Aluminum Foil Packaging Industry Overview

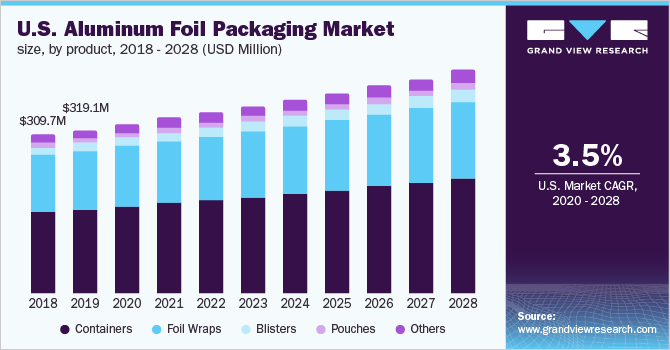

The global aluminum foil packaging market size is expected to reach USD 47.8 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.5% from 2020 to 2028. Aluminum foil packaging products such as pouches, foils, and wraps, among others, are used in the food and beverage industry as they provide an excellent barrier against moisture, light, and oxygen.

The majority of the food consumed in western countries comes packaged. Aluminum packaging is gaining demand in food application, as it not only protects the food from contamination or spillage but also attracts consumer attention. These products are flexible, light, and are easy to recycle, which is expected to be key factors for their growing popularity in end-use applications.

Aluminum Foil Packaging Market Segmentation

Grand View Research has segmented the global aluminum foil packaging market on the basis of product, end-use, and region:

Based on the Product Insights, the market is segmented into Foil Wraps, Pouches, Blisters, Containers, and Others.

- The aluminum foil wraps segment dominated the aluminum foil packaging market and accounted for the largest revenue share of over 33.0% in 2020.

- They are used as one of the layers in snack pouches, liquid cartons, candy wraps, confectionery wraps, and pharmaceutical pouches or bags. These extensive applications across end-use industries have made foil wraps a prominent product segment.

- Pouches are used for packaging products across the food and beverage, personal care and cosmetics, and home care industries.

- The Cost-effectiveness and convenience of pouches compared to rigid packaging solutions are mainly driving their growth across various applications.

Based on the End-use Insights, the market is segmented into Food & Beverage, Tobacco, Pharmaceutical, Cosmetic, and Others.

- The food and beverage segment dominated the market and accounted for the largest revenue share of 46.0% in 2020.

- Due to flexibility, lightweight, food safety, aroma protection, wide availability, and low cost are also responsible for the widespread adoption of aluminum foils in the food and beverages industry for packaging applications.

- Tobacco is a perishable consumer product where aluminum foil is the ideal barrier material for the inner lining of cigarette packets. This application segment is expected to witness a CAGR of 3.4% over the projected period.

Aluminum Foil Packaging Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies & Market Share Insights

Some of the key players are focusing on mergers and acquisitions to increase their product portfolio and customer base. For instance, in June 2019, Amcor plc completed the acquisition of Bemis Company Inc., a U.S.-based packaging manufacturer, for nearly USD 6.8 billion. The acquisition has significantly expanded the former’s product portfolio, customer base, manufacturing capability, and geographic presence across the world.

Some of the prominent players in the global aluminum foil packaging market include:

- Amcor Plc

- Constantia Flexibles

- Novelis Aluminum

- Raviraj Foils Limited

- Ampco

- Symetal

- Aliberico S.L.U

- Coppice alupack ltd

- Eurofoil Luxembourg S.A.

Order a free sample PDF of the Aluminum Foil Packaging Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment