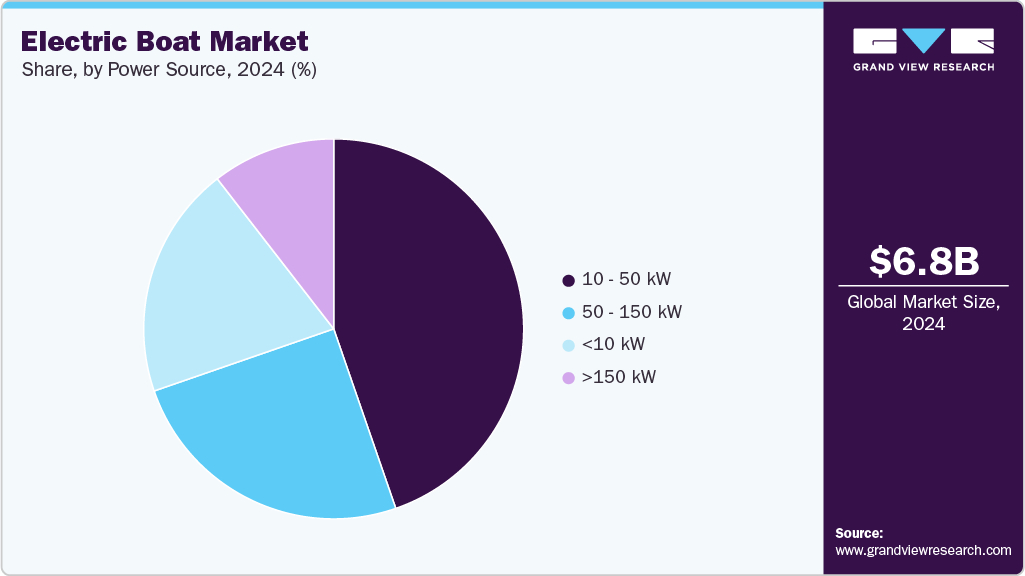

The global electric boat market size was estimated at USD 6.78 billion in 2024 and is projected to reach USD 14.09 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The market is gaining significant momentum, driven by stringent environmental regulations focused on reducing emissions and supporting global carbon neutrality goals.

Technological advancements in battery efficiency and electric motor performance are accelerating the adoption of electric boats. These innovations are improving range, speed, and operational reliability, making electric alternatives increasingly viable for both recreational and commercial maritime applications. For instance, in November 2022, Samsung Heavy Industries developed a liquid hydrogen fuel cell propulsion system for ships, receiving approval in principle from DNV. This breakthrough, achieved in collaboration with hydrogen technology partners, highlights the growing focus on next-generation sustainable marine propulsion and the industry’s transition toward low-emission alternatives to conventional engines.

Rising consumer demand for sustainable and quiet boating is another key factor propelling market growth. Both leisure and commercial operators are increasingly turning toward eco-friendly and low-noise vessels. This trend is reinforced by strategic collaborations and investment initiatives aimed at expanding electric propulsion technologies. For example, in November 2024, the International Electric Marine Association (IEMA) partnered with the Electric & Hybrid Marine Expo to advance maritime electrification through education and industry-wide cooperation. Similarly, in April 2022, X Shore, a Swedish electric boat manufacturer, secured USD 50 million in funding to scale production of its Eelex 8000 model and strengthen R&D in zero-emission maritime solutions, reflecting the strong investor confidence and growth potential of this market.

Key Market Trends & Insights

- North America accounted for 46.8% of the global market share in 2024.

- The U.S. electric boat industry held a dominant position in 2024.

- By boat type, the leisure boats segment captured the largest share of 42.1% in 2024.

- By propulsion type, the outboard electric propulsion segment accounted for the largest share in 2024.

- By battery type, the lithium-ion batteries segment held the largest market share in 2024.

Download a free sample PDF of the Electric Boat Market Intelligence Study, published by Grand View Research.

Market Performance

- 2024 Market Size: USD 6.78 Billion

- 2030 Projected Market Size: USD 14.09 Billion

- CAGR (2025–2030): 13.5%

- North America: Largest market in 2024

Competitive Landscape

Some of the key players operating in the market include Yamaha Motor Co., Ltd., Vision Marine Technologies, Duffy Electric Boat Company, RAND Boats ApS, and SVP Yachts d.o.o.

- Yamaha Motor Co., Ltd., founded in 1955 and headquartered in Iwata, Japan, specializes in electric propulsion systems and marine engines. The company offers high-performance electric outboard motors and advanced battery solutions tailored for recreational and commercial boats. Yamaha emphasizes motor efficiency, durability, and environmental sustainability, maintaining a strong global presence while investing heavily in clean marine mobility R&D.

- Vision Marine Technologies, founded in 2011 and headquartered in Montreal, Canada, designs and manufactures electric propulsion systems for boats, focusing on reducing emissions and minimizing noise pollution. The company partners with boat manufacturers globally to promote sustainable marine mobility and accelerate the adoption of eco-friendly electric boating technologies.

Key Companies

- Yamaha Motor Co., Ltd.

- Vision Marine Technologies

- Duffy Electric Boat Company

- RAND Boats ApS

- SVP Yachts d.o.o. (Greenline)

- ElectraCraft, Inc.

- Frauscher Bootswerft GmbH

- X Shore AB

- Pure Watercraft Inc.

- Volvo Penta Corporation

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global electric boat market is poised for rapid expansion, supported by advancements in battery technology, stringent emission regulations, and shifting consumer preferences toward eco-friendly marine transport. The convergence of sustainability mandates, technological innovation, and capital investments is fostering a robust ecosystem for electric propulsion adoption. North America’s leadership underscores strong infrastructure development and early adoption of clean marine solutions. As manufacturers enhance range, speed, and efficiency, and as governments incentivize low-emission maritime operations, the market is expected to witness widespread electrification across leisure, commercial, and passenger vessels. Going forward, strategic collaborations, R&D investments, and scalable production capabilities will define competitive advantage and long-term market growth.

No comments:

Post a Comment