The global automotive parts packaging market size was valued at USD 9.39 billion in 2024 and is projected to reach USD 12.19 billion by 2030, expanding at a CAGR of 4.5% from 2025 to 2030. Market growth is largely fueled by the steady expansion of the global automotive industry, particularly the rise in automotive production and aftermarket sales.

As vehicle ownership continues to grow in both developed and emerging economies, demand for parts replacement, maintenance, and repair services is rising in tandem. This trend directly drives the need for secure, efficient, and sustainable packaging solutions designed to handle components of varying sizes — from small fasteners to bulky engine parts. The rapid adoption of e-commerce platforms specializing in auto parts has further reinforced the demand for tamper-proof and durable packaging to maintain product safety during last-mile delivery.

The increasing focus on component protection and supply chain optimization is another major growth driver. Automotive parts are highly vulnerable to corrosion, static discharge, moisture, and physical damage. To address this, manufacturers are investing in packaging solutions with enhanced protective properties such as anti-corrosion films, volatile corrosion inhibitor (VCI) packaging, and electrostatic discharge (ESD) protection. At the same time, packaging solutions are being designed for stackability, space utilization, and digital traceability through barcoding and RFID tagging — all of which improve warehouse and logistics efficiency.

Sustainability has become a central theme in the automotive parts packaging market. With OEMs and Tier 1 suppliers actively pursuing environmental goals, demand is surging for recyclable, reusable, and returnable packaging systems. Plastic crates, pallets, and other returnable solutions are increasingly favored in intra-industry logistics due to their long-term cost efficiency and durability. Moreover, regulatory requirements and corporate sustainability commitments are encouraging innovations in biodegradable and compostable packaging materials.

Key Market Insights:

- Asia Pacific dominated the market in 2024, accounting for more than 36.0% of global revenue.

- By packing type, the reusable segment held the largest share, exceeding 56.0% in 2024.

- By component type, the battery segment led the market with over 18.0% share in 2024.

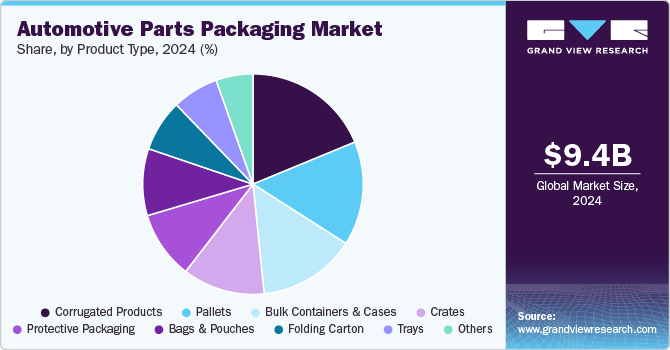

- By product type, the corrugated products segment accounted for more than 18.0% of revenue in 2024.

Order a free sample PDF of the Automotive Parts Packaging Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2024 Market Size: USD 9.39 Billion

- 2030 Projected Market Size: USD 12.19 Billion

- CAGR (2025–2030): 4.5%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights:

The automotive parts packaging market is marked by strong competition among global leaders and regional players. Companies differentiate themselves through innovations in materials, customization, compliance with industry standards, and supply chain efficiency. Increasingly, leading players are prioritizing eco-friendly materials, such as recyclable plastics and biodegradable composites, to meet the sustainability requirements of OEMs and Tier 1 suppliers.

Strategic initiatives such as mergers, acquisitions, partnerships, and geographic expansions are shaping the competitive landscape.

Recent Developments:

- November 2024 – Nefab expanded its U.S. operations by opening a 19,000-square-foot mold-making facility in Grand Blanc, Michigan, via its PolyFlex subsidiary. The facility integrates injection molding, thermoforming, and tooling, improving cost efficiency, lead times, and design capabilities for advanced packaging solutions.

- August 2022 – ORBIS Corporation showcased its reusable packaging solutions for EV and battery applications at The Battery Show in Michigan. The company demonstrated how its innovations support sustainability, product protection, and supply chain efficiency in the automotive industry.

Key Players:

- Sealed Air

- DS Smith

- Smurfit Kappa

- Knauf Industries

- Nefab Group

- Thermopack

- Holostik

- ITB Packaging

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The automotive parts packaging market is set for steady growth, supported by rising automotive production, aftermarket expansion, and the accelerating adoption of e-commerce in the auto parts sector. Increasing demand for protective, efficient, and sustainable packaging — combined with technological advancements and stronger regulatory frameworks — positions the industry as a critical enabler of global automotive supply chains.

No comments:

Post a Comment