Blood Testing Industry Overview

The global blood testing market size is expected to reach USD 140.3 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 8.3% from 2021 to 2028. The shortened length of stay at hospitals and reduced contact between patient and concerned physician coupled with the rise in outpatient services have increased the demand for blood testing services. Additionally, the growing prevalence of target diseases such as diabetes, COVID-19, and cardiovascular diseases is expected to drive the market at a significant rate.

The preliminary blood testing techniques employed in medical and wellness settings play a crucial role in the management of patient health and prevention of cardiovascular disorders along with diabetes. However, presently several novel blood tests have been introduced into the market, which detect circulating DNA fragments in the bloodstream to facilitate diagnosis. Such tests, including, cancer and prenatal tests; have gained immediate traction as they are comparatively sophisticated. Thus, expanding research activities to unlock the potential of blood tests is expected to boost the market growth.

On the other hand, several biotech companies are investing in the development of cutting-edge, affordable blood testing products that could be employed each time at a doctor’s visit. For instance, SomaLogic, a company operational in Colorado, has developed the SOMAscan platform. This platform functions by quantifying large amounts of proteins in a blood sample to find relevant health traits in susceptible individuals. The company has already employed this approach to develop tests that detect early signs of heart disorders, liver disease, and diabetes, among few other conditions.

Blood Testing Market Segmentation

Grand View Research has segmented the global blood testing market on the basis of test type and region:

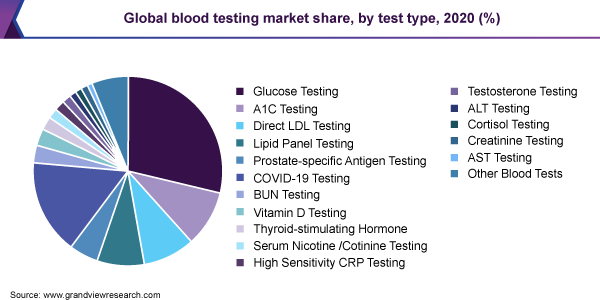

Based on the Type Insights, the market is segmented into Glucose, A1C, Direct LDL, Lipid panel, Prostate-specific antigen, COVID-19, BUN, Vitamin D, Thyroid-stimulating hormone, Serum Nicotine / Cotinine, High sensitivity CRP, Testosterone, ALT, Cortisol, Creatinine, AST, and Other tests

- The glucose testing segment dominated the market for blood testing and accounted for the largest revenue share of 28.7% in 2020. This can be attributed to the high market penetration of these tests in the global market.

- COVID-19 pandemic outbreak is expected to offer profitable opportunities to key operational entities for expansion of business expansion and innovative product offerings pertaining to glucose monitoring.

- A1C testing is anticipated to witness lucrative growth through the study period. A1C testing also known as glycated hemoglobin testing is expected to witness significant market growth owing to high convenience.

Blood Testing Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Companies Profile & Market Share Insights

Market players are involved in the development and launch of novel products to increase their market presence. For instance, in April 2020, the company launched its third COVID 19 test, which is a laboratory-based antibody blood test that helps in detecting the antibody IgG. This launch has expanded Abbott’s molecular tests segment, increasing segment revenue.

Some prominent players in the global Blood Testing market include:

- Abbott

- Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- Quest Diagnostics

- Biomerica, Inc.

- Becton, Dickinson and Company

- Siemens Healthineers

- Danaher Corporation

- Trinity Biotech Plc

Order a free sample PDF of the Blood Testing Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment