Livestock Artificial Insemination Industry Data Book Covers Bovine, Equine, Swine, Ovine & Caprine Market

The global Livestock Artificial Insemination industry was estimated at USD 6.45 billion in 2022 and is anticipated to increase at a significant CAGR of 6.30% from 2023 to 2030.

Grand View Research’s livestock artificial insemination industry data book is a collection of market sizing information & forecasts, regulatory data, competitive benchmarking analyses, macro-environmental analyses, and technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

Bovine Artificial Insemination Market Insights

The global bovine artificial insemination market size was valued at USD 2.84 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 6.17% from 2023 to 2030. Increasing demand for beef and dairy products, the need for sustainable food production, advancements in bovine reproduction technology, and supportive initiatives by market participants are some of the key factors driving the market growth.

The COVID-19 pandemic of 2020-21 and macroeconomic headwinds of 2022-23 had a notable impact on the market, with supply chain challenges, dampened growth rate, reduced sales & marketing activities, etc. However, the market is expected to grow notably through 2030, as the underlying drivers continue to fuel its progress. In its 2023 outlook, Genus plc reported no change in its medium-term growth expectations despite the macroeconomic conditions. The company aims to continue leveraging opportunities in the market by promoting the adoption of sexed semen and beef/dairy genetics.

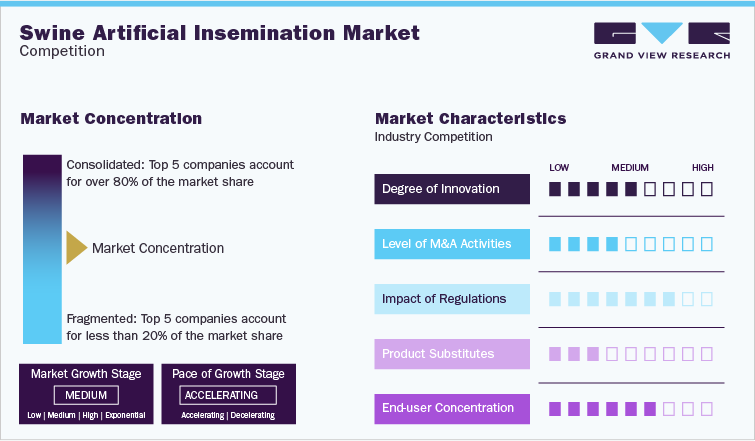

Swine Artificial Insemination Market Insights

The global swine artificial insemination market size was valued at USD 1.91 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 6.67% from 2023 to 2030. Increasing consumption of pork meat, adoption of artificial insemination in swine, demand for sustainable food production, and initiatives by key market players are some of the leading factors contributing to the market growth. As per OECD estimates, global consumption of pork meat is projected to increase from 112.58 megatons in 2022 to 127.27 megatons in 2029. Amongst the several countries, China is a major producer as well as consumer of pork meat and is expected to remain dominant over the forecast period.

The market was significantly impacted by the African swine fever, the COVID-19 pandemic, as well as the macroeconomic challenges of 2022. A major impact of the African Swine Fever was observed in 2018-19 wherein there was a notable decline in sow herds in key markets such as China. Customers in the value chain also faced issues such as high grain, fuel, and fertilizer prices; the continued adverse impact of COVID-19 on operations, supply chain hurdles, and inflationary pressures on input costs.

Order your copy of the Free Sample of “Livestock Artificial Insemination Industry Data Book - Bovine, Equine, Swine, Ovine & Caprine Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Ovine & Caprine Artificial Insemination Market Insights

The global ovine and caprine artificial insemination market size was valued at USD 1.06 billion in 2022 and is expected to grow at a CAGR of 6.25% from 2023 to 2030. The unlimited breeding selection, access to a wide variety of ram (male sheep) and buck (male goat) at a relatively lower price, reduced risk of ruminant diseases that spread through sexual contact, and more mating per buck or ram are some of the key factors driving this market. In addition, the producer of goats and sheep can make genetic improvements through Artificial Insemination (AI) by preventing the risk of diseases and economic loss. Ovine breeding through artificial insemination has assumed greater importance, with commendable achievements reported in the U.S., Eastern & Central Europe, and South American regions.

The COVID-19 pandemic harmed the market during the year 2020. Most veterinary and livestock hospitals halted artificial insemination activities during the pandemic as it was not considered an emergency treatment. Ovine & Caprine artificial insemination & seminal fluid collection companies faced significant supply chain challenges owing to the increased animal welfare issues, zoonotic measures, and state & nationwide lockdowns. However, several animal husbandries continued their AI activities of collecting, preparing, and storing normal & sexed semen during the period. Considering the up and downside scenarios, the market witnessed a slight dip in growth rate during the year 2020.

Go through the table of content of Livestock Artificial Insemination Industry Data Book to get a better understanding of the Coverage & Scope of the study

Livestock Artificial Insemination Industry Data Book Competitive Landscape

The livestock artificial insemination market is highly competitive, with several companies and organizations operating globally. These entities provide a range of services and products related to artificial insemination, including semen collection, processing, storage, distribution, and reproductive management. Genus, for instance, is one of the leading companies in the livestock genetics industry. They offer artificial insemination services and have a wide portfolio of genetics for dairy and beef cattle, pigs, and sheep.

Key players operating in the Livestock Artificial Insemination Industry are:

- Genus Plc

- SEMEX

- URUS Group

- STgenetics

- Munster Bovine

- Stallion AI Services

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment