The global bitcoin market size was valued at USD 17.05 billion in 2021 and is projected to reach USD 132.91 billion by 2030, expanding at a CAGR of 26.2% from 2022 to 2030. Market growth is driven by the advantages of Bitcoin, including faster and cheaper payments, lower volatility, and secure transactions.

Beyond functioning as a medium of exchange, Bitcoin is increasingly viewed as a store of value. Unlike traditional financial systems that require centralized authorization, Bitcoin transactions are settled instantly on a decentralized blockchain. Its dominance in the cryptocurrency ecosystem also positions it as a reserve currency for digital assets, influencing the value movements of other cryptocurrencies. Introduced in January 2009 with the mining of the genesis block, Bitcoin remains the first and most prominent cryptocurrency.

Bitcoin’s popularity has also led to the emergence of altcoins, or Bitcoin derivatives. Litecoin, for example, was the first major altcoin designed as a lighter and faster version of Bitcoin. Other examples include Bitcoin Cash and Bitcoin Diamond. Since most altcoins’ values are aligned with Bitcoin’s performance, Bitcoin’s growth continues to foster broader market expansion.

Security is another major factor fueling adoption. Supported by more than 18 million miners, Bitcoin’s proof-of-work consensus mechanism ensures a high level of decentralization, making it one of the most secure payment networks globally. This credibility has driven recognition at the national level; for example, in September 2021, El Salvador declared Bitcoin a legal tender.

Key Market Insights:

- North America accounted for the largest revenue share of over 29.0% in 2021.

- Asia Pacific is projected to record the fastest CAGR during the forecast period.

- By application, the exchange segment dominated with a revenue share of more than 45.0% in 2021.

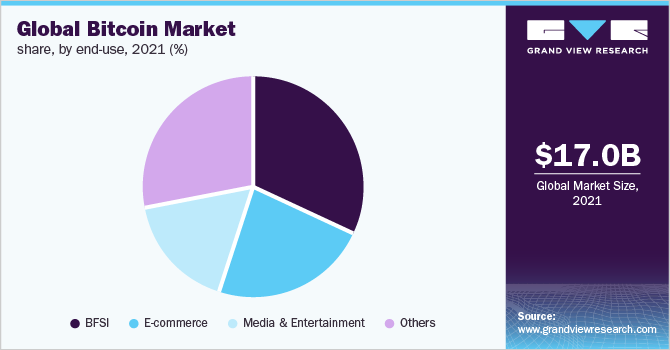

- By end-use, the BFSI sector held the largest share of over 32.0% in 2021.

Order a free sample PDF of the Bitcoin Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2021 Market Size: USD 17.05 Billion

- 2030 Projected Market Size: USD 132.91 Billion

- CAGR (2022–2030): 26.2%

- North America: Largest market in 2021

- Asia Pacific: Fastest-growing market

Key Companies & Market Share Insights:

The competitive landscape includes major players adopting strategies such as geographic expansion, partnerships, and M&A to strengthen market presence.

- In April 2022, Blockstream Corporation, Inc. and Block, Inc. (formerly Square, Inc.) announced the construction of a Bitcoin mining facility in Texas, powered by Tesla’s solar and storage solutions. The project involves a 3.8 MW solar PV array and a 12 MWh Tesla Megapack.

- BlackRock, Inc., the world’s largest asset manager, partnered with Coinbase Inc. to provide institutional clients on its Aladdin platform access to Bitcoin via Coinbase Prime, integrating trading, custody, reporting, and prime brokerage services.

Key Players:

- Blockstream Corporation Inc.

- Coinbase Inc.

- Coinify ApS

- Unocoin Technologies Pvt Limited

- Bitstamp Ltd.

- itBit Trust Company LLC

- Blockchain Luxembourg SA

- Kraken (Payward Inc.)

- BitPay Inc.

- Plutus Financial Inc. (ABRA)

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The bitcoin market is poised for rapid expansion, fueled by its pioneering status, secure network, and growing institutional adoption. With North America leading in revenue and Asia Pacific emerging as the fastest-growing market, Bitcoin’s role as both a transactional currency and a long-term store of value is expected to drive substantial opportunities in the coming decade.

No comments:

Post a Comment