Lubricants Industry Data Book Covers Automotive Lubricants, Industrial Lubricants, Marine Lubricants, and Aerospace Lubricants Market

The global Lubricants industry was estimated at 42.49 million tons in 2022 and is anticipated to increase at a significant CAGR of 3.0% from 2023 to 2030.

Grand View Research’s Lubricants Industry database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed Industrial outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Industrial Lubricants Market Insights

The global industrial lubricants market size was valued at 16.24 million tons in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. Rapid industrialization in developing countries followed by a rise in the number of trade activities fuels the demand for industrial lubricants. Rising investments in R&D activities along with proper expansion channels help the growth of key players. Some industries slated to witness considerable growth include unconventional energy, chemicals, and mining. This trend is expected to further strengthen product demand in compressors, hydraulics, industrial engines, centrifuges, and bearings.

Over the past decade, emerging economies such as India, Japan, South Africa, China, and Brazil have witnessed a significant rise in the industrial sector. Industries such as the ones manufacturing foundry, plastics, metal consumer appliances, and more, along with mining industries have gained significant importance and thus demand high-quality industrial lubricants.

This trend has led to the increasing use of lubricants such as process oils, metalworking fluids, industrial oils, and engine oils. Stable industrial output in these markets is expected to continue to drive the demand for industrial lubricants. India has a significant market share of process oils, with over half of the total industrial lubricant demand. Rapid growth and development in power generation & distribution have driven the demand for transformer oils.

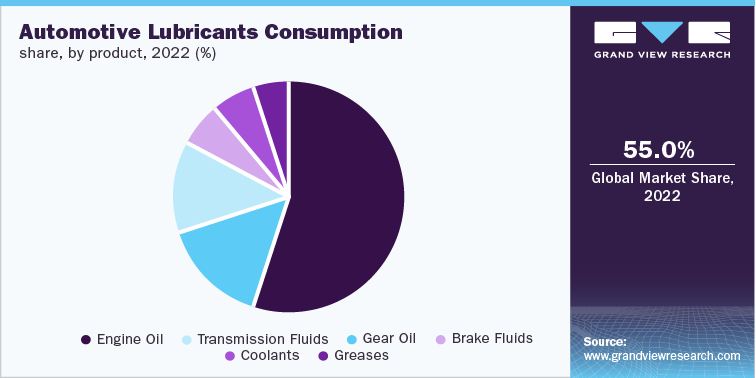

Automotive Lubricants Market Insights

The global automotive lubricants market size was estimated at 24.18 million tons in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.8% from 2023 to 2030. Growing demand for high-performance and lightweight vehicles in emerging economies such as India and China along with a shift in consumer preference towards sustainable lubricants is the key factor driving the market growth.

Increasing automotive production coupled with a shift in trend from heavy vehicles to lightweight vehicles is a key driving factor since the latter contributes significantly to weight savings and lower carbon emissions. A 10% reduction in the weight of an automobile results in approximately 5% to 7% fuel savings. In addition, the reduced weight also aids in controlling the emission of CO2 throughout the life cycle of the vehicle. It further helps the overall performance of the vehicle in terms of acceleration and handling. Moreover, the reduction in mass at unhinged points provides for a reduction in noise and vibration, making it a smoother ride. Thus, growing concerns regarding fuel consumption and greenhouse gas (GHG) emissions are expected to boost the demand for lubricants in commercial as well as passenger vehicles.

The U.S. is the largest consumer of the product in North America with a revenue share of 67.7% in 2022. According to the International Trade Administration, the U.S. is the second largest market for sales and production of vehicles in 2022 with light vehicles accounting for 14.5 million units of sales. Additionally, according to the Motor & Equipment Manufacturers Association, the foreign direct investment for the automotive industry in the country amounted to USD 143.3 billion in 2019. Thus, the advancing automotive industry in the country is anticipated to be the major driving force for the product over the forecast period.

Order your copy of the Free Sample of “Lubricants Industry Data Book - Automotive Lubricants, Industrial Lubricants, Marine Lubricants and Aerospace Lubricants Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Marine Lubricants Market Insights

The global marine lubricants market size was valued at 1.93 million tons in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. Rising demand for durable products and increasing trade activities, especially in emerging economies of Asia Pacific, are among the key trends escalating market growth. The U.S. is the largest consumer of the product in North America with a revenue share of 70.9% in 2022.

Marine engine oils are the major segment within the marine lubricants market space in the U.S. The production of finished goods that are in high demand in emerging economies is resulting in increased exports from the U.S. As air transport has its limitations, goods are transported through the sea route. Marine lubricants are widely utilized in the shipping industry to protect and enhance the efficiency of engines and equipment. These are high-performance fuels, specially designed to enable optimal performance in operations. They possess various exceptional inherent characteristics such as extending engine life and protecting components at high temperatures, improving performance and reliability of machinery, enhancing protection from mechanical wear and mitigating cold corrosion.

Extensive R&D in the global marine industry Changing needs arising from various high-performance heavy shipping industries are leading to extensive R&D activities in the global marine sector. This is prompting the development of a variety of products to offer reduced maintenance, improved oil life, and superior machine operating performance.

Go through the table of content of Lubricants Industry Data Book to get a better understanding of the Coverage & Scope of the study

Lubricants Industry Data Book Competitive Landscape

The global lubricants market is competitive markets with a large number of well diversified regional, and independent small scale and large scale manufacturers and suppliers. The small-scale companies majorly compete on the basis of price, after sales service and delivery timelines. Whereas the large scale companies focus on product development and innovations as well as marketing strategies. Some companies are also redefining their supply chain to reduce cost and customer delays.

Key players operating in the Lubricants Industry are:

- ExxonMobil Corp.

- Royal Dutch Shell Co.

- British Petroleum

- Total Energies

- Chevron Corporation

- Fuchs Group

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com/sector-reports-list

Follow Us: LinkedIn | Twitter

No comments:

Post a Comment