Heparin Industry Overview

The global heparin market size was valued at USD 7.42 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 2.5% from 2023 to 2030. The increasing prevalence of conditions such as renal impairment, coronary artery disease, and venous thromboembolism is anticipated to drive the market. According to the CDC in 2022, each year around 900,000 people could be affected in the United States with venous thromboembolism which may result in the death of 10% - 30% of people within one month of diagnosis.

The outbreak of COVID-19 has boosted the market significantly in 2020 and 2021. As per JAMA Journal in 2021, abnormal blood clots are common in COVID-19 patients owing to clot–promoting autoantibodies which lead to deep vein thrombosis and pulmonary embolisms, which creates an opportunity for heparin. As per an article published in the Journal of the American Heart Association (JAHA) in 2021, anticoagulation therapy of low-molecular-weight heparin given in the early stages of disease could better prevent COVID‐19–associated coagulopathy and endotheliopathy that lead to a better prognosis in a patient. All the above factors are expected to contribute to market growth.

Gather more insights about the market drivers, restraints, and growth of the Global Heparin Market

High demand for anticoagulants is anticipated to boost the overall market. Furthermore, rising health care expenditure and initiatives undertaken by government bodies are some of the key factors anticipated to drive the market growth. The increasing prevalence of chronic diseases such as cardiovascular disorders, deep vein thrombosis, pulmonary embolism, and renal diseases is considered to be one of the major factors driving the overall market.

Lack of exercise, excess smoking and drinking, unhealthy food habits, and changing lifestyles are some major factors that increase the incidence of non-communicable diseases such as coronary artery disease (CAD), hypertension, and diabetes. According to the Korea Biomedical Review, the prevalence of diabetes over 30 years stood at 13.8% in 2020. Diabetic patients have a high probability of blood coagulation which leads to heart disease and kidney complications. The use of heparin for the treatment of such conditions is projected to drive market growth.

Browse through Grand View Research's Pharmaceuticals Industry Related Reports

Erythropoietin Drugs Market - The global erythropoietin drugs market size was valued at USD 6.87 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 1.5% from 2023 to 2030.

Artemisinic Acid Market - The global artemisinic acid market size was valued at USD 699.18 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.24% from 2023 to 2030.

Heparin Industry Segmentation

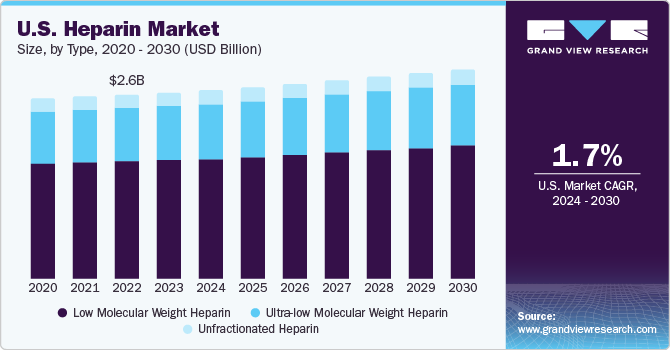

Grand View Research has segmented the global heparin market based on type, routes of administration, application, end-use, source, and region:

Heparin Type Outlook (Revenue, USD Million, 2018 - 2030)

- Low Molecular Weight Heparin

- Ultra-low Molecular Weight Heparin

- Unfractionated Heparin

Heparin Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Intravenous

- Subcutaneous

Heparin Application Outlook (Revenue, USD Million, 2018 - 2030)

- Venous Thromboembolism

- Atrial Fibrillation

- Renal Impairment

- Coronary Artery Disease

- Others

Heparin End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Outpatient

- Inpatient

Heparin Source Outlook (Revenue, USD Million, 2018 - 2030)

- Porcine

- Bovine

- Others

Heparin Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

July 2022: Baxter, BBraun, Fresenius Kabi, and Pfizer are experiencing a shortage attributable to high demand and delays in manufacturing. The high demand is a result of escalated hospitalization rates in the nation owing to SARS-CoV-2.

January 2022: Optimvia and Ginkgo Bioworks announced a partnership to enhance biosynthetic heparin manufacturing capacity.

Key Companies profiled:

Some prominent players in the global Heparin Industry include

- Pfizer Inc.

- LEO Pharma A/S

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc

- Sanofi

- Aspen Holdings

- Fresenius SE & Co. KGaA

- B. Braun Medical, Inc.

- Sandoz (Novartis AG)

Order a free sample PDF of the Heparin Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment