The global molecular cytogenetics market was valued at USD 2.40 billion in 2024 and is projected to reach USD 6.39 billion by 2033, expanding at a CAGR of 11.7% from 2025 to 2033. Growth is primarily driven by the rising use of molecular cytogenetic techniques in clinical diagnostics and research, especially within oncology, genetic disorder screening, and prenatal testing.

High-resolution tools such as fluorescence in situ hybridization (FISH), comparative genomic hybridization (CGH), and array-based platforms enable precise analysis of chromosomal abnormalities, making them essential to modern laboratory workflows. Increasing adoption in personalized medicine, coupled with advancements in automation and imaging technologies, continues to accelerate demand across hospitals, academic institutions, and research centers.

Key Market Trends & Insights

- North America accounted for the largest share of the global market in 2024 at 46.01%.

- The U.S. molecular cytogenetics market is expected to experience strong growth throughout the forecast period.

- By product, consumables held the leading share at 39.54% in 2024.

- By application, oncology dominated with 39.84% of total revenue in 2024.

- By technology, the CGH segment led with a 36.20% revenue share in 2024.

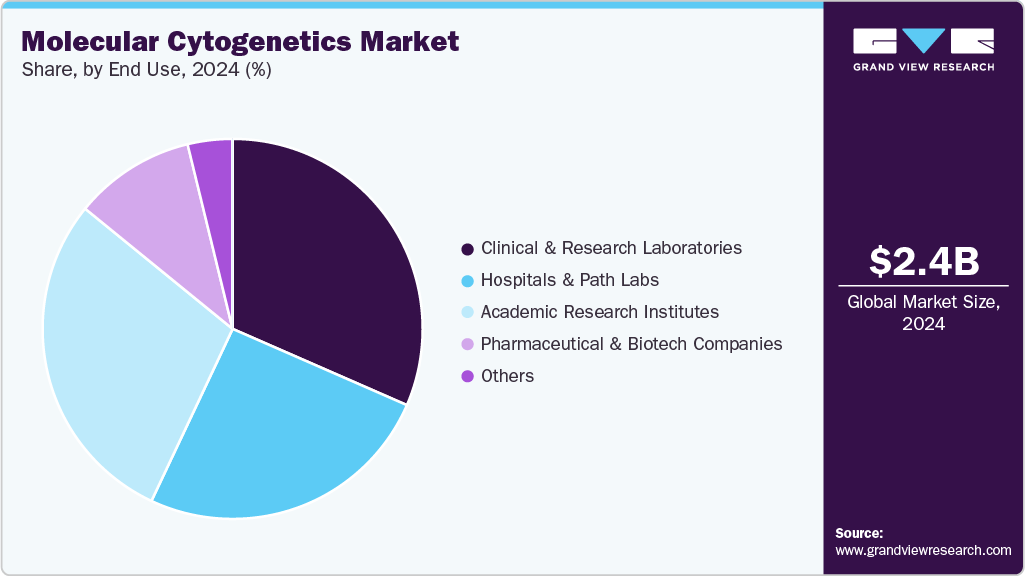

- By end use, clinical & research laboratories represented the largest segment in 2024.

Download a free sample PDF of the Molecular Cytogenetics Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 2.40 Billion

- 2033 Forecast: USD 6.39 Billion

- CAGR (2025–2033): 11.7%

- Largest Regional Market: North America

- Fastest-Growing Region: Asia Pacific

Competitive Landscape

Key companies are expanding global footprints, launching advanced diagnostic platforms, and enhancing the accuracy of cytogenetic testing through continuous innovation. Strategies such as product launches, partnerships, mergers, and acquisitions are widely observed as firms aim to strengthen research capabilities, broaden product portfolios, and meet surging demand for high-resolution and scalable genetic testing technologies.

Recent Developments

- March 2025: Hangzhou Diagens Biotechnology Co., Ltd. unveiled iMedImage, an AI-driven model for automated chromosome segmentation, karyotyping, and abnormality detection. Achieving 92.7% sensitivity and 91.5% specificity, the platform significantly reduces manual workload and enhances diagnostic efficiency in cytogenetics laboratories.

- April 2024: Bionano Genomics partnered with Hangzhou Diagens Biotechnology to launch China’s first clinical cytogenetic workflow integrating optical genome mapping (OGM) with AI-based karyotype analysis, approved under an OEM agreement by the NMPA.

- October 2023: Manipal HealthMap completed the acquisition of Medcis PathLabs, expanding its diagnostics network across 16 states and adding more than 100 centers specializing in molecular cytogenetics, histopathology, and microbiology.

Prominent Companies

- BIOVIEW

- Danaher

- MetaSystems

- Agilent Technologies, Inc.

- Abbott

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Oxford Gene Technology IP Limited

- F. Hoffmann-La Roche Ltd

- PerkinElmer

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The molecular cytogenetics market is entering a high-growth phase, propelled by expanding clinical applications, rapid advancements in AI and imaging technologies, and rising demand for precise genetic testing. With continued innovation and strategic industry collaborations, the market is poised for substantial transformation over the coming decade.

No comments:

Post a Comment