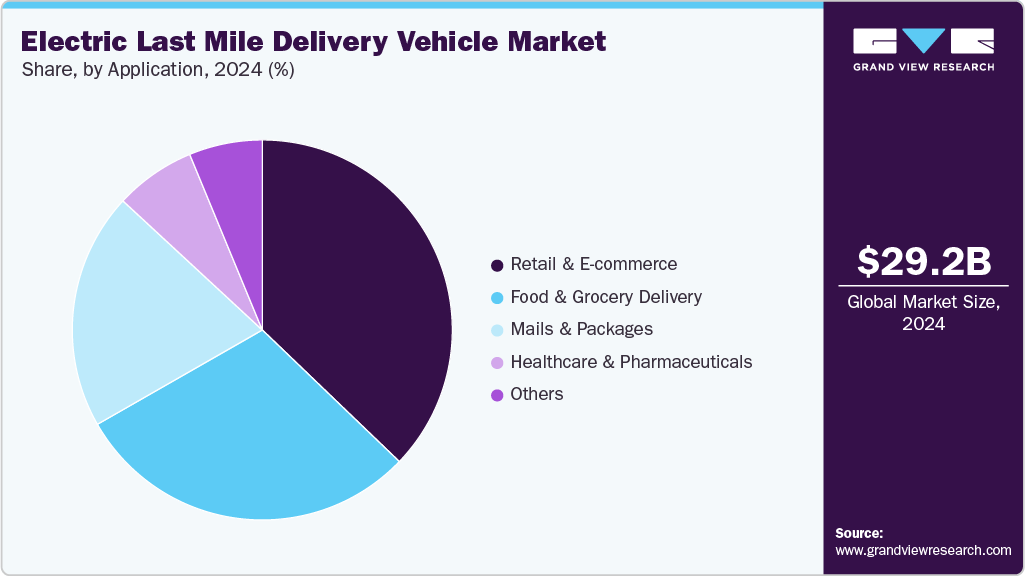

The global electric last-mile delivery vehicle market was valued at USD 29.17 billion in 2024 and is projected to reach USD 139.41 billion by 2033, expanding at a CAGR of 19.4% from 2025 to 2033. Growing e-commerce activity and tightening urban emission regulations continue to accelerate adoption across logistics and retail sectors.

The rapid expansion of e-commerce—intensified further in the post-pandemic landscape—has significantly increased the demand for efficient, timely, and cost-effective last-mile delivery solutions. As online shopping becomes deeply embedded in consumer behavior across both urban and suburban regions, retailers and logistics companies face mounting pressure to accommodate rising delivery volumes. Electric last-mile delivery vehicles have emerged as a strategic solution, offering lower operating costs, superior maneuverability in congested cities, and strong compatibility with digitally optimized logistics networks. These benefits are prompting major e-commerce platforms and third-party logistics providers to invest heavily in fleet electrification.

Key Market Trends & Insights

- Asia Pacific held the largest regional share at 38.1% in 2024.

- The U.S. maintained a dominant position in the electric last-mile delivery industry in 2024.

- 4-wheelers were the leading vehicle type, accounting for 57.28% of the market in 2024.

- By payload capacity, the above 500 kg segment captured the largest share in 2024.

- The retail & e-commerce segment remained the leading application area in 2024.

Download a free sample PDF of the Electric Last Mile Delivery Vehicle Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 29.17 Billion

- 2033 Projected Market Size: USD 139.41 Billion

- CAGR (2025–2033): 19.4%

- Largest Market in 2024: Asia Pacific

Competitive Landscape

Leading companies in the electric last-mile delivery vehicle industry are actively expanding their portfolios, strengthening distribution networks, and forming strategic partnerships to enhance market penetration.

Notable Developments

- July 2025 – Ford Pro announced an upcoming AWD variant of the E-Transit Custom, launching in spring 2026. The model integrates a high-power front electric motor with the existing rear motor setup to improve traction in rugged or slippery conditions—ideal for Nordic and Alpine delivery operations. It retains a 64 kWh battery, offers 100-, 160-, or 210-kW power options, up to 337 km WLTP range, and supports 125 kW DC fast charging (10–80% in ~39 minutes). The vehicle also features a 1,011 kg payload, 6.8 m³ cargo volume, and 2.3-ton towing capacity.

- July 2024 – Workhorse introduced a 208-inch extended-wheelbase version of its W56 electric step van, increasing cargo volume to 1,200 ft³ while maintaining a 150-mile zero-emission range and ~10,000 lb payload capacity. The model builds on the 178-inch version with over 100 improvements, including enhanced serviceability, additional charging port configurations, upgraded doors, a redesigned rear-box structure, and modular accessory options to support diverse commercial use cases.

Prominent Companies

- Last Mile Mobility (Mahindra Group)

- GM Envolve

- Ford Motor Company

- GreenPower Motor Company

- Workhorse

- Star EV Corporation, USA

- Rivian

- Chevrolet

- Gogoro Inc.

- Honda

- Tata Motors

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The electric last-mile delivery vehicle market is entering a high-growth phase driven by surging e-commerce demand, supportive environmental policies, and rapid advancements in electric mobility technologies. As logistics networks modernize and urban sustainability goals intensify, electrified last-mile fleets are expected to become a global standard across commercial delivery ecosystems.

No comments:

Post a Comment