The global Bitcoin market was valued at USD 17.05 billion in 2021 and is projected to reach USD 132.91 billion by 2030, expanding at a CAGR of 26.2% from 2022 to 2030. Market growth is driven by several advantages associated with Bitcoin, including faster and lower-cost transactions, enhanced security, and its growing acceptance as a decentralized digital asset.

Bitcoin is increasingly used not only as a medium of exchange for goods and services but also as a store of value. With the emergence of Bitcoin, financial transactions no longer require central authorization and can be settled almost instantly through blockchain technology. This decentralized nature has attracted aspiring investors and traders seeking alternative investment avenues, significantly influencing adoption worldwide.

Bitcoin’s dominance in the cryptocurrency ecosystem further strengthens its market position. As the first cryptocurrency, introduced in January 2009 with the mining of the genesis block, Bitcoin holds a pioneering status. Many investors regard it as a reserve currency for the broader cryptocurrency market, given its market leadership, liquidity, and influence over other digital assets.

Key Market Trends & Insights

- North America dominated the global Bitcoin market, accounting for over 29.0% of total revenue in 2021.

- The Asia Pacific region is expected to grow at the highest CAGR over the forecast period.

- By application, the exchange segment led the market with a revenue share of more than 45.0% in 2021.

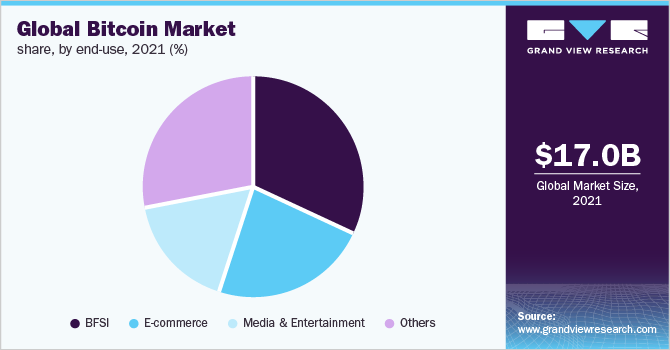

- By end use, the banking, financial services, and insurance (BFSI) segment held the largest revenue share of over 32.0% in 2021.

Download a free sample PDF of the Bitcoin Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2021 Market Size: USD 17.05 Billion

- 2030 Projected Market Size: USD 132.91 Billion

- CAGR (2022–2030): 26.2%

- North America: Largest market in 2021

- Asia Pacific: Fastest-growing regional market

Competitive Landscape

The Bitcoin market is characterized by the presence of several prominent players pursuing strategies such as geographic expansion, strategic partnerships, and mergers & acquisitions to strengthen their market footprint.

For example:

- April 2022: Blockstream Corporation, Inc. and Block, Inc. (formerly Square, Inc.) began developing a Bitcoin mining facility in Texas, powered by solar energy and Tesla battery storage. The facility is supported by a 3.8 MW solar PV array and a 12 MWh Tesla Megapack, reflecting growing emphasis on sustainable crypto mining.

- BlackRock, Inc., the world’s largest asset manager, partnered with Coinbase, Inc. to enable institutional users of BlackRock’s Aladdin platform to access Bitcoin through Coinbase Prime. This integration provides institutional clients with trading, custody, reporting, and prime brokerage services, signaling increasing institutional adoption of Bitcoin.

Key Players Include:

- Blockstream Corporation Inc.

- Coinbase Inc.

- Coinify ApS

- Unocoin Technologies Pvt. Limited

- Bitstamp Ltd.

- itBit Trust Company LLC

- Blockchain Luxembourg SA

- Kraken (Payward Inc.)

- BitPay Inc.

- Plutus Financial Inc. (ABRA)

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The Bitcoin market is expected to witness substantial growth, supported by rising investor interest, expanding institutional participation, and Bitcoin’s role as both a digital payment mechanism and a store of value. As blockchain adoption accelerates and regulatory clarity improves, Bitcoin is likely to remain a foundational asset within the global cryptocurrency ecosystem.

No comments:

Post a Comment