Surgical Sutures Industry Overview

The global surgical sutures market size was valued at USD 4.2 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. The COVID-19 pandemic led to a change in healthcare priorities. The healthcare providers mainly focused on the COVID-19 infected patients, while the government imposed complete lockdowns to avoid the spread of the virus. All the elective surgeries were postponed or kept on hold to avoid contracting the virus, leading to a shortage in demand for surgical sutures. Hence, a rapid drop in the sales of surgical sutures was observed in 2020 due to the outbreak of the COVID-19 pandemic.

The COVID-19 pandemic had a major negative impact on the market in 2020. With the economies opening up and countries returning to normalcy, surgical procedures are expected to be carried out at a much faster pace. Hospitals and ambulatory care centers are constantly strategizing to maximize the number of elective surgeries that are carried out. Healthcare providers are aiming to achieve this through telehealth assessment, screening tools, and optimized coordination tools.

Gather more insights about the market drivers, restraints, and growth of the Global Surgical Sutures market

Mobile apps allow the surgeons to provide information about the procedure, post-care instructions, and a checklist of items that need to be completed before showing up on the day of the procedure. This helps the healthcare providers to optimize procedures rooms and staff while helping patients receive the care they need. Similar strategies are helping the hospitals and ambulatory surgical centers to overcome the loss they have incurred during the pandemic and generate revenues at the pre-COVID growth rate. This has further helped the market to regain its growth in 2021.

A rise in lifestyle diseases due to the increasing adoption of a sedentary lifestyle is another factor majorly contributing to the market growth. Lifestyle diseases such as ischemic heart diseases, cerebrovascular diseases, orthopedic disorders, cancers, and mental illness are constantly rising, globally. This continuous rise in the prevalence of lifestyle diseases and growing demand for a higher number of surgical procedures are driving the market for surgical sutures.

The rise in healthcare expenditure by most countries and improving healthcare infrastructure in emerging economies are expected to promote patient footfall. In addition, technological advancement by key players helps to initiate more precise procedures, which increases the success rate of surgery. This is also leading to the growth of the market for surgical sutures.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Surgical Stapling Devices Market - The global surgical stapling devices market size was valued at USD 4.88 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.33% from 2023 to 2030.

Microsurgery Market - The global microsurgery market size was valued at USD 2.2 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 5.5% during the forecast period.

Surgical Sutures Market Segmentation

Grand View Research has segmented the global surgical sutures market based on type, filament, application, and region:

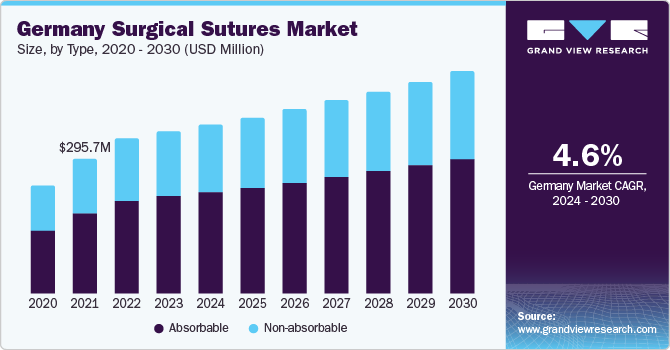

Surgical Sutures Type Outlook (Revenue, USD Million, 2017 - 2030)

- Absorbable

- Non-absorbable

Surgical Sutures Filament Outlook (Revenue, USD Million, 2017 - 2030)

- Monofilament

- Multifilament

Surgical Sutures Application Outlook (Revenue, USD Million, 2017 - 2030)

- Ophthalmic Surgery

- Cardiovascular Surgery

- Orthopedic Surgery

- Neurological Surgery

- Others

Surgical Sutures Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

August 2021: Ethicon US, LLC, which is a part of Johnson & Johnson, announced the launch of ProxiSure™ Suturing Device in the U.S. The device features Ethicon endomechanical, suture and curved needle technologies and is an advanced laparoscopic suturing device.

September 2020: Smith & Nephew launched its HEALICOIL KNOTLESS Suture Anchor. With this, the company aimed to grow its revolutionary line of advanced healing solutions for rotator cuff repair.

Key Companies profiled:

Some prominent players in the global surgical sutures market include:

- Covidien

- Ethicon US, LLC. (Johnson & Johnson Services, Inc.)

- Braun Melsungen AG

- Smith & Nephew

- Integra Lifesciences

- Peter Surgical

- Internacional farmaceutica

- CONMED CORPORATION

- Sutures India Pvt. Ltd.

Order a free sample PDF of the Surgical Sutures Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment