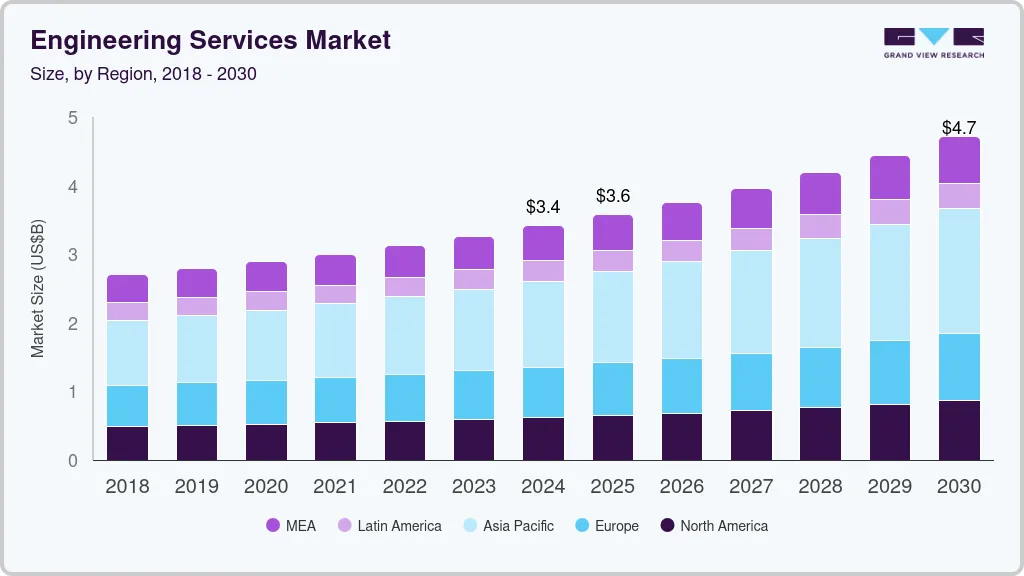

The global engineering services market was valued at USD 3,419.59 billion in 2024 and is projected to reach USD 4,722.7 billion by 2030, registering a CAGR of 5.7% from 2025 to 2030. Market growth is fueled by rising investments in infrastructure development, energy transition initiatives, and the accelerating adoption of industrial automation across both developed and emerging economies.

Increasing regulatory emphasis on sustainability is also reshaping engineering service portfolios. With stricter emissions standards, energy-efficiency mandates, and environmental assessment requirements, engineering firms are expanding capabilities in green design, renewable energy system integration, and low-impact infrastructure planning. This includes solar and wind project engineering, sustainable materials selection, lifecycle assessments, and advanced building and industrial energy modeling. Industries such as transportation, utilities, manufacturing, and real estate are increasingly prioritizing environmentally conscious project execution, driving further transformation in engineering specifications and service offerings.

Key Market Trends & Insights

- Asia Pacific held the largest market share at nearly 37% in 2024.

- The U.S. engineering services market continues to experience steady, broad-based growth.

- By engineering service type, the non-memory ATE segment accounted for over 19% of the market in 2024.

- Environmental projects represented the leading application segment in 2024.

- By end use, the communications segment currently dominates the market.

Download a free sample PDF of the Engineering Services Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 3,419.59 billion

- 2030 Projected Market Size: USD 4,722.7 billion

- CAGR (2025–2030): 5.7%

- Largest Regional Market (2024): Asia Pacific

Recent Developments

- 2025: Balfour Beatty secured an $889 million contract from the Texas Department of Transportation to rebuild 2.3 miles of Interstate 30 in east Dallas County. Pre-construction activities are scheduled to begin in 2026, highlighting the company’s growing role in U.S. infrastructure projects.

- 2024: Glenfarne Group LLC selected Kiewit as the construction contractor for the Texas LNG export terminal in Brownsville, Texas. The plant will process roughly 0.5 billion cubic feet per day of natural gas into 4 million tonnes of LNG annually, with construction planned to begin by November 2024.

- 2024: STRABAG SE, together with PORR AG, agreed to acquire select assets of the VAMED Group—including technical operations management for Vienna General Hospital (AKH Wien), construction project divisions, the Austrian project development unit, and spa holdings—for approximately €90 million. This acquisition is expected to enhance STRABAG’s capabilities in technical facility management within the healthcare sector.

Prominent Companies

- STRABAG SE

- Jones Lang LaSalle Incorporated

- Balfour Beatty Inc.

- Kiewit Corporation

- AECOM

- NV5 Global, Inc.

- Barton Malow

- Brasfield & Gorrie LLC

- Nearby Engineers

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The engineering services market is positioned for stable and sustainable growth, driven by infrastructure modernization, accelerating industrial automation, and rising demand for environmentally responsible project execution. As regulatory frameworks evolve and industries prioritize energy-efficient and low-impact engineering solutions, service providers with strong sustainability capabilities and diversified technical expertise are expected to benefit the most.

No comments:

Post a Comment