The global alternative financing market was valued at USD 10.82 billion in 2022 and is projected to reach USD 45.72 billion by 2030, expanding at a CAGR of 20.2% from 2023 to 2030. Market growth is primarily driven by the increasing need for small businesses and individuals to access capital, particularly in environments where traditional financing options remain restrictive.

Conventional banking institutions often impose stringent lending requirements, making it difficult for many borrowers to secure loans. Alternative financing solutions—such as peer-to-peer lending, crowdfunding, and digital lending platforms—offer more flexible and accessible capital options, especially for borrowers who do not meet traditional credit criteria. As a result, adoption of alternative finance products has grown significantly.

Technological advancements, particularly in fintech innovations and online lending platforms, have further accelerated industry growth. Digital transformation has enabled faster loan approvals, improved risk assessment through data analytics, and enhanced borrower experiences, making alternative financing an attractive option for both businesses and individuals.

Key Market Trends & Insights

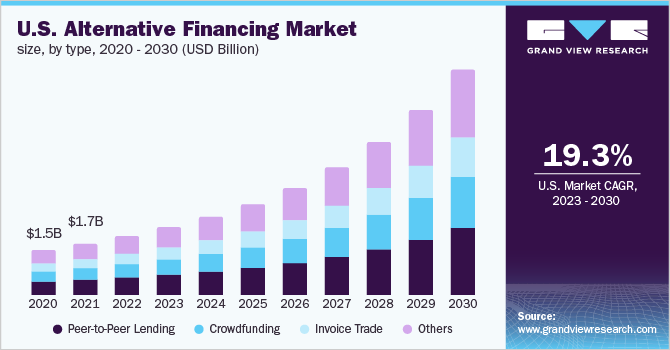

- North America dominated the global alternative financing market, accounting for more than 29.0% of total revenue in 2022.

- By type, the peer-to-peer lending segment led the market, capturing over 28.0% of global revenue in 2022.

- By end user, the businesses segment dominated the market, accounting for more than 65.0% of revenue in 2022.

Download a free sample PDF of the Alternative Financing Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 10.82 Billion

- 2030 Projected Market Size: USD 45.72 Billion

- CAGR (2023–2030): 20.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest-growing regional market

Competitive Landscape

Alternative financing providers are increasingly engaging in partnerships and collaborations with financial institutions, fintech firms, and technology providers to expand their offerings and geographic reach.

For example, in May 2022, OnDeck announced an expanding list of strategic partnerships, including SoFi Technologies, Inc. and LendingTree, aimed at supporting small businesses across the U.S. These collaborations combine advanced fintech capabilities and digital lending solutions with OnDeck’s AI and machine learning expertise, enabling businesses to access working capital more efficiently.

In addition, companies are diversifying their product portfolios to meet evolving borrower and lender needs, with strong emphasis on digital-first platforms. Many key players are also expanding into new regional markets to capitalize on emerging growth opportunities, reflecting the continued innovation and evolution of the alternative financing ecosystem.

Key Players Include:

- LendingCrowd

- Upstart Network, Inc.

- Funding Circle

- OnDeck

- GoFundMe

- Wefunder, Inc.

- LendingTree, LLC

- Prosper Funding LLC

- Fundly

- Kickstarter, PBC

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The alternative financing market is poised for strong growth as demand for flexible, technology-driven funding solutions continues to rise. Supported by fintech innovation, strategic partnerships, and expanding digital ecosystems, alternative finance is reshaping how businesses and individuals access capital, offering faster, more inclusive, and more efficient financing options worldwide.

No comments:

Post a Comment