Blockchain-oriented Services Industry Data Book Covers Decentralized Finance, Blockchain Messaging Apps, Decentralized Identity, Non-fungible Token, and Web 3.0 Blockchain Market

The global blockchain-oriented services industry generated over USD 29.09 billion in 2021 and is expected to grow at a CAGR of 41.3% over the forecast period.

Grand View Research’s blockchain-oriented services industry databook is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

Access the Global Blockchain-oriented Services Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies

Decentralized Finance Market Growth & Trends

The global decentralized finance market size is expected to reach USD 231.19 billion by 2030, expanding at a CAGR of 42.5% from 2023 to 2030, according to a new study conducted by Grand View Research, Inc. The Decentralized Finance (DeFi) market is experiencing significant growth in terms of revenue attributed to the rapid technological advancements and continuous innovation within the crypto industry. In addition, the market's expansion is propelled by the high level of transparency and real-time settlement capabilities offered by DeFi networks.

In April 2023, Life DeFi, a prominent decentralized finance ecosystem, unveiled its latest collaboration with a Web3 infrastructure provider, Validation Cloud. This strategic partnership aims to empower retail users by enabling them to easily stake their digital assets directly from the Life DeFi Wallet mobile applications. Leveraging the robust validator nodes offered by Validation Cloud, this collaboration ensures a seamless, trustworthy, and secure staking experience for users of the Life DeFi platform.

The rise of Decentralized Finance (DeFi) will create new business opportunities for traditional banks and other financial service providers in the coming years. As the use cases for decentralized finance expand and gain traction, financial institutions will have the potential to integrate comprehensive solutions. This could include offering asset securitization and financing to institutional clients within decentralized finance protocols. Furthermore, financial firms may develop specialized services tailored for Web 3.0 enterprises and entrepreneurs, such as compliance solutions, risk management, or insurance underwriting for DeFi protocols.

During the COVID-19 pandemic, the emergence of decentralized finance platforms gained significant attention as investors sought higher yields amidst historically low-interest rates. These platforms provide services comparable to traditional financial institutions but with less regulatory oversight, making them appealing to investors during the pandemic. One of the key advantages of DeFi is its decentralized nature, devoid of any central authority, which is expected to unlock new possibilities and opportunities for the market.

Order your copy of the Free Sample of “Blockchain-oriented Services Industry Data Book - Decentralized Finance, Blockchain Messaging Apps, Decentralized Identity, Non-fungible Token, Web 3.0 Blockchain Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

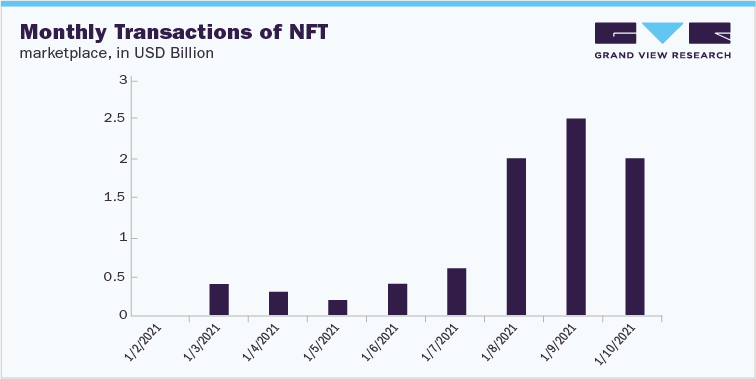

Non-fungible Token Market Growth & Trends

The global non-fungible token market size is expected to reach USD 211.72 billion by 2030, growing at a CAGR of 33.9% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growing demand for digital art worldwide is one of the major factors driving the market growth. Digital art is defined as the art that is displayed or created using digital technologies.

The growing use of cryptocurrency globally is also anticipated to drive market growth. This is because cryptocurrency is used by people to purchase digital assets. According to CoinMarketCap, as of February 2022, the total global capitalization of cryptocurrency is USD 1.76 trillion, making it equivalent to the world’s 8th largest economy.

The market growth of non-fungible token (NFT) companies is further supported by the substantial funding they have raised. In August 2022, during a community event broadcast live, Collective Proof, a non-fungible token, announced that it had successfully raised USD 50 million in a Series A funding round. The funding round, led by a16z, saw the participation of several prominent investors, including Seven Seven Six, Collab+Currency, True Ventures, Flamingo DAO, SV Angel, and VaynerFund. This substantial investment comes as Proof prepares to launch its upcoming NFT collection, further solidifying its position in the NFT market.

The COVID-19 pandemic is expected to impact the market positively over the forecast period. The restrictions imposed during the pandemic confined people at homes and limited their sources of income. As a result, NFT-based gaming platforms such as Axie Game have gained increased popularity as they help people earn income amid the COVID-19 pandemic.

Go through the table of content of Blockchain-oriented Services Industry Data Book to get a better understanding of the Coverage & Scope of the study

Competitive Landscape

Key players operating in the Blockchain-oriented Services industry are:

- Compound Labs, Inc.

- MakerDAO

- Aave

- Signal

- Cyber Dust

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment