The global nickel market size was estimated at USD 20.04 billion in 2022 and is projected to reach USD 29.15 billion by 2030, growing at a CAGR of 5.2% from 2023 to 2030. The increasing usage of stainless steel (SS) in the automotive industry is expected to drive the demand for nickel.

Stainless steel, an alloy composed of iron, nickel, chromium, titanium, and other elements, finds wide applications in automobiles, including exhaust systems, fuel tanks, suspension components, gaskets, and body & frame parts. Its key benefits include high strength, durability, corrosion and heat resistance, sustainability, and aesthetic appeal.

In the U.S., stainless steel consumption has been a major factor fueling nickel demand. According to the International Stainless Steel Forum, SS consumption in the Americas grew by 21.7% in 2021 and by 3.1% in 2022 on a year-on-year basis. However, stainless steel melt shop production declined by 14.8% in 2022.

Growing investment in nickel-based batteries is expected to further strengthen demand. For instance, in June 2023, Samsung SDI and General Motors announced a USD 3 billion investment to set up an EV battery cell plant in Indiana, U.S. Scheduled for construction in 2026, the facility is expected to generate over 1,700 jobs and produce high-nickel cylindrical battery cells with a capacity of 30 GWh. GM aims to manufacture 400,000 electric vehicles in the U.S. from 2022 to 2024 and expand its production capacity to 1 million units in North America by 2025. To support this goal, GM is also considering two additional plants.

Key Market Highlights:

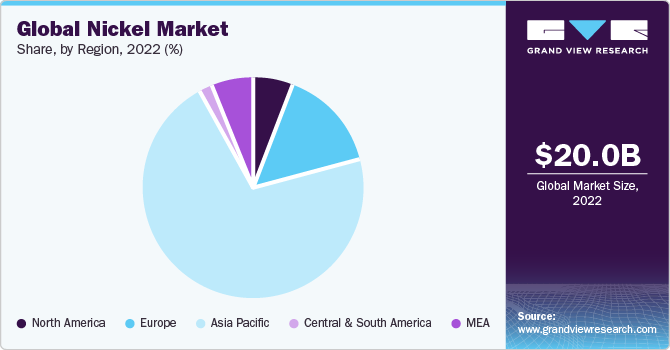

- Asia Pacific dominated the market with a revenue share of over 71% in 2022.

- China accounted for 80% of the Asia Pacific market share in 2022.

- By application, the stainless steel segment held a 63% revenue share in 2022.

Download a free sample PDF of the Nickel Market Intelligence Study from Grand View Research.

Market Performance:

- 2022 Market Size: USD 20.04 Billion

- 2030 Projected Market Size: USD 29.15 Billion

- CAGR (2023–2030): 5.2%

- Asia Pacific: Largest market in 2022

Prominent Companies & Market Dynamics:

Nickel reserves are globally diverse, with nearly 300 million tons estimated worldwide. Indonesia, Australia, Russia, South Africa, and Canada together account for more than 50% of the world’s resources. Around 25 countries collectively produce over 2 million tons of nickel annually. However, under-investment in recent years has limited the pipeline of new nickel projects. Greenfield projects typically require nearly a decade to transition from exploration and feasibility to production, creating supply constraints that may drive up prices in the near future.

Key Companies:

- Anglo American Plc

- BHP

- Eramet

- Glencore

- IGO Ltd.

- Metallurgical Corporation of China Ltd.

- Norilsk Nickel

- Rio Tinto

- South32 Ltd.

- Vale

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The nickel market is set for steady growth, supported by rising stainless steel demand and expanding investment in nickel-based batteries. However, supply-side constraints and limited new projects could put upward pressure on prices, further shaping the global market outlook.

No comments:

Post a Comment