CBD Pet Industry Overview

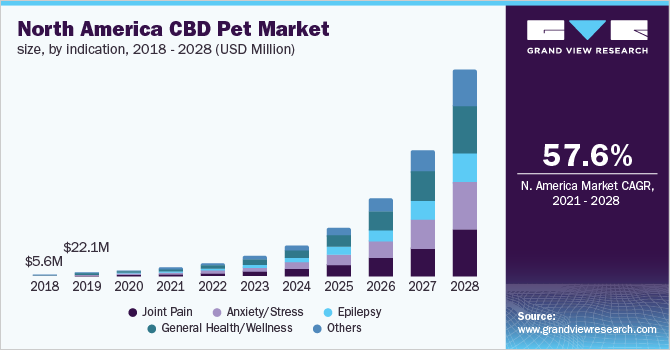

The global CBD pet market size is expected to reach USD 4.79 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 58.9% from 2021 to 2028. Increasing health expenditure and growing health concerns among the owners of domesticated animals are driving the market. In addition, increasing demand for cannabidiol (CBD) infused food products is boosting the market growth. For instance, in 2019, Nestle owned Purina, a pet food company, broadcasted its decision to invest in CBD-infused dog food production. Furthermore, increased usage of natural supplements in treating various lifestyle-related disorders in domesticated animals is fueling the growth.

The Covid-19 pandemic has increased pet ownership, resulting in significant spending on pets. As per the APPA estimation, 11.4 million households got a new companion animal during the pandemic. As a result, an upsurge in the sales of pet supplements in 2020was partially a result of the flood of CBD supplements into the market to address issues comprising anxiety, pain management, and inflammation for their pets.

CBD Pet Market Segmentation

Grand View Research has segmented the global CBD pet market on the basis of animal type, indication, end use, and region:

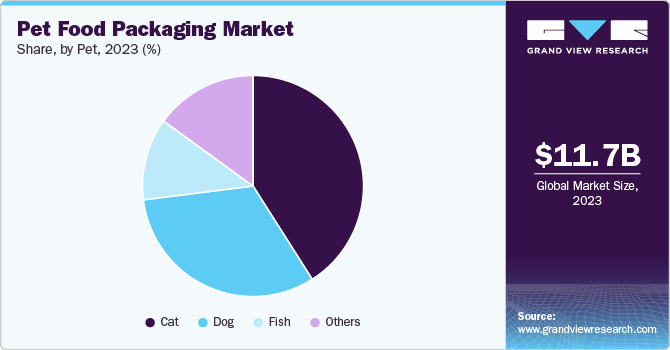

Based on the Animal Type Insights, the market is segmented into Dog and Cat

- The dog segment dominated the market and accounted for a share of over 68.0% in 2020.

- The cat segment is expected to witness lucrative growth over the forecast period.

Based on the Indication Insights, the market is segmented into Joint Pain, Anxiety/Stress, Epilepsy, General Health/Wellness, and Others

- The general health/wellness segment dominated the market with a revenue share of over 23.0% in 2020.

- The joint pain accounted for the second-largest revenue share in 2020.

Based on the End-use Insights, the market is segmented into Hospitals, Ambulatory Surgery Centers, Pet Specialty Stores, E-commerce, CBD Store, and Others

- The e-commerce segment dominated the market and accounted for a revenue share of more than 40.0% in 2020.

- The growth can be attributed to the easy availability of various CBD products on online portals. The prescription-related complication can be avoided using an online platform.

CBD Pet Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is highly competitive. The pet food companies such as Nestle; Mars Inc.; and General Mills Inc. are also expected to enter into the market in the coming years by opting for strategies such as new product launches, acquisitions, and collaborations in order to increase their market penetration.

Some prominent players in the global CBD Pet market include:

- Honest Paws

- Canna-Pet

- Fomo Bones

- Pet Relief

- HolistaPet

- Joy Organics

- Wet Noses

- CBD Living

- Pet stock

- Petco

- Charlotte’s Web

Order a free sample PDF of the CBD Pet Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment