Antifungal Drugs Industry Overview

The global antifungal drugs market size was valued at USD 15.30 billion in 2022 and is projected to witness at a compound annual growth rate (CAGR) of 3.74% from 2023 to 2030. The growing prevalence of fungal infections such as aspergillosis and candidiasis is one of the key factors propelling the market. Fungal infections encompass both systemic and superficial infections including infections of the skin, eye, mouth, and vagina. Antifungal products with fungicidal activity are mostly used to treat a wide array of diseases, such as athlete's foot, ringworm, and fungal meningitis, caused by fungal agents. Moreover, mounting cases of patients suffering from hospital-acquired or nosocomial infections and infectious diseases are poised to propel the growth of the market during the forecast period.

Fungal diseases are a public health problem as they can affect any individual. However, there is a severe threat of fungal infections to people with weak immune responses such as patients with AIDS. There is a high possibility of the development of opportunistic fungal infections in these patients. According to statistics published by the Centers for Disease Control and Prevention in 2016, every year, nearly 220,000 new individuals are affected by cryptococcal meningitis, which is a brain infection and has resulted in 181,000 deaths per year around the world. Most of the deaths are reported in sub-Saharan Africa, as the prevalence of HIV/AIDS is more in these countries.

Gather more insights about the market drivers, restraints, and growth of the Global Antifungal Drugs market

The COVID-19 outbreak is predicted to restrain the market for antifungal drugs over the forecast period. The COVID-19 virus has spread to nearly all countries on the earth since its discovery in December 2019, causing the World Health Organization (WHO) to announce it as a public medical emergency. In the pneumonia cases, COVID-19, a novel coronavirus, was confirmed as the causative culprit. This virus quickly spread over the globe, killing a great number of individuals. The WHO declared COVID-19 a global pandemic in March 2020, and strict measures to halt the disease's spread were suggested. The pandemic has slowed the development of the healthcare industry and disturbed the supply chain since then.

The market for antifungal medications was impacted by flight limitations during the first quarter of 2020. The antifungal medicine business has been affected by supply chain disruption and strict social distancing rules. The unblocking of economies during the 2nd quarter of 2020, however, has resurrected the market for antifungal drugs, which had been stalling. Moreover, in order to stem the spread of COVID-19, government authorities in a majority of countries have ordered nationwide lockdowns. Similarly, health systems in a number of countries around the world were having trouble maintaining their supply chains. The slowness of the supply chain has also impacted the demand for antifungal medications.

The ongoing public-private partnership agreements in the pharmaceutical industry for the development of novel therapeutics are projected to offer tremendous growth opportunities to the market for antifungal drugs. For example, CARB-X, an international public-private partnership, is anticipated to provide around USD 350 million in the coming five years to boost the R&D pipeline. Partners involved are the U.S. Department of Health and Human Services, Antimicrobial Resistance Centre in England, and Boston University School of Law. A considerably large range of antifungal preparations, both topical and oral agents such as creams, sprays, tablets, and injections, are commercially available in the market for antifungal drugs. The rising popularity of over-the-counter antifungal drugs for dermal infections is further escalating market growth. However, the expiration of patents on branded therapeutics and the availability of counterfeit drugs are estimated to impede the growth of the market for antifungal drugs over the forecast period.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

Herpes Simplex Virus Treatment Market - The global herpes simplex virus treatment market size was valued at USD 1.54 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.24% from 2023 to 2030.

Monkeypox Vaccine and Treatment Market - The global monkeypox vaccine and treatment market size was valued at USD 85.23 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.16% from 2022 to 2030.

Antifungal Drugs Market Segmentation

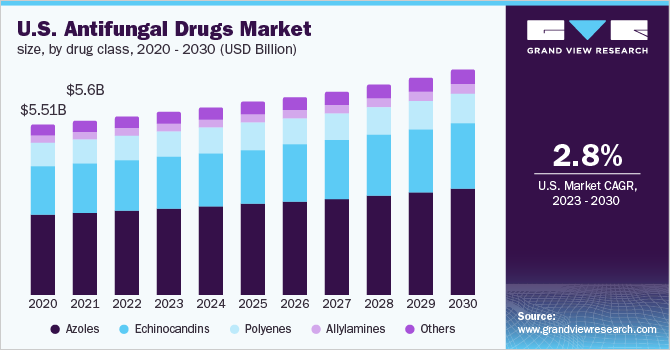

Grand View Research has segmented the global antifungal drugs market by drug class, indication, dosage form, distribution channel and region:

Antifungal Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

Antifungal Drugs Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Dermatophytosis

- Aspergillosis

- Candidiasis

- Others

Antifungal Drugs Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

- Oral Drugs

- Ointments

- Powders

- Others

Antifungal Drugs Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Pharmacies

- Retails Pharmacies

- Others

Antifungal Drugs Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

July 2018: Sato Pharmaceutical Co., Ltd. and Eisai Co., Ltd. announced release of NAILIN oral antifungal tablets in Japan for the treatment of onychomycosis.

June 2016: Merck entered into definitive agreement to acquire Afferent Pharmaceuticals.

Key Companies profiled:

Some of the prominent players in the antifungal drugs market include:

- Novartis AG

- Pfizer, Inc.

- Bayer AG

- Sanofi

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Abbott

- Glenmark

- Enzon Pharmaceuticals, Inc.

- Astellas Pharma, Inc.

Order a free sample PDF of the Antifungal Drugs Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment