The global whole genome sequencing market was valued at USD 2.12 billion in 2024 and is projected to reach USD 6.67 billion by 2030, expanding at a robust CAGR of 22.17% from 2025 to 2030. The market is witnessing rapid growth driven by technological advancements, declining sequencing costs, and the increasing adoption of personalized medicine. These factors are reshaping the genomics landscape and influencing multiple sectors, including healthcare, life sciences research, and agriculture.

One of the primary drivers of the WGS market is the continuous evolution of sequencing technologies. Advances in next-generation sequencing (NGS) platforms have significantly improved the speed, accuracy, and cost-efficiency of genome sequencing. High-throughput sequencing capabilities enable rapid analysis of large volumes of genetic data, accelerating research and clinical decision-making. Emerging innovations such as nanopore sequencing and single-cell sequencing are further enhancing genomic analysis capabilities.

In May 2024, SOPHiA GENETICS partnered with Microsoft and NVIDIA to develop a scalable WGS analytics solution for healthcare institutions, with planned customer availability by the end of the year. Such collaborations highlight the growing integration of artificial intelligence and cloud computing into genomic workflows, improving accessibility for research institutions, diagnostic laboratories, and clinical settings.

Key Market Trends & Insights

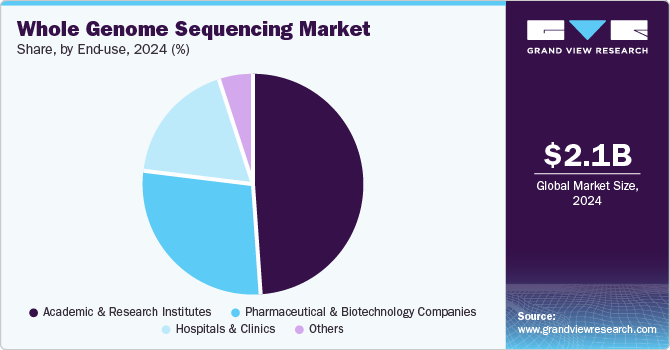

- North America accounted for the largest market share of 51.97% in 2024.

- By product & service, the consumables segment dominated the market with a revenue share of 61.15% in 2024.

- By type, large whole genome sequencing held the largest market share in 2024.

- By workflow, the sequencing segment accounted for 52.07% of the market in 2024.

- By application, human whole genome sequencing led the market with a revenue share of 63.09% in 2024.

Download a free sample PDF of the Whole Genome Sequencing Market Intelligence Study by Grand View Research

Market Size & Forecast

- 2024 Market Size: USD 2.12 Billion

- 2030 Projected Market Size: USD 6.67 Billion

- CAGR (2025–2030): 22.17%

- Largest Market (2024): North America

- Fastest Growing Market: Asia Pacific

Competitive Landscape

The whole genome sequencing market is highly competitive, with leading players focusing on expanding production capacity, strengthening research capabilities, and advancing technological innovation. Strategic initiatives such as mergers, acquisitions, and partnerships are widely adopted to enhance service offerings, improve sequencing efficiency, and strengthen global market presence.

Prominent Companies

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc.

- BGI

- QIAGEN

- Agilent Technologies

- ProPhase Labs, Inc. (Nebula Genomics)

- Psomagen

- Azenta US, Inc. (GENEWIZ)

Recent Developments

- September 2024: MGI Tech Co., Ltd. announced that it secured global commercialization and distribution rights for its new sequencing platforms, CycloneSEQ-WT02 and CycloneSEQ-WY01. These platforms incorporate advancements in protein engineering, flow cell architecture, and basecalling algorithms to improve sequencing accuracy and throughput.

- January 2024: Ultima Genomics revealed plans to introduce high-capacity sequencing instruments capable of sequencing a human genome for as low as USD 100, according to company leadership.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The whole genome sequencing market is poised for exponential growth, driven by rapid technological innovation, expanding clinical and research applications, and increasing investments in precision medicine. As sequencing costs continue to decline and data analytics capabilities improve, WGS is expected to become a cornerstone of modern healthcare and genomics research through 2030.

No comments:

Post a Comment