The global automated test equipment market size was estimated at USD 7,749.8 million in 2024 and is projected to reach USD 10,192.4 million by 2030, growing at a CAGR of 4.8% from 2025 to 2030. Market growth is primarily driven by the rising complexity and volume of semiconductors used across diverse sectors such as consumer electronics, automotive, telecommunications, and industrial automation.

As electronic devices continue to become smaller and more functionally integrated, the need for faster, more precise, and cost-effective testing solutions has intensified. Manufacturers are increasingly adopting ATE to improve testing throughput, ensure product reliability, and reduce time-to-market. Moreover, the surging demand for high-performance chips in AI, 5G, and IoT applications is further accelerating the deployment of automated testing systems in semiconductor fabrication and assembly processes.

The electrification and digitization of the automotive industry represent a major trend shaping the global ATE market. The expansion of electric vehicles (EVs), autonomous driving technologies, and software-defined vehicles has created growing demand for testing sophisticated electronic control units (ECUs), battery management systems, and sensor networks. Consequently, automated testing has become critical to ensuring performance, safety, and compliance with stringent automotive standards. This has encouraged automotive OEMs and Tier 1 suppliers to invest in scalable and modular ATE solutions that can adapt to the evolving complexities of modern vehicle electronics.

Key Market Trends & Insights

- Asia Pacific dominated the automated test equipment market, accounting for the largest revenue share of 52.32% in 2024.

- By product, the Non-Memory ATE segment led the market with the largest revenue share of 60.77% in 2024.

- By vertical, the power generation segment accounted for the largest revenue share in 2024.

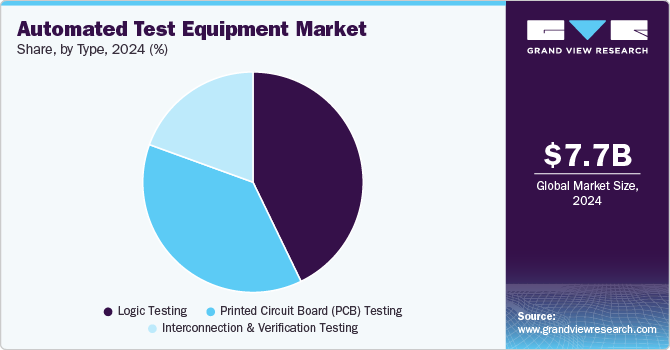

- By type, the logic testing automated test equipment segment held the largest revenue share in 2024.

Download a free sample PDF of the Automated Test Equipment Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 7,749.8 Million

- 2030 Projected Market Size: USD 10,192.4 Million

- CAGR (2025–2030): 4.8%

- Asia Pacific: Largest market in 2024

Competitive Landscape

The global ATE market is characterized by strong competition among established players and emerging innovators. Leading companies are investing heavily in R&D, focusing on test accuracy, cost reduction, and automation to cater to the evolving needs of the semiconductor and electronics industries.

Key Players and Strategic Highlights

- Aemulus Corporation offers modular and flexible test systems for analog and mixed-signal semiconductor devices. Its platforms are widely used in consumer electronics, automotive IC testing, and power management applications. The company emphasizes low-cost, high-efficiency solutions suitable for both volume production and R&D, and collaborates with fabless semiconductor companies and foundries across Southeast Asia.

- Chroma ATE Inc. provides advanced test systems for power electronics, EV components, and LED drivers. Its automated solutions are integrated with software automation and real-time data analytics, enabling precise testing of high-voltage and high-efficiency devices, especially in EV and renewable energy markets.

- VIAVI Solutions Inc. delivers smart testing technologies for wireless communications, optical components, and network infrastructure. The company plays a key role in 5G deployment by validating RF and optical interfaces, and supporting protocol and performance testing for telecom operators, data centers, and semiconductor firms.

- ADVANTEST CORPORATION manufactures semiconductor test systems covering memory, logic, SoC, and RF chips. Its T2000 and V93000 series are extensively adopted by major IDMs and foundries, optimized for AI, mobile, and automotive semiconductors. The company also offers automation solutions such as handlers and device interfaces for mass production environments.

Emerging participants like STAr Technologies Inc., Danaher, and TESEC Corporation are further contributing to market competitiveness.

- STAr Technologies Inc. provides SoC, memory, and logic semiconductor test systems, including wafer-level and burn-in solutions. The company has strengthened its footprint across Asia-Pacific through strategic partnerships and localized engineering support.

- Danaher, through subsidiaries such as Tektronix and Keithley Instruments, offers high-precision instruments like signal analyzers, parametric testers, and source measurement units used in R&D and validation across consumer electronics, automotive, and aerospace sectors.

- TESEC Corporation specializes in high-power ATE systems for power semiconductor devices including MOSFETs, IGBTs, and SiC/GaN-based devices. Its systems are tailored for EVs, industrial automation, and energy storage, supporting performance testing under demanding conditions.

Key Companies Profiled

- Aemulus Corporation

- Chroma ATE Inc.

- VIAVI Solutions Inc.

- Astronics Corporation

- ADVANTEST CORPORATION

- Cohu, Inc.

- Teradyne Inc.

- STAr Technologies Inc.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global automated test equipment market is witnessing steady growth driven by the ongoing evolution of semiconductor technologies and the increasing integration of electronics in every industrial segment. Rising demand for advanced chips in AI, 5G, IoT, and EV applications continues to position ATE as a critical enabler of performance, precision, and efficiency across next-generation electronic systems.

No comments:

Post a Comment