Fixed And Mobile C-arms Industry Overview

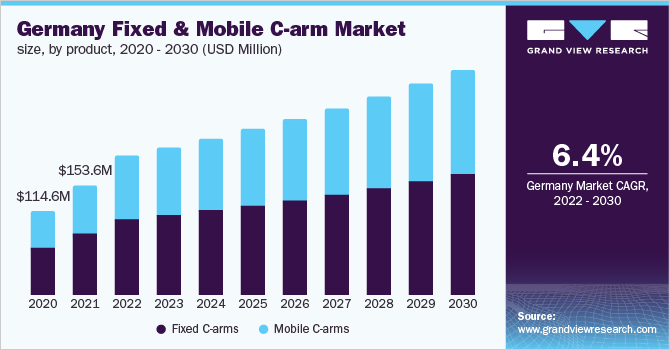

The global fixed and mobile C-arms market size was valued at USD 2.02 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030. The market growth can be attributed to the growing number of surgical procedures, and technological advancements in the development of novel C-arms. In addition, the rising geriatric population, which is susceptible to various chronic disorders, is also expected to contribute to the market growth.

The use of C-arm systems in intraoperative procedures has become an important tool in modern surgical practice. It enhances the technical proficiency of the surgeon in addition to reducing the morbidity and patient’s duration/length of stay (LOS) in the hospital. The powerful imaging system on the C-arm allows for many movements to be performed in a single session. C-arm machines are widely utilized in orthopedic, urology, gastrointestinal, pain management, cardiovascular, emergency, and therapeutic studies such as stent or needle placements.

Gather more insights about the market drivers, restraints, and growth of the Global Fixed and Mobile C-arms market

Many market players make constant efforts to develop advanced systems, such as the integration of Artificial Intelligence (AI)-enabled technology and 3D mapping capabilities in a C-arm system, which would improve process planning, increase real-time intraoperative guidance, and considerably reduce surgical operation times. For instance, in January 2022, Philips announced the integration of cloud-based AI and 3D mapping into its mobile C-arm System Series - Zenition - to enhance workflow efficiency and improve endovascular treatment outcomes. Philips further stated that the combination of these technologies would result in a 50% reduction in radiation exposure and a more than 20% reduction in procedure times.

The rising geriatric population susceptible to various chronic conditions such as cardiovascular, orthopedic, and respiratory diseases, coupled with increasing patient awareness, is expected to drive the market growth over the forecast period. According to the WHO, the population of people aged 60 years and above will be about 2.1 billion by 2050 from 1.5 billion in 2020. In addition, the increasing level of accuracy with 3D visualization and the introduction of flat-panel detectors replacing image intensifiers, which lowers patient dose and increases image quality, has led to increasing demand for these devices in recent years, allowing healthcare experts to understand the intensity of a disease better.

The COVID-19 pandemic negatively impacted the C-arms market, since these systems are used in guidance for mostly elective surgeries. Studies suggest that about 28 million elective procedures may be canceled around the world during the COVID-19 pandemic's peak disruption period of 12 weeks. However, the elective surgery rate has increased by one-fifth after the lockdown and also decreased elective surgery waiting times by as much as one-third, thus creating opportunities for market expansion.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Portable Medical Devices Market - The global portable medical devices market size was valued at USD 63.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.30 % from 2023 to 2030.

Wound Care Market - The global wound care market size was valued at USD 21.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.15% from 2023 to 2030.

Fixed And Mobile C-arms Market Segmentation

Grand View Research has segmented the global fixed and mobile C-arms market based on product, application, and region:

Fixed And Mobile C-arms Product Outlook (Revenue, USD Million, 2017 - 2030)

- Fixed C-arms

- Mobile C-arms

Fixed And Mobile C-arms Application Outlook (Revenue, USD Million, 2017 - 2030)

- Orthopedics and Trauma

- Neurosurgery

- Cardiovascular

- Pain Management

- Gastroenterology

- Others

Fixed And Mobile C-arms Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

April 2021: Carestream Health, in collaboration with Ziehm Imaging, announced the addition of a mobile C-arm to its increasing innovative product line. The Ziehm Vision RFD C-arm is expected to expand Carestream's mobile and fluoroscopic product offerings to benefit even more healthcare providers.

Key Companies profiled:

Some of the prominent players in the global fixed and mobile C-arms market include:

- GE Healthcare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Medtronic

- Ziehm Imaging GmbH

- Shimadzu Corporation

- Hologic Corporation

- Canon Medical Systems

- FUJIFILM

- Eurocolumbus

Order a free sample PDF of the Fixed And Mobile C-arms Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment