The global alternative financing market size was valued at USD 10.82 billion in 2022 and is projected to reach USD 45.72 billion by 2030, expanding at a compound annual growth rate (CAGR) of 20.2% from 2023 to 2030. Growth in this sector is primarily fueled by the increasing demand from small businesses and individuals seeking easier access to capital.

Traditional banks often impose strict lending criteria, which prevents many from qualifying for loans. In contrast, alternative financing solutions provide a more accessible pathway to funding, especially for those unable to meet conventional banking requirements. This accessibility has significantly boosted the adoption of alternative finance products. Additionally, advancements in fintech and online lending platforms have been instrumental in driving industry expansion.

Digital innovations have streamlined the lending process, minimizing both time and costs compared to traditional banking. Online platforms connect borrowers with multiple lenders, making it easier for small enterprises and individuals to secure funding. At the same time, perceptions of alternative financing have shifted. The negative stigma surrounding non-traditional loans has lessened as borrowers increasingly view it as a legitimate and practical option.

Economic downturns have also contributed to the sector’s growth, as traditional banks often tighten lending practices during challenging times. Alternative financing offers a reliable solution by ensuring capital availability when businesses and individuals face financial strain. Furthermore, these products are generally considered more flexible and cost-effective than traditional loans, supporting their rising popularity.

Government initiatives have also strengthened the industry by introducing supportive policies and regulations, which enhance borrower and lender confidence. This regulatory backing has further positioned alternative financing as a trusted and sustainable option for capital access.

Key Market Insights:

- North America dominated the global industry in 2022, accounting for over 29.0% of total revenue.

- By type, the peer-to-peer lending segment led the market in 2022 with a share of more than 28.0%.

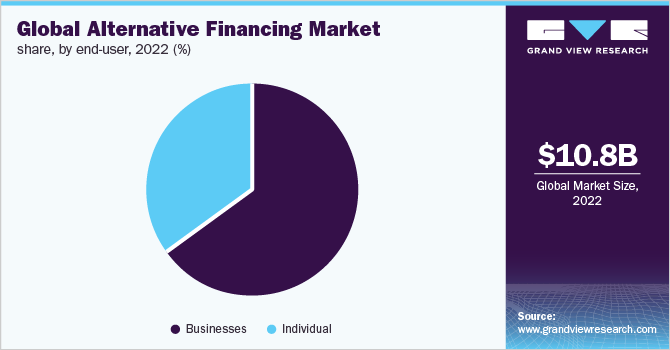

- By end-user, the businesses segment dominated the market in 2022, contributing over 65.0% of overall revenue.

Order a free sample PDF of the Alternative Financing Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2022 Market Size: USD 10.82 Billion

- 2030 Projected Market Size: USD 45.72 Billion

- CAGR (2023–2030): 20.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest-growing market

Key Companies & Market Share Insights:

To strengthen their market presence, several alternative financing providers have established partnerships with fintech firms, banks, and technology enablers. For example, in May 2022, OnDeck announced strategic collaborations with SoFi Technologies, Inc. and LendingTree to enhance funding opportunities for small businesses nationwide. These alliances leverage OnDeck’s AI and ML capabilities alongside partner offerings, enabling businesses to access working capital more efficiently.

Firms are also broadening their product portfolios to cater to evolving borrower and lender needs. A strong emphasis on digital transformation is evident as companies aim to provide seamless, user-friendly experiences. Additionally, leading players are expanding into international markets to capture untapped opportunities, reflecting the industry’s continuous innovation and adaptation.

Key Players:

- LendingCrowd

- Upstart Network, Inc.

- Funding Circle

- OnDeck

- GoFundMe

- Wefunder, Inc.

- LendingTree, LLC

- Prosper Funding LLC

- Fundly

- Kickstarter, PBC

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The alternative financing market is experiencing rapid growth, supported by greater accessibility, digital innovations, evolving borrower perceptions, and strong government backing. With flexible structures and expanding global adoption, alternative finance is becoming a cornerstone of modern capital solutions.

No comments:

Post a Comment