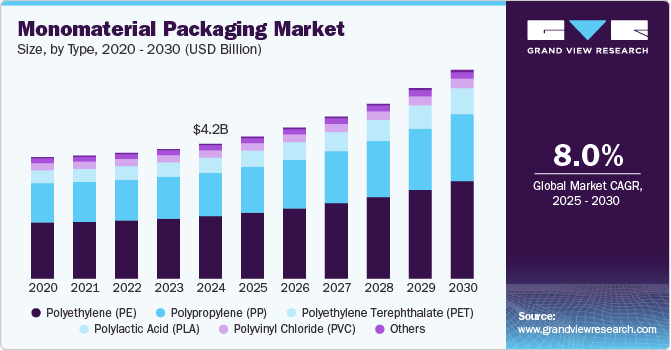

The global monomaterial packaging market was valued at USD 4.19 billion in 2024 and is projected to reach USD 6.50 billion by 2030, expanding at a CAGR of 8.01% from 2025 to 2030. Market growth is being driven by rising sustainability concerns, evolving regulatory frameworks, and continuous technological advancements that are accelerating the adoption of monomaterial packaging solutions.

Increasing consumer preference for recyclable and environmentally responsible packaging, along with stricter Extended Producer Responsibility (EPR) regulations and limitations on single-use plastics, is encouraging brands to transition toward sustainable alternatives. As governments and regulatory bodies worldwide intensify their focus on waste reduction and circular economy initiatives, monomaterial packaging is emerging as a viable and scalable solution.

The rapid growth of e-commerce is further supporting market expansion, as businesses seek durable, lightweight, and recyclable packaging formats suited for shipping and logistics. Leading global brands and retailers—including Unilever, Nestlé, and Procter & Gamble (P&G)—are expected to continue investing in monomaterial packaging to achieve their long-term sustainability targets. Additionally, cost efficiencies achieved through optimized recycling processes and increased sourcing of local raw materials are likely to enhance adoption rates. Ongoing advancements in coating technologies and material processing are expected to position monomaterial packaging as a key enabler of future circular economy models and eco-friendly packaging solutions.

Key Market Trends & Insights

- Asia Pacific dominated the global market, accounting for 42.25% of total revenue in 2024.

- By material type, the polyethylene (PE) segment held the largest share, capturing over 46.0% of market revenue in 2024.

- By end-use industry, the Food & Beverage segment led the market with a revenue share of 53.60% in 2024.

Download a free sample PDF of the Monomaterial Packaging Market Intelligence Study by Grand View Research.

Market Size & Forecast

- Market Size (2024): USD 4.19 Billion

- Projected Market Size (2030): USD 6.50 Billion

- CAGR (2025–2030): 8.01%

- Largest Regional Market: Asia Pacific (2024)

Competitive Landscape

The monomaterial packaging market features a dynamic competitive environment, with both established global players and emerging innovators focusing on advanced, sustainable packaging technologies. Strategic collaborations, mergers, and acquisitions are common, as companies seek to strengthen their product portfolios, expand geographic reach, and accelerate innovation.

The growing emphasis on sustainability and recyclability is intensifying competition and driving continuous product development across the industry.

- January 2025: SGT Group, a leading producer of PET preforms and food-grade rPET based in Rezé, Loire-Atlantique, announced the acquisition of Axium Packaging, a key player in the plastic packaging sector. This strategic move strengthens SGT Group’s position in the European market and creates new opportunities for growth and innovation.

- January 2024: Mars China introduced a Snickers bar featuring dark chocolate cereal packaged in mono-material flexible packaging. The product offers a low-sugar and low-glycemic index (GI) alternative and is individually wrapped using mono polypropylene (PP) material designed for recycling. This initiative aligns with the “Designed for Recycling” principle and highlights the growing use of flexible packaging in the food sector, particularly for snacks, biscuits, and instant food products due to its lightweight, moisture-resistant, and versatile properties.

Key Players Include:

- Amcor Plc

- Berry Global Group

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Constantia Flexibles

- ProAmpac

- Borouge

- Smurfit Kappa Group

- TOPPAN Inc.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The monomaterial packaging market is poised for robust growth, supported by regulatory pressure, rising consumer demand for sustainable packaging, and advancements in material and processing technologies. As brands increasingly align their packaging strategies with circular economy principles, monomaterial solutions are expected to play a critical role in shaping the future of environmentally responsible packaging worldwide.

No comments:

Post a Comment