healthcare specialists and primary care physicians in the U.S. is one of the major factors expected to accelerate the market growth in the U.S. For instance, according to the Association of American Medical Colleges (AAMC) estimation, there is a shortage of both primary and specialty care physicians between 37,800 and 124,000 physicians by 2034.

High-scale investment in digital health and virtual care by the government of the U.S. is also anticipated to boost market growth. Besides, remote provision for healthcare services has been established from a long back in the U.S. The National Aeronautics and Space Association (NASA) played a significant role in the development of telemedicine. Several studies stated that in 1960, NASA has established telemedicine in the United States. Now, about 76% of hospitals in the U.S. connect with patients using some form of telemedicine.

Gather more insights about the market drivers, restraints, and growth of the U.S. Telehealth market

In recent years, virtual healthcare plays a vital role in improving health equity by providing timely treatment and clinical assessment, especially to the most vulnerable population. In order to strengthen telehealth services and rural health in the U.S., the Biden-Harris Administration in August 2021 invested over 19 million USD through Health Resources and Services Administration (HRSA) at the U.S. Department of Health and Human Services (HHS).

The COVID-19 pandemic has shown the importance of virtual healthcare services. Before the pandemic, the utilization of virtual healthcare services in the U.S. was nominal. In order to deal with the shortage of physicians during COVID-19, the telehealth market is skyrocketed in the U.S. Telehealth has been considered an emergency tool during the COVID-19 pandemic. Due to several conditions, such as high COVID-19 infection rate, difficulty in accessing medical care, and the national emergency during the coronavirus pandemic, there is an increase in investments by the government organization in the U.S.

For instance, in February 2021, the United States Department of Agriculture (USDA) invested $42 Million in telemedicine infrastructure and distance learning to health outcomes and education. USDA funded 86 projects to rural communities through Distance Learning and Telemedicine (DLT) program to help people by providing rural healthcare education and grant to purchase telemedicine interactive telecommunications distance learning equipment.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Digital Biomarkers Market - The global digital biomarkers size was valued at USD 2.43 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 21.9% from 2022 to 2030.

Healthcare Digital Twins Market - The global healthcare digital twins market size was valued at USD 462.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 25.6% from 2022 to 2030.

U.S. Telehealth Market Segmentation

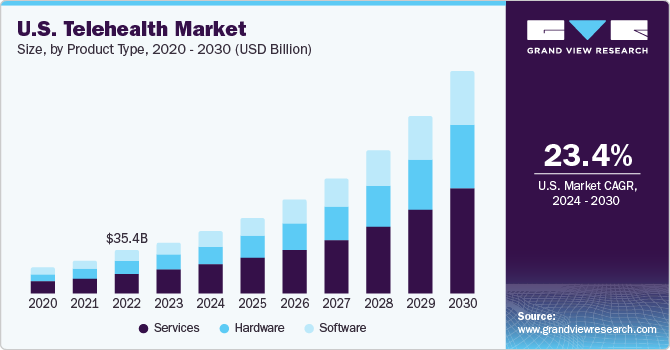

Grand View Research, Inc. has segmented the U.S. telehealth market based on product type, delivery mode, and end use:

U.S. Telehealth Product Type Outlook (Revenue, USD Million, 2016 - 2028)

- Hardware

- Software

- Services

U.S. Telehealth Delivery Mode Outlook (Revenue, USD Million, 2016 - 2028)

- Web-based

- Cloud-based

- On-premises

U.S. Telehealth End-use Outlook (Revenue, USD Million, 2016 - 2028)

- Providers

- Payers

- Patients

Market Share Insights

June 2021: GE Healthcare collaborated with the American College of Cardiology (ACC) to build a road map for digital technology using Artificial Intelligence (AI) technology for improved health outcomes in cardiology including valvular heart disease, coronary artery disease, and heart failure.

January 2018: Philips made partnerships with American Well in telehealth to provide better consumer health and professional healthcare.

Key Companies profiled:

Some prominent players in the U.S. telehealth market include:

- Koninklijke Philips N.V.

- Siemens Healthineers

- Cerner Corporation

- GE Healthcare

- Medtronic PLC

- Teladoc Health Inc.

- American Well

- Doctor on Demand

- SMed

- MDLive

Order a free sample PDF of the U.S. Telehealth Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment