Steel Industry Data Book Covers Stainless Steel, Carbon Steel, Electrical Steel, Weathering Steel, and Sintered Steel Market

Grand View Research’s steel industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with an agricultural statistics e-book.

Access the Global Steel Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies

Carbon Steel Market Growth & Trends

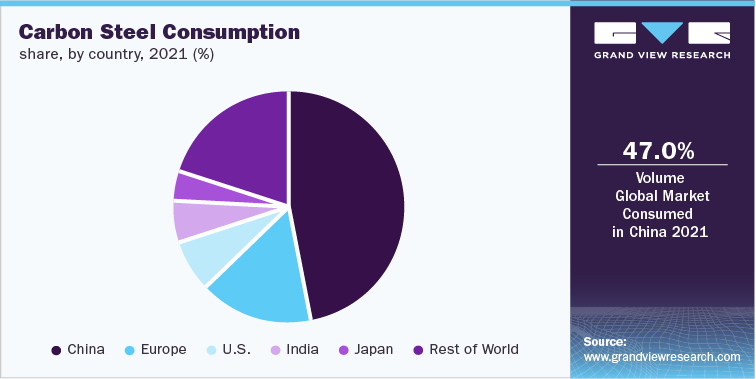

The global carbon steel market size is expected to reach USD 1,301.53 billion by 2030, expanding at a CAGR of 3.4%, according to a new report by Grand View Research, Inc. Increasing investment in the construction sector on account of factors such as rising housing needs, boosting tourism, and increasing commercial space is likely to augment the demand for carbon steel over the forecast period.

For instance, in August 2022, Nakheel PJSC announced a master plan vision for the Dubai islands. The plan involves the construction of five islands of 17 square kilometers by 2040. These islands are expected to have 80 resorts & hotels, cultural hubs, boutiques, dedicated public parks, and residential spaces. Such kinds of investments are expected to fuel the product demand over the coming years.

Carbon steel is one of the key materials used in the construction sector on account of its strength and hardness. It is used in rectangular tubing, highway construction plates, structural framework beams, and bridges. It is also a popularly used material in the manufacturing of hollow structural sections and rebars. Plain carbon steel exhibits various properties such as plasticity, ductility, flexibility, and bending ability. During natural calamities, such as earthquakes, it is a very useful material owing to its crack resistance. Thus, growth in the construction industry, especially after the pandemic aided the product demand.

Further, the automotive industry is another vital end-use for the market. For instance, high carbon steel finds use in various automotive applications such as door panels, vehicle chassis, and bushings, among others. A rise in vehicle production is thus anticipated to boost product consumption over the forecast period. According to OICA, world automotive production rose by 6% from 2021 to 2022.

Further, the growing emphasis toward sustainable production is aiding the market growth. For instance, in 2022, BMW, to further support its goal of reducing carbon dioxide emissions signed an agreement with Salzgitter AG to deliver low carbon steel. The product will be used in car production at the company’s European plants, from 2026 onwards. The company aims at fulfilling 40% of its demand by making use of low carbon steel at its plants in Europe, by 2030, thereby reducing carbon dioxide emissions by 400 kilotons per annum.

Availability of substitutes such as aluminum alloys and other lightweight alloys is anticipated to hinder market growth over the coming years. Aluminum alloys are the major substitutes for carbon steel in applications like shipbuilding. They are expected to gain a higher preference owing to properties like lightweight, which helps reduce the weight of the ship, enhance fuel efficiency, provide higher corrosion resistance, non-magnetic properties, and offer low cost maintenance.

Despite the various advantages of aluminum alloys, there is one drawback associated with them. Their high cost when compared to carbon steel restricts their consumption. However, this drawback can be compensated for with higher earnings.

Order your copy of the Free Sample of “Steel Industry Data Book - Stainless Steel, Carbon Steel, Electrical Steel, Weathering Steel, Sintered Steel Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Structural Steel Market Growth & Trends

The global structural steel market size is expected to reach USD 162.46 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 5.5% over the forecast period. The market growth is attributed to the growth in the construction sector and rising demand for steel as a green and sustainable material. Structural steel is utilized for construction-related applications. Its high carbon content offers high strength and low ductility. It is available in the form of various shapes such as I-beam, Z-shape, angle, tee, bar, and rod, depending upon the applications. It can be customized into a variety of shapes in different thicknesses and sizes owing to its ductility. Based on application, the market is segmented into residential and non-residential, where the latter dominates the market, in terms of revenue share.

Growing spending on the commercial sector & infrastructural developments across various nations is augmenting the product demand in non-residential applications. The segment is further divided into industrial, commercial, offices, and institutional. Structural steel is widely used in numerous industrial sectors owing to its high strength-to-weight ratio. In the construction industry, it is utilized in designing and building industrial spaces, such as warehouses, bridges, and factories. Growth in the manufacturing sector is expected to propel the need for new factories and plants. For instance, after the emergence of the COVID-19 pandemic, various new facilities were established to meet the rising demand for PPE in the U.S.

Asia Pacific was the dominant regional market in 2020 and this trend is anticipated to continue over the forecast period. The growing construction spending in the developing economies of the region is anticipated to augment the product demand. For instance, in August 2021, India announced that it aims at spending INR 100 trillion (USD 1.35 trillion) on infrastructure development for boosting economic growth and jobs in the country. The competitive rivalry is extremely high in the market due to the presence of several small- and large-scale players spread across the world. The companies are striving to recover from their losses caused by the COVID-19 pandemic and are taking initiatives, such as mergers & acquisitions and capacity expansions, to further widen their reach.

Go through the table of content of Steel Industry Data Book to get a better understanding of the Coverage & Scope of the study

Competitive Landscape

Key players operating in the Steel industry are:

- Ansteel Group

- ArcelorMittal

- Baotou Steel

- China Baowu Group

- China Steel Corporation

- Cleveland-Cliffs

Check out more Industry Data Books, published by Grand View Research

No comments:

Post a Comment