Life Science Tools Industry Overview

The global life science tools market size is expected to reach USD 227.3 billion by 2028, expanding at a CAGR of 11.9% over the forecast period, according to a new report by Grand View Research, Inc. Technological advancements in different life science tools are expected to enhance their adoption among prominent end users of the market, thereby leading to the market growth. For instance, improvements in quantitative accuracy, MS resolution, and information sciences have enhanced the accuracy and utility of mass spectrometry-based methods in the field of proteomics.

Products such as Cell Culture Systems and 3D Cell Culture, Flow Cytometry, PCR and qPCR, Nucleic Acid Preparation, Nucleic Acid Microarray, and Transfection Devices and Gene Delivery Technologies have witnessed substantial growth after the COVID-19 pandemic. Novel research has suggested the use of a flow cytometry-based method for COVID-19 testing. Researchers have also used the technique to explore types of T cells involved in COVID-19 immune responses.

Life Science Tools Market Segmentation

Grand View Research has segmented the global life science tools market on the basis of technology, product, end-use, and region:

Based on the Technology Insights, the market is segmented into Genomic Technology, Proteomics Technology, Cell Biology Technology, Other Analytical & Sample Preparation Technology, and Lab Supplies & Technologies

- The cell biology technology segment dominated the market for life science tools and accounted for the largest revenue share of 33.9%in 2020.

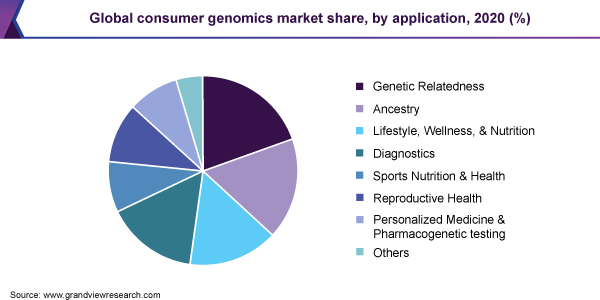

- In recent times, the genomics industry has witnessed a substantial number of advancements and expansion of the application of gene editing tools for the treatment of genetic diseases.

- The proteomics segment is expected to expand at a significant CAGR as proteome analysis can provide a complete depiction of functional and structural information of the cell and their response mechanisms against drugs and other foreign factors.

Based on the Product Insights, the market is segmented into Cell Culture Systems & 3D Cell Culture, Liquid Chromatography, Mass Spectrometry, Flow Cytometry, Cloning & Genome Engineering, Microscopy & Electron Microscopy, Next Generation Sequencing, PCR & qPCR, Nucleic Acid Preparation, Nucleic Acid Microarray, Sanger Sequencing, Transfection Devices & Gene Delivery Technologies, NMR, Other Separation Technologies, and Other Products & Services

- The cell culture systems and 3D cell culture segment dominated the market for life science tools and accounted for the largest revenue share of 17.9% in 2020.

- The PCR and qPCR segment witnessed substantial growth from 2019 to 2020 owing to high utilization in COVID-19 diagnosis.

- The nucleic acid microarray segment is expected to expand at the fastest CAGR.

Based on the End-use Insights, the market is segmented into Government & Academic, Biopharmaceutical Company, Health Care, Industry, and Others

- The health care segment dominated the market for life science tools and accounted for the largest revenue share of 33.7% in 2020.

- Increasing adoption of genomic and proteomic workflows in hospitals to diagnose and treat several clinical abnormalities is expected to drive the market for life science tools.

Life Science Tools Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Mergers and acquisition, divestments, and new product development and launch are the key strategies adopted by the established market players while some emerging players are involved in obtaining funding for their product development and launch.

Some prominent players in the global Life Science Tools market include:

- Agilent Technologies

- Becton, Dickinson and Company

- Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Illumina, Inc.

- Thermo Fisher Scientific, Inc

- QIAGEN

Order a free sample PDF of the Life Science Tools Market Intelligence Study, published by Grand View Research.