Advanced Payment Cards Industry Data Book Covers Virtual Cards, Dual Interface Payment Card, and Biometric Payment Cards Market

The global Advanced Payment Cards Industry generated over USD 20.50 billion in 2022 and is expected to grow at a CAGR of 20.4 % over the forecast period.

Grand View Research’s advanced payment cards sector database is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

Access the Global Advanced Payment Cards Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies

Virtual Cards Market Growth & Trends

The global virtual cards market size is expected to reach USD 60.06 billion by 2030, expanding at a CAGR of 20.9% from 2023 to 2030, according to a new study conducted by Grand View Research, Inc. The increasing usage of digital payment platforms is creating the demand for virtual cards worldwide, which is anticipated to drive the growth of the market. In addition, various types of virtual cards offer the consumer a particular set of benefits, such as efficiency and convenience, which also bodes well for the growth of the market.

Virtual cards are changing the financial landscape by introducing a new level of protection for everyone involved in the payment transaction. Hospitality is one industry that has endorsed the use of virtual cards. Moreover, virtual cards are creating the possibility of making payments more dynamic during the check-in and check-out process for the consumers.

The investments being raised by virtual card solution providers are expected to create new possibilities for the growth of the market during the projected period. For instance, in May 2022, MasterCard and fintech company OPay announced their collaboration, paving the way for access to financial services and economic prosperity by bringing digital commerce to thousands of people in the Middle East and Africa. With this collaboration, OPay consumers and merchants in this region will be able to engage with brands and businesses anywhere in the world.

Dual Interface Payment Card Market Growth & Trends

The global dual interface payment card market size is expected to reach USD 23.66 billion by 2030, growing at a CAGR of 16.7% from 2023 to 2030, according to a new study conducted by Grand View Research, Inc. The market is anticipated to witness growth due to the increasing usage of payment cards across the globe. For instance, in June 2021, according to the Smart Payment Association (SPA), payment cards consist of 40-60% of total online payments made, either directly or indirectly. At the same time, the strong emphasis of payment service providers on offering enhanced payment solutions to their customers is expected to propel growth.

The increasing investments by venture capital into the companies offering dual interface cards for payment is anticipated to create new opportunities for the growth of the market during the forecast period. For instance, in April 2022, Financepeer, an Edu-fintech company, raised USD 31 million through a Series B funding round. The funds were utilized to enhance its technology platform and expand its offerings. Later, in June 2022, Financepeer launched a UVA card powered by Visa. This UVA card or a dual-interface card was designed for students to make day-to-day transactions easier. Such initiatives are expected to propel the growth of the industry.

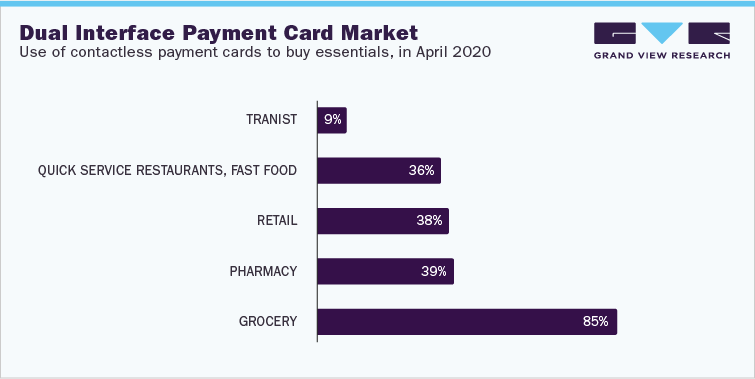

The outbreak of COVID-19 played a vital role in driving the growth of the dual interface payment card market. The COVID-19 pandemic increased the preference for contactless payments among the people while processing payments at restaurants is one of the factors expected to drive the market growth. Moreover, in April 2020, according to a Mastercard survey, almost 8 out of 10 people located globally said that they use contactless payments.

Order your copy of the Free Sample of “Advanced Payment Cards Industry Data Book - Virtual Cards, Dual Interface Payment Card, and Biometric Payment Cards Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Biometric Payment Cards Market Growth & Trends

The global biometric payment cards market size is expected to reach USD 4,345.8 million by 2030, registering a CAGR of 62.3% from 2022 to 2030, according to a new report by Grand View Research, Inc. Biometric payment cards are divided into biometric debit and credit cards that are used to perform payment transactions.

The biometric sensors within these cards offer the most secure payment method to the user, which is fueling the growth of the market. Moreover, the contactless payment method is becoming gradually more popular, which enhances security and reduces the time required for the payment processing. Thus, these aforementioned factors are expected to drive the growth of the market during the forecast period.

The increased demand for tap-to-pay payments method in order to initiate touchless transactions has driven the market's growth. For instance, in 2020, according to the Visa Back to Business Study, 48.0% of Germans, after COVID-19, adopted new payment methods, from which nearly 16.0% of consumers are using tap to pay technology. Furthermore, the companies operating in the biometric payment cards market are involved in strategic partnerships to launch biometric cards, which is fueling the growth of the market. For instance, in 2019, Zwipe, the biometric payment company, entered into a partnership with Goldpac, a China-based Fintech Company. This partnership was aimed at launching biometric payment cards and offering related services to Goldpac’s extensive customer network.

Global biometric payment card providers are continuously implementing new technologies to improve the customer’s payment experience. For instance, in January 2022, Fingerprint cards, a biometric company, met Mastercard's increased security criteria for its second-generation T-Shape sensor module. This technology made payment processing easy and convenient for the customer as well as for merchants, with increased security. Thus, such advancements in technology open wide opportunities for future growth of the market.

Competitive Landscape

Key players operating in the Advanced Payment Cards industry are:

- American Express Company

- JPMorgan Chase & Co.

- Mastercard

- Marqeta, Inc.

- Skrill USA, Inc.

- Stripe, Inc.

- Adyen

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment