The global investment casting market was estimated at USD 17.43 billion in 2025 and is projected to reach USD 24.95 billion by 2033, expanding at a CAGR of 4.5% from 2026 to 2033. The market is experiencing steady growth, driven primarily by rising demand from the aerospace, automotive, and industrial manufacturing sectors, where high dimensional accuracy, complex geometries, and superior surface finishes are critical.

The medical device industry has emerged as a rapidly growing end-use segment for investment casting. Aging populations, expanding healthcare access, and increasing surgical procedures are driving demand for precision-engineered components such as surgical instruments, dental fixtures, and orthopedic implants. Investment casting enables the production of biocompatible and corrosion-resistant components using materials such as stainless steel, titanium, and cobalt-chrome alloys. Its ability to deliver complex designs with smooth surface finishes makes it especially suitable for medical applications that require high precision, cleanliness, and patient safety compliance.

Demand is further supported by growth in the energy and industrial sectors, where investment cast components are widely used in gas turbines, valves, impellers, and pump housings. These applications rely on the mechanical strength, thermal stability, and durability that investment casting provides. As global infrastructure development accelerates and renewable energy capacity expands—particularly in wind and thermal power generation—the need for high-performance cast components continues to rise. Countries such as China, United States, and India, which are investing heavily in energy and industrial infrastructure, are expected to sustain long-term demand for investment casting solutions.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share, contributing over 39.2% of the global market in 2025.

- The U.S. investment casting market is expected to grow at a CAGR of 4.3% from 2026 to 2033.

- By material, the alumina-based segment dominated the market with over 54% revenue share in 2025.

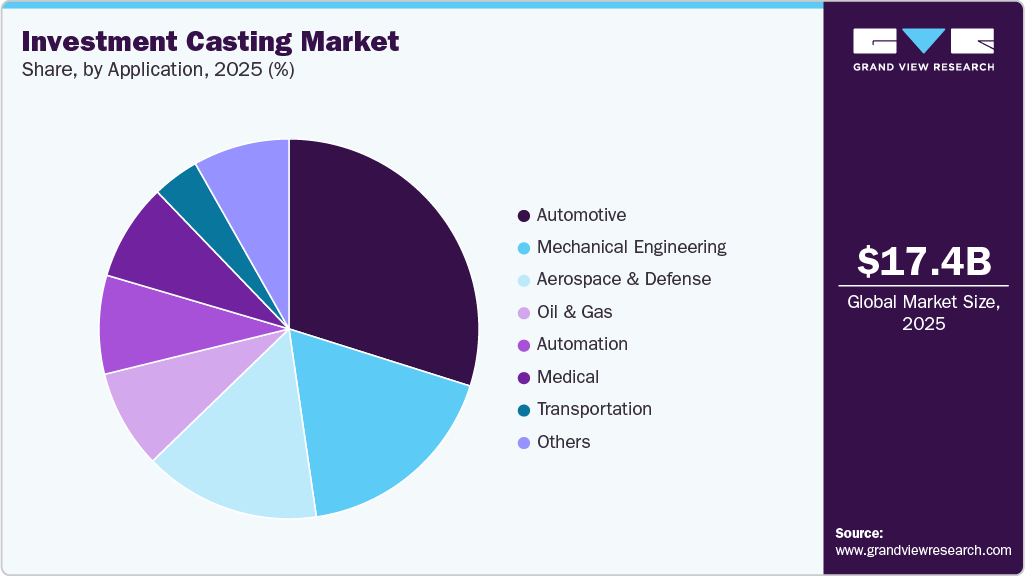

- By application, the automotive segment led the market, accounting for over 29% of total revenue in 2025.

Download a free sample PDF of the Investment Casting Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2025 Market Size: USD 17.43 Billion

- 2033 Projected Market Size: USD 24.95 Billion

- CAGR (2026–2033): 4.5%

- Largest Regional Market: Asia Pacific (2025)

Competitive Landscape

The global investment casting market is moderately consolidated, with key players focusing on technological innovation, capacity expansion, and advanced materials to enhance competitiveness. Digital manufacturing, additive manufacturing integration, and process automation are increasingly shaping the competitive environment.

- In September 2024, 3D Systems introduced QuickCast Air, an advanced software tool designed to optimize material removal from the interior of investment casting patterns. This innovation significantly reduces material consumption, lowers pattern production costs, shortens build times, and improves burnout and draining efficiency. The technology enables manufacturers—particularly in aerospace, defense, and energy sectors—to produce large, high-precision casting patterns faster and at significantly reduced costs, without limitations on geometric complexity.

Some of the key players operating in the global investment casting market include:

- Alcoa Corporation

- CIREX

- Dongying Giayoung Precision Metal Co., Ltd.

- Impro Precision Industries Limited

- JW CASTING

- MetalTek

- Milwaukee Precision Casting

- Precision Castparts Corp.

- RLM Industries, Inc.

- Uni Deritend Ltd

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global investment casting market is positioned for stable growth through 2033, supported by sustained demand from aerospace, automotive, medical, energy, and industrial sectors. The process’s ability to deliver complex, high-performance components with exceptional precision continues to drive adoption across critical applications. Ongoing advancements in digital tools, materials engineering, and additive manufacturing integration are expected to further enhance efficiency and cost-effectiveness, enabling market participants to strengthen their competitive positioning in the years ahead.

No comments:

Post a Comment