U.K. and Germany Diet and Nutrition Apps Industry Overview

The U.K. and Germany diet and nutrition apps market size was valued at USD 22.1 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030. The COVID-19 pandemic has increased awareness regarding health and wellbeing. Daily active users on diet and nutrition apps increased from 2019 to 2020, as per various research papers. In addition, studios, wellness clubs, and gyms are increasing their online presence, thereby boosting adoption. Diet and nutrition apps utilize machine learning, artificial intelligence, and other technologies to provide personalized programs to customers. These apps are also offering personalized diet charts, no equipment workout routines, and personalized health coaches as well as track footsteps & monitor diet, among others. Such advantages are increasing the growth potential of the market. For instance, MyFitnessPal provides personalized diet and activity tracking to its customers.

Increasing penetration of smartphones and the internet further propel the market growth. As per the report of GSMA, in 2020, 82% of people adopted smartphones in the U.K., and this percentage is projected to increase to 85% by 2025. Only 2% of the population had a 5G connection in 2020. However, the percentage is projected to increase to 42% by 2025. Mobile applications for smartphones have made life easy by making it convenient to perform daily activities.

Gather more insights about the market drivers, restraints, and growth of the U.K. and Germany Diet and Nutrition Apps Market

With the increasing adoption of smartphones and easy availability of technologically advanced devices, innovators have started investing to capitalize on growth opportunities by focusing on delivering quality healthcare and comfort to consumers through various mobile platforms that would help them track their fitness regimes and obtain answers to fitness-related inquiries over the phone, or through several mobile applications. For instance, several apps such as Fitbit, MyFitnessPal, MyNetDiary, Noom, and Fitbit have been launched in the past few years to help individuals track healthy lifestyles and store their healthcare information during their fitness journey.

Growing health consciousness propels market growth. The increasing prevalence of chronic diseases such as diabetes, CVDs, and other lifestyle diseases has forced people to opt for healthy diets. According to the report of the International Diabetes Federation, in 2019, about 9.5 million adults were living with diabetes in Germany. Furthermore, the increasing prevalence of obesity within the region further fuels market growth. These diet and nutrition apps help lose weight by tracking calorie intake and monitoring their day-to-day activities.

Browse through Grand View Research's Healthcare IT Industry Related Reports

Women’s Health App Market - The global women’s health app market size was valued at USD 3.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.6% from 2023 to 2030.

Fitness Platforms for Disabled Market - The global fitness platforms for disabled market size was valued at USD 1.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 21.9% from 2022 to 2030.

U.K. and Germany Diet and Nutrition Apps Industry Segmentation

Grand View Research, Inc. has segmented the U.K. and Germany diet and nutrition apps market based on type, platform, devices, and country.

U.K. And Germany Diet And Nutrition Apps Type Outlook (Revenue, USD Million, 2017 - 2030)

- Weight Loss/ Gain Tracking Apps

- Calorie Counting Apps

- Meal Planning Apps

- Others

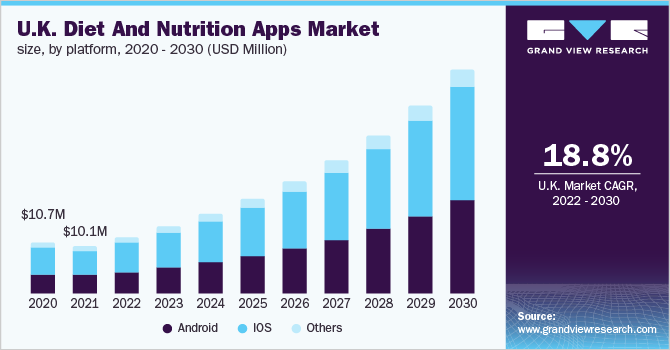

U.K. And Germany Diet And Nutrition Apps Platform Outlook (Revenue, USD Million, 2017 - 2030)

- iOS

- Android

- Others

U.K. And Germany Diet And Nutrition Apps Devices Outlook (Revenue, USD Million, 2017 - 2030)

- Smartphones

- Tablets

- Wearable Devices

Market Share Insights:

July 2021: The U.K. government announced the launch of an app for combating obesity. It is a surveillance app and will help in scrutinizing the daily routine of locals for curbing the prevalence of obesity.

January 2021: Google completed the acquisition of Fitbit, which was announced in November 2019, for USD 2.1 billion. This acquisition was aimed to help the company provide more choices, innovate faster, and make better products.

Key Companies profiled:

Some prominent players in the U.K. and Germany Diet and Nutrition Apps Industry include

- Adidas

- MyNetDiary Inc.

- FatSecret

- FitNow, Inc.

- Eat This Much Inc.

- Under Armour, Inc.

- Azumio, Inc.

- Lifesum AB

- Fitbit, Inc.

- MyFitnessPal, Inc.

- Noom, Inc.

Order a free sample PDF of the U.K. and Germany Diet and Nutrition Apps Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment