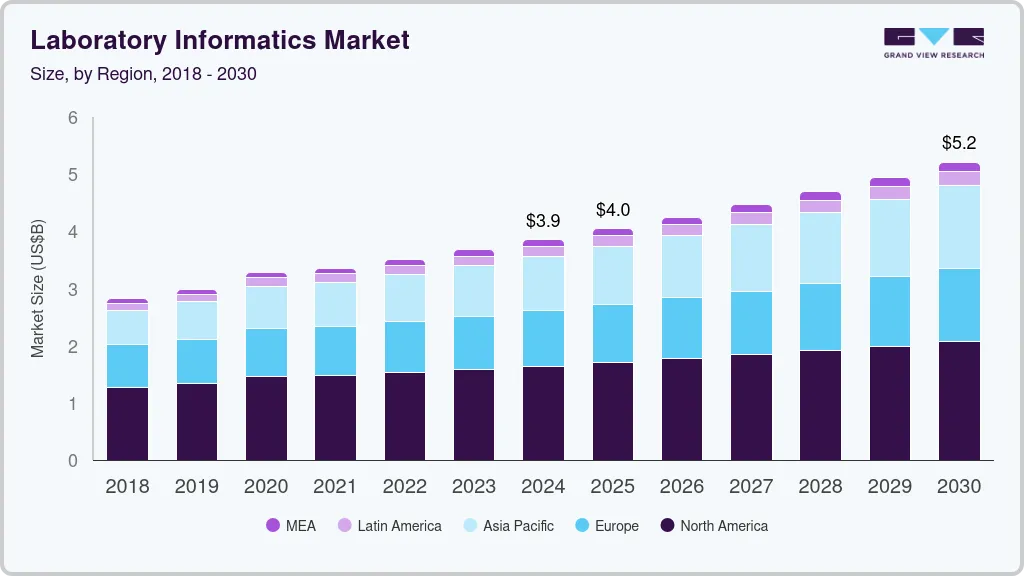

The global laboratory informatics market was valued at USD 3.9 billion in 2024 and is projected to reach USD 5.21 billion by 2030, expanding at a CAGR of 5.17% from 2025 to 2030. Market expansion is driven by the accelerating demand for laboratory automation, supported by rapid advancements in molecular genomics, genetic testing, and personalized medicine.

The growing focus on cancer genomics, greater patient involvement in the healthcare process, and rising adoption of cloud-based systems are among the major contributors to market growth. Cloud-native laboratory informatics platforms—supported by user-friendly interfaces and increasing startup activity—are becoming standard in research environments. Additionally, the integration of cloud, mobile, and voice-enabled technologies within laboratories is further strengthening demand for modern lab informatics solutions.

Key Market Trends & Insights

- North America led the market in 2024 with a 42.55% share.

- The U.S. represented the largest national market in 2024.

- By product, Laboratory Information Management Systems (LIMS) dominated with 50.40% share in 2024.

- By component, the services segment accounted for 56.60% of total revenue in 2024.

- By delivery mode, the web-based segment held 42.91% of the market in 2024.

- By end-use, life science companies led with a 28.90% share in 2024.

Download a free sample PDF of the Laboratory Informatics Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 3.9 Billion

- 2030 Forecast: USD 5.21 Billion

- CAGR (2025–2030): 5.17%

- Largest Market (2024): North America

- Fastest-Growing Region: Asia Pacific

Competitive Landscape

The laboratory informatics market is highly fragmented, comprising a mix of established companies and emerging startups. Competition is particularly strong among smaller players striving to strengthen their market position. Vendors are focusing on developing technologically advanced platforms—particularly SaaS-based solutions and high-utility, specialized tools—to differentiate themselves.

A growing cohort of innovative companies, including Artificial, Benchling, Synthace, and others, is reshaping the competitive landscape through cloud-native and automation-focused solutions.

Prominent Companies

- Abbott

- Agilent Technologies, Inc.

- IDBS

- LabLynx, Inc.

- LabVantage Solutions, Inc.

- LabWare

- McKesson Corporation

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

- Waters

Recent Developments

- February 2024: LabVantage Solutions, Inc. introduced an integrated, digitally native ecosystem combining advanced analytics, semantic search (AILANI), and purpose-built LIMS solutions to support R&D workflows. The ecosystem is designed to enhance productivity, decision-making, collaboration, and operational efficiency.

- November 2023: Thermo Fisher Scientific Inc. entered a strategic partnership with Flagship Pioneering to accelerate development of multiproduct bioplatforms, establish new platform companies focused on advanced biotech tools, and expand their life science tools and diagnostics capabilities.

- September 2023: LabWare expanded its global presence by opening a new office in Wageningen, The Netherlands, extending its footprint across six continents with a network of more than 40 offices.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

Growing technological innovation, rising demand for automated laboratory workflows, and the widespread shift toward cloud-based solutions are expected to sustain steady growth in the laboratory informatics market through 2030. The sector continues to evolve rapidly, driven by advances in genomics, personalized medicine, and digital transformation across research and clinical environments.

No comments:

Post a Comment