The global submersible pumps market was valued at USD 11.70 billion in 2022 and is projected to reach USD 17.50 billion by 2030, growing at a CAGR of 5.2% from 2023 to 2030. The positive outlook for the oil and gas sector, supported by rising exploration and production activities, is expected to remain a key driver of market growth over the forecast period.

Increasing investments by oil and gas companies in upstream activities are anticipated to boost demand for submersible pumps used in drilling, extraction, and fluid handling operations. In parallel, technological advancements in pump manufacturing and the launch of new products designed to enhance performance, durability, and energy efficiency are further supporting market expansion. Submersible pumps are particularly well suited for harsh and challenging environments, including flooding-prone areas and waterlogged conditions, as their underwater operation minimizes the risk of mechanical damage.

Macroeconomic stability and economic growth significantly influence construction and industrial activities, thereby impacting the demand for submersible pumps. Global economic developments often create a cascading effect across infrastructure, energy, and industrial sectors. Demand for submersible pumps is closely linked to infrastructure development, especially in water supply and wastewater treatment systems. Investments aimed at upgrading or expanding municipal and industrial water infrastructure are expected to drive steady demand.

Growth in large-scale infrastructure projects—including water supply networks, wastewater treatment plants, and construction activities—continues to support market expansion. Submersible pumps play a critical role in dewatering construction sites and managing groundwater levels across various infrastructure and industrial applications.

Key Market Trends & Insights

- Asia Pacific dominated the global submersible pumps market in 2022, accounting for 47.2% of total revenue

- By product, the borewell segment led the market with a 46.4% revenue share in 2022

- By drive type, the electric drive segment accounted for 72.6% of market revenue in 2022

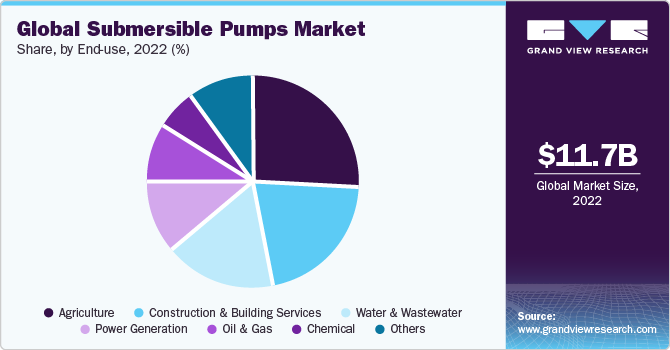

- By end use, the agriculture segment held the largest share at 25.9% in 2022

Download a free sample PDF of the Submersible Pumps Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 11.70 Billion

- 2030 Projected Market Size: USD 17.50 Billion

- CAGR (2023–2030): 5.2%

- Asia Pacific: Largest market in 2022

Competitive Landscape

Manufacturers operating in the global submersible pumps market are adopting various strategies to strengthen their market presence, including geographical expansion, new product launches, and mergers & acquisitions. These initiatives help companies enhance technological capabilities, expand customer reach, and address evolving application requirements.

For instance, in 2023, Holland Pump Co., a provider of specialty pump rental and dewatering solutions, acquired BPR Pumping & Vacuum Solutions, a U.S.-based pump rental company, to expand its service portfolio and regional footprint.

Some of the prominent players in the global submersible pumps market include:

- Xylem

- Sulzer Ltd.

- KSB SE & Co. KGaA

- Grundfos Holding A/S

- Atlas Copco

- Flowserve

- Wilo SE

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The submersible pumps market is expected to witness steady growth driven by rising oil and gas exploration activities, expanding water and wastewater infrastructure, and increasing construction projects worldwide. Continuous technological innovation focused on efficiency, durability, and adaptability to harsh environments will further support market expansion. As infrastructure investment and industrial activity continue to grow, submersible pumps will remain a vital component across multiple end-use sectors.

No comments:

Post a Comment