Spinal Implants and Devices Industry Overview

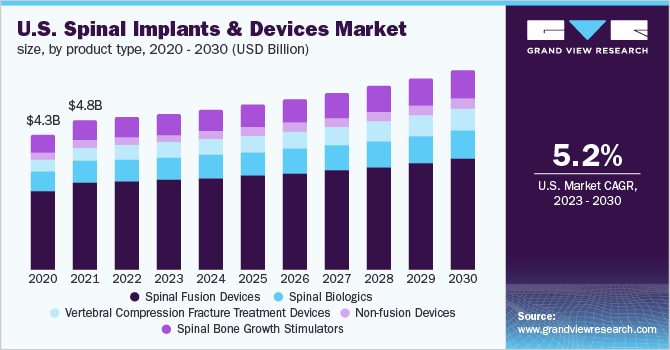

The global spinal implants & devices market size was valued at USD 12.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR of 5.2% in the forecast period from 2023 to 2030. The market growth can be attributed to the growing incidences of spinal cord injuries (SCIs) across the globe. Compression of the spinal cord or injury causes damage from the outside of the cord. This compression is mainly due to either spinal degeneration, bone fracture, or abnormalities, such as a hematoma or herniated disk.

WHO data states that approximately 250,000 and 500,000 SCI cases occur every year across the world. The majority of the SCIs are caused due to preventable causes such as falls, road traffic accidents, and violence. According to WHO, the estimated incidence of SCI annually is 40-80 cases per million in the world. The mortality risk is higher among SCI patients since they lead to premature deaths 2 to 5 times more likely than patients who do not have SCI. The majority of the traumatic SCIs are due to work or sports-related injuries. Moreover, the increasing geriatric population and the number of people with obesity frequently develop symptoms associated with spinal disorders such as spinal stenosis that further boost the demand for spinal implant surgeries, thereby propelling the market growth. Obesity also tends to worsen an existing low back problem and can lead to the recurrence of the condition. The major spine-related disorders pertaining to the geriatric population include degenerative disc diseases, spondylolisthesis, vertebral compression fractures, and spinal stenosis.

Gather more insights about the market drivers, restraints, and growth of the Global Spinal Implants and Devices Market

The rise in road traffic crashes has significantly led to an increase in the number of SCIs. Based on National Spinal Cord Injury Statistical Center (NSCSC) data, motor vehicle accidents such as cars, as well as steamrollers, bulldozers, forklifts, and other unclassified vehicles are some of the driving factors in SCI causes. As per NCBI, based on a study enrolling all patients with spinal fractures after car accidents, the lumbosacral spine was the most commonly involved region. Some of the common motor vehicle accident-related spine injuries include whiplash (it is a neck/cervical spine injury), herniated disc, and vertebral fractures. According to the National Spinal Cord Injury Statistical Center at UAB, from 2018 to 2019, fall was the second-leading cause of SCI (31.8%). In the U.S., fall-induced SCI has significantly increased over the last 4 decades and it is common among people aged 65 years and above. Based on NCBI, around 75% of SCI cases due to falls come under 76 years of age and older population.

The existence of numerous market players accompanied by funds raised by the government for research and development further leads to technological evolution. One of the key technological trends reinforcing the spinal implants & devices market is the use of computer-based navigation systems and titanium implants that provide real-time images of the spine and clear MRI images, respectively. This enhanced the scope of minimally invasive surgeries as compared to open back surgeries. A significant advancement in the spinal surgery market was the launch of NuVasive’s Pulse integrated technology platform. It is the first, single platform that has multiple technologies so that surgeons can undertake more safe & effective and less disruptive surgical methods in all spine procedures.

The market is moving toward consolidation, wherein the major players are acquiring potential start-ups and mid-sized players to increase their dominance in the industry. For instance, in February 2021, NuVasive acquired Simplify Medical, a privately held company and developer of the Simplify Cervical Artificial Disc for cervical total disc replacement (cTDR). In March 2021, IMPLANET offered to acquire a majority stake in Orthopedic & Spine Development (OSD) specializing in spine surgical implants.

The COVID-19 pandemic has impacted the spine surgery market to a great extent. Based on a survey in Central Europe, about 90% of the participants noticed a reduction in the number of degenerative spinal disease patients in outpatient clinics. The study also noticed that around 50% of the surgeons who developed SARS-CoV2 canceled all elective and semi-elective procedures. 36% of the surgeons postponed decompression surgery or lumbar disc with minor symptoms.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Orthopedic Implants Market - The global orthopedic implants market size was valued at USD 33.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030.

Spinal Fusion Device Market - The global spinal fusion device market size was valued at USD 6.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.4% from 2021 to 2028.

Spinal Implants and Devices Market Segmentation

Grand View Research, Inc. has segmented the global spinal implants & devices market based on product, technology, surgery type, procedure type, and region.

Product Outlook (Revenue, USD Million, 2016 - 2030)

- Spinal Fusion Devices

- Spinal Biologics

- Vertebral Compression Fracture Treatment Devices

- Non-fusion Devices

- Spinal Bone Growth Stimulators

Technology Outlook (Revenue, USD Million, 2016 - 2030)

- Spinal Fusion And Fixation Technologies

- Vertebral Compression Fracture Treatment

- Motion Preservation Technologies

Surgery Type Outlook (Revenue, USD Million, 2016 - 2030)

- Open Surgery

- Minimally Invasive Surgery

Procedure Type Outlook (Revenue, USD Million, 2016 - 2030)

- Discectomy

- Laminotomy

- Foraminotomy

- Corpectomy

- Facetectomy

Spinal Implants and Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

October 2021: NuVasive launched Cohere TLIF-O implant and also announced the upcoming launch of the Cohere TLIF-A implant for posterior spine surgery.

November 2020: Medtronic completed its friendly tender offer for Medicrea International.

Key Companies profiled:

Some prominent players in the global Spinal Implants and Devices Market include -

- Medtronic

- Johnson & Johnson

- Stryker

- NuVasive

- Zimmer Biomet

- Globus Medical, Inc.

- Alphatec Spine, Inc.

- Orthofix Holdings, Inc.

- RTI Surgical Holdings

- ulrich GmbH & Co. KG

- B. Braun Melsungen AG

- Seaspine Holdings Corporation

Order a free sample PDF of the Spinal Implants and Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment