The U.S. solar films market was valued at USD 916.26 million in 2023 and is projected to expand to USD 1,404.52 million by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 6.0% from 2024 to 2030. This growth is significantly propelled by continuous technological advancements in solar film development. Ongoing enhancements in the efficiency of materials and designs have substantially improved their energy-harvesting capabilities. High-efficiency solar films can capture a larger portion of solar radiation, converting it into electricity with greater effectiveness. These innovations have resulted in a notable increase in energy output from solar film installations, making them highly appealing to residential, commercial, and industrial consumers across the country. As solar films become more adept at transforming sunlight into usable energy, they are playing a crucial role in accelerating the widespread adoption of solar energy solutions nationwide.

Furthermore, the integration of smart technology is transforming the solar energy industry. These advanced films are equipped with sensors, controls, and connectivity features that enable real-time adjustments based on environmental conditions. Smart solar films can automatically regulate their tint levels, optimizing the balance of natural light and heat entering buildings or vehicles. This not only enhances user comfort and convenience but also maximizes the energy efficiency of solar panels, thereby reducing the need for manual intervention. The incorporation of smart technology aligns solar films with the broader trend of creating intelligent and energy-efficient environments, making them a preferred choice for both consumers and businesses and fueling market growth in the U.S.

Key Market Insights:

- By Type: The encapsulation segment held the largest revenue share at 67.3%. Encapsulation films are vital for protecting delicate solar cells from environmental factors like moisture, dust, and physical damage.

- By Polymer Type: Fluoropolymer emerged as the dominant segment, accounting for a 65.08% market revenue share.

- By Thickness: Films less than 100 mm thick commanded the largest revenue share, at 45.70%.

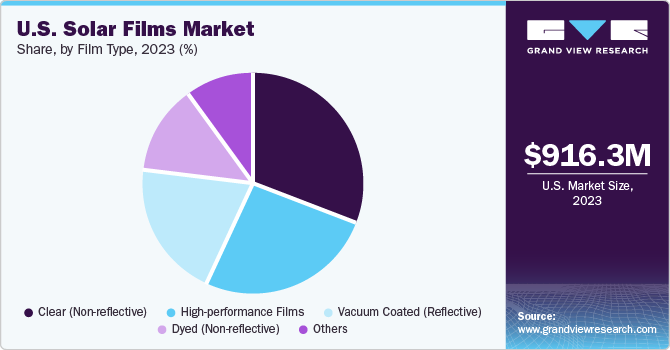

- By Film Type: Clear (non-reflective) films secured the largest revenue share of 31.02%. This segment's growth is driven by the increasing demand for sustainable energy solutions that seamlessly integrate with architectural designs and maximize natural light transmission.

- By Application: The construction sector represented the largest application segment, with a 56.27% revenue share.

- By End-Use: The commercial sector accounted for the largest revenue share, at 39.99%. This is attributed to the commercial sector's growing focus on sustainability and energy efficiency, where solar films offer an attractive solution for reducing carbon footprint and energy costs.

Order a free sample PDF of the U.S. Solar Films Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 916.26 Million

- 2030 Projected Market Size: USD 1,404.52 Million

- CAGR (2024-2030): 6.0%

Key Companies & Market Share Insights

The U.S. solar films market is highly fragmented, with numerous prominent players operating within the space. Leading companies compete by expanding their production capacities, diversifying product portfolios, and adopting innovative technologies in solar film manufacturing. Key participants in the market include 3M, Honeywell International Inc., Johnson Window Films Inc., Mitsubishi Polyester Films, and Jolywood, among others.

In October 2023, Endurans Solar, a U.S.-based manufacturing company, announced plans to expand production capacity at its backsheet manufacturing facility in Nashua, New Hampshire. However, the specific scale of the expansion was not disclosed.

In May 2023, First Solar, Inc. completed the acquisition of Evolar AB, a leading European developer of perovskite technology. The deal involved an upfront payment of approximately $38 million, with an additional $42 million tied to future technical achievements.

Also in May 2023, DuPont introduced new frontsheet materials under its Tedlar brand during the 2023 SNEC International Photovoltaic Power Generation and Smart Energy Exhibition.

Key Players

- 3M

- Honeywell International Inc.

- Johnson Window Films Inc.

- Mitsubishi Polyester Films

- Jolywood

- Dupont

- Garware Suncontrol Film

- Solar Control Films Inc.

- Polytronix Inc

- DUNMORE

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. solar films market is experiencing robust growth, driven by continuous technological advancements that boost energy efficiency and smart integration. This expansion is further fueled by increased adoption across residential, commercial, and industrial sectors, all seeking sustainable energy solutions. Key segments like encapsulation, fluoropolymer films, and thinner films are leading the market, with construction and commercial applications dominating. The market, though fragmented, sees key players innovating and expanding to meet growing demand.

No comments:

Post a Comment