Cleaning Services Category - Procurement Intelligence

The Cleaning Services category is expected to register a CAGR of 6.7% from 2022 to 2030. It has seen steady growth over the past few years due to increasing demand for cleaning services in both developed and developing economies. Factors such as rising urbanization, growing awareness of hygiene and cleanliness, and increasing use of green cleaning products are also driving the growth.

This category is highly fragmented, with numerous small and large players operating in different regions. Companies are continuously focusing on providing complete services in-house. The U.S., China, and Germany are the largest exporters of service equipment in the world. In 2021, the U.S. exported cleaning supplies worth USD 4.18 billion.

Order your copy of the Cleaning Services Procurement Intelligence, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The COVID-19 pandemic has had a significant impact on the market. On one hand, the demand for cleaning services has increased as individuals and businesses prioritize cleanliness and sanitation to prevent the spread of the virus. On the other hand, the pandemic has also led to economic uncertainty and financial constraints, which have affected the ability of some businesses and individuals to afford professional services.

Cleaning Services Sourcing Intelligence Highlights

- This category is highly fragmented due to the complete integration of the services which has enabled companies to engage in one-stop providers of the services

- The cost of cleaning supplies depends on various factors such as business size, business type, and geographic locations

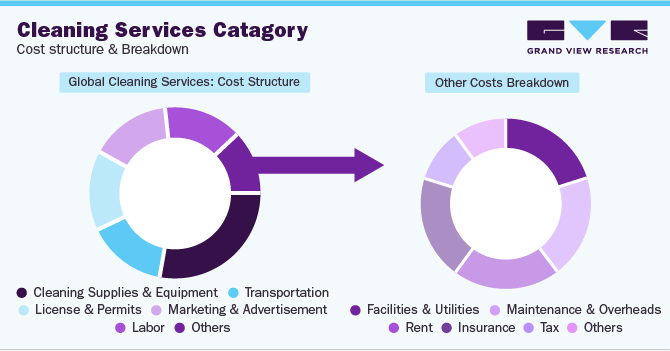

- Cleaning equipment and supplies, transportation, labor, license, and permits, and transportation account for the largest cost component of the cleaning business

- Fluctuations in feedstock prices such as chemicals used in cleaning which includes chlorine, liquid ammonia, and others are expected to impact the service prices

List of Key Suppliers

- ABM Industries

- C&W Facility Services, Inc

- Sodexo S.A

- Compass Group USA

- ServiceMaster Clean

- Jones Lang LaSalle Incorporated (JLL)

- Pritchard Industries Inc

- Clean Group Commercial Cleaning

- CleanNet USA Inc.

- Stanley Steemer International, Inc.

- Quadrat Facility Services GmbH

Cleaning Services Procurement Intelligence Report Scope

- Cleaning Services Category Growth Rate: CAGR of 6.7% from 2023 to 2030

- Pricing Growth Outlook: 8% - 10% (Annually)

- Pricing Models: Cost plus pricing model, fixed price pricing model

- Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

- Supplier Selection Criteria: Residential cleaning capabilities, commercial cleaning capabilities, industrial cleaning services, technical specifications, operational capabilities, regulatory standards and mandates, category innovations, and others.

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

No comments:

Post a Comment