The global molecular diagnostics market was valued at USD 25.75 billion in 2024 and is projected to reach USD 33.08 billion by 2030, growing at a CAGR of 3.97% from 2025 to 2030. Market growth is driven by rapid technological advancements, a rising geriatric population, and increasing demand for accurate, efficient genetic testing solutions.

The accelerating adoption of Point-of-Care (POC) testing is further propelling market expansion, supported by growing consumer awareness and the rising need for convenient self-diagnostic tools. This shift has prompted companies to introduce innovative testing platforms. For example, in February 2023, Huwel Lifesciences launched a portable RT-PCR device capable of detecting multiple viral pathogens—including respiratory viruses and STDs—within 30 minutes. Designed for use in clinics and corporate environments, the device delivers high accuracy comparable to traditional PCR systems while eliminating the need for specialized training or controlled laboratory settings.

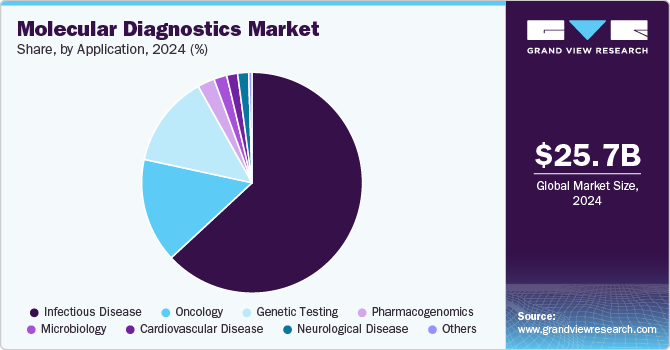

Key Market Trends & Insights

- North America dominated the molecular diagnostics market in 2024 with a 40.95% revenue share.

- By product, reagents led with 65.44% of the market in 2024.

- By test location, central laboratories accounted for 78.8% of total revenue in 2024.

- By technology, the PCR segment held the largest share at 68.0% in 2024.

- By application, infectious disease testing dominated the market with a 63.1% share in 2024.

Download a free sample PDF of the Molecular Diagnostics Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 25.75 Billion

- 2030 Forecast: USD 33.08 Billion

- CAGR (2025–2030): 3.97%

- Largest Regional Market: North America

Competitive Landscape

Leading companies in the molecular diagnostics market continue to pursue strategies such as product launches, partnerships, collaborations, mergers & acquisitions, regulatory approvals, and capacity expansions. These initiatives aim to broaden geographic reach, strengthen technological capabilities, and accelerate the development of advanced diagnostic solutions—collectively supporting sustained market growth over the forecast period.

Recent Developments

- August 2024: Sysmex Corporation expanded its strategic alliance with QIAGEN to advance genetic testing through enhanced research, development, production, clinical validation, and global commercialization efforts.

- January 2023: QIAGEN introduced the EZ2 Connect MDx platform to improve automation in sample processing. The system supports multiple downstream applications, including dPCR and PCR workflows.

- February 2023: BD obtained FDA Emergency Use Authorization for a multiplex molecular diagnostic test capable of detecting COVID-19, influenza A/B, and RSV using the BD MAX System, delivering results in under two hours from a single swab.

- April 2023: Quest Diagnostics acquired the MRD platform from Haystack Oncology, strengthening its portfolio in minimal residual disease detection for oncology applications.

Prominent Companies

- BD

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Abbott

- Agilent Technologies, Inc.

- Danaher

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- Grifols

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The molecular diagnostics market continues to evolve as technological innovations, increased adoption of POC testing, and expanding clinical applications reshape diagnostic workflows worldwide. With sustained investment, strategic partnerships, and growing demand for rapid and precise testing, the market is poised for steady expansion through 2030.

No comments:

Post a Comment