The India pharmaceutical manufacturing market size was valued at USD 17.79 billion in 2023 and is projected to reach USD 35.38 billion by 2030, expanding at a CAGR of 10.5% from 2024 to 2030. Market growth is primarily fueled by increasing R&D expenditure, rapid advancements in manufacturing technologies, and the rising geriatric population coupled with a higher prevalence of chronic diseases. Additionally, the surge in clinical trials and growing investments in pharmaceutical IT are expected to create lucrative opportunities for the industry in the coming years.

India’s aging population is set to drive the demand for pharmaceutical products while encouraging companies to adopt automation and advanced technologies to enhance production efficiency. According to estimates from the United Nations Population Fund, the population aged 65 years and above in India is expected to double and reach 192 million by 2030. By 2050, one in every five Indians is projected to be over 65 years old. With aging closely linked to cardiovascular diseases, cancer, and other chronic conditions, the need for continuous monitoring and POC diagnostics in home care and assisted living facilities is expected to rise significantly.

India holds a strong position in the global pharmaceutical manufacturing landscape, with over 10,000 manufacturing facilities. Companies are increasingly focusing on streamlining processes and reducing drug development costs. To achieve this, they are adopting advanced solutions such as Pharma 4.0, which enables the computerization and digital integration of manufacturing operations. This leads to the creation of intelligent value chain networks and further accelerates technological advancements in pharmaceutical manufacturing across the country.

Key Market Dynamics & Insights:

- By dosage: The tablets segment led the India pharmaceutical manufacturing market with a 45.3% share in 2023 and is anticipated to grow at the fastest pace during the forecast period.

- By manufacturing type: The contract manufacturing segment dominated with a 53.2% share in 2023 and is expected to expand at the highest growth rate over the coming years.

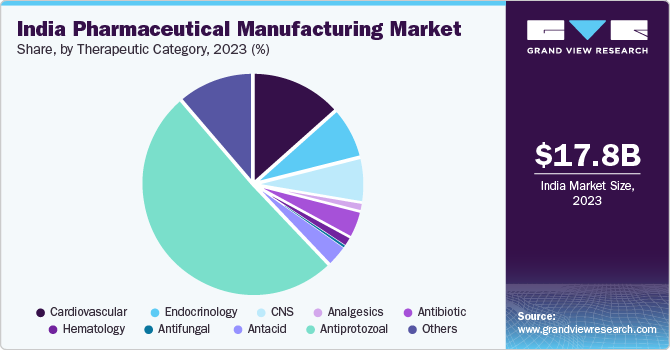

- By therapeutic category: The cardiovascular segment accounted for a revenue share of 13.7% in 2023 and is projected to grow at the fastest CAGR during the forecast period.

Order a free sample PDF of the India Pharmaceutical Manufacturing Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 17.79 Billion

- 2030 Projected Market Size: USD 35.38 Billion

- CAGR (2024–2030): 10.5%

Key Companies & Market Share Insights

Prominent players in the industry include Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cipla, Inc., and Lupin. These companies are expanding their product portfolios through upgrades and adopting strategies such as acquisitions and government approvals to strengthen their market presence. Meanwhile, emerging firms are increasingly collaborating with established players to leverage their distribution networks and broaden their market reach.

Key Players

- Cipla Inc.

- La Renon Healthcare Pvt. Ltd.

- Eris Lifesciences

- Lupin

- Glenmark Pharmaceuticals Ltd.

- Torrent Pharmaceuticals Ltd.

- Ipca Laboratories Ltd.

- Intas Pharmaceuticals Ltd.

- Micro Labs Ltd.

- MSN Laboratories

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The India pharmaceutical manufacturing market is poised for substantial growth, supported by rising R&D investments, rapid technological adoption, and a steadily expanding geriatric population. With a strong global presence and over 10,000 manufacturing facilities, India continues to emerge as a critical hub for cost-efficient and advanced drug production. As companies embrace digitalization and automation, the market is expected to strengthen its global competitiveness, paving the way for sustained innovation and long-term industry growth.

No comments:

Post a Comment